KP Energy Limited (NSE: KPEL) reported a strong operational performance in the third quarter of FY26, supported by higher execution in wind balance-of-plant and related infrastructure activities.

Financial Highlights

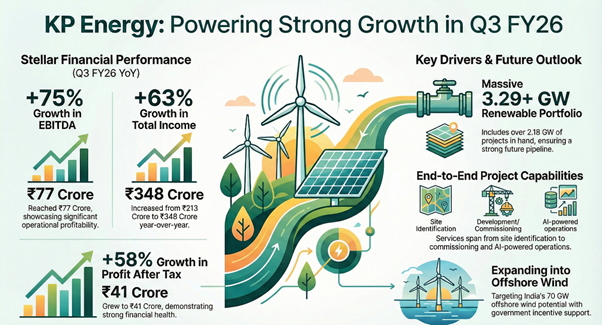

Revenue from operations rose 63% year on year to ₹345 crore in Q3 FY26, compared with ₹212 crore in Q3 FY25. Total income increased to ₹348 crore from ₹213 crore a year earlier. For the nine months ended December 2025, revenue from operations grew 61% year on year to ₹865 crore, up from ₹538 crore in the corresponding period last year.

EBITDA for the quarter increased 75% year on year to ₹77 crore from ₹44 crore, reflecting operating leverage from higher project execution. EBITDA margin improved to about 22.3% from 20.8% in Q3 FY25. For the nine-month period, EBITDA rose 65% year on year to ₹195 crore, with margins remaining broadly stable compared with the previous year.

Profit before tax grew 69% year on year to ₹57 crore in Q3 FY26, while profit after tax increased 58% to ₹41 crore, compared with ₹26 crore a year earlier. For the nine months, PAT rose 48% year on year to ₹103 crore. Basic EPS for the quarter increased to ₹6.18 from ₹3.96 in Q3 FY25.

Cost pressures remained visible, with total operating expenses rising 60% year on year to ₹270 crore in the quarter. Higher depreciation and finance costs reflected capacity additions and increased scale of operations.

Segment Update

From a segment perspective, infrastructure development continued to account for the bulk of revenues, while power generation and O&M services contributed a smaller but stable share. Revenue from infrastructure development stood at ₹333 crore in Q3 FY26, compared with ₹205 crore a year earlier.

Standalone & Consolidated Financial

KP Energy ended the quarter with projects in hand exceeding 3.29 GW, providing medium-term revenue visibility. The company reported a cumulative installed capacity of over 2.18 GW and operational IPP assets of about 1.11 GW.

The company’s market capitalization stood at about ₹2,074 crore as of January 20, 2026. The stock performance during the quarter broadly tracked trends in the listed renewable energy EPC and wind sector.

On valuation, KP Energy continues to trade in line with domestic renewable EPC peers, reflecting expectations of steady earnings growth backed by a visible project pipeline.

What Investors are Watching

Key monitorable include quarterly execution pace, conversion of the 3.29 GW project pipeline into billings, EBITDA margin sustainability above 20%, and working capital intensity as project scale increases. Progress on large wind and hybrid projects and repeat orders from existing clients remain important.

Risks & Concerns

Risks include delays in project execution, volatility in steel and logistics costs, higher-than-expected working capital requirements, and dependence on policy-driven wind sector tender activity. Any slowdown in order inflows or margin compression could affect earnings visibility.