Kotak Mahindra Bank Ltd (NSE: KOTAKBANK; BSE: 500247), Established in 1985, is one of India’s leading financial services conglomerates. In February 2003, its flagship company received a banking license from the RBI, becoming the first non-banking finance company in India to convert into a bank. As of September 2025, it is the 4th largest private sector bank in India by balance sheet size.

Market Capitalization

The bank’s market capitalization stood at approximately INR 3,84,818 crore (USD 45.4 billion) as of the market close on January 24, 2026.

Recent Financial Performance (Q3FY26)

Kotak Mahindra Bank announced its unaudited standalone and consolidated financial results for the quarter ended December 31, 2025 (Q3FY26), reporting steady growth across its diversified financial services portfolio.

A significant corporate development during the period was the sub-division (split) of each existing equity share from a face value of ₹5 into five equity shares of ₹1 each, which became effective on January 14, 2026.

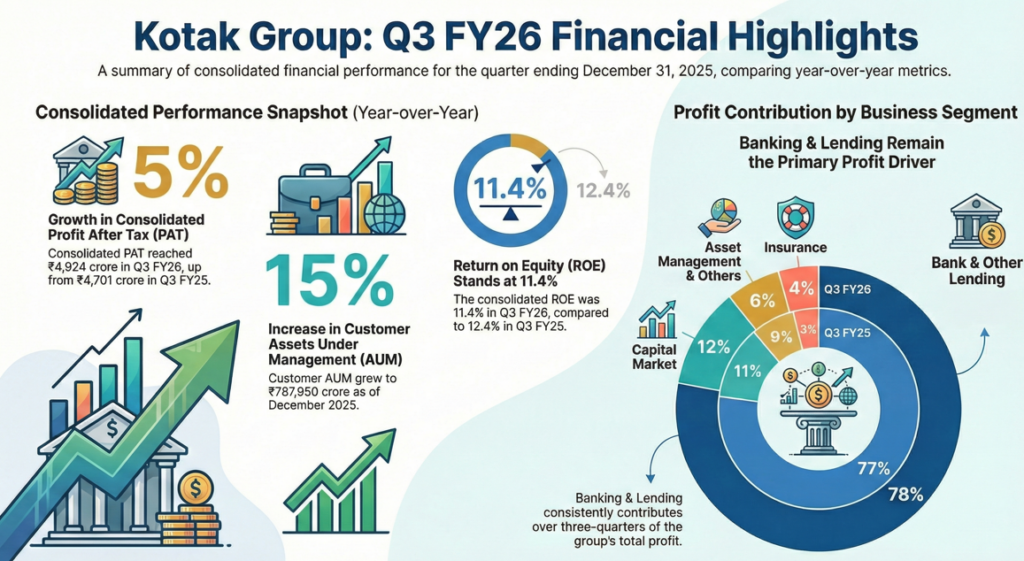

The Group’s Consolidated Profit After Tax (PAT) reached ₹4,924 crore, representing a 5% year-on-year (YoY) increase and a 10% sequential growth from the previous quarter. This profit figure included an estimated post-tax incremental cost of ₹98 crore related to the implementation of the new Labour Code.

Key metrics for the quarter include:

- Asset Growth: Consolidated customer assets, including advances and credit substitutes, grew 15% YoY to ₹598,780 crore. Total Customer Assets Under Management (AUM) also rose 15% YoY to ₹787,950 crore.

- Standalone Bank Results: The Bank’s standalone PAT stood at ₹3,446 crore, up 4% YoY. Net Interest Income (NII) increased to ₹7,565 crore, while the Net Interest Margin (NIM) was reported at 4.54%.

- Efficiency and Returns: The consolidated Return on Assets (ROA) was 2.10%, and the Return on Equity (ROE) stood at 11.39%. The consolidated Book Value Per Share increased to ₹176.

- Asset Quality: Standalone asset quality remained robust, with the Gross Non-Performing Asset (GNPA) ratio declining to 1.30% and the Net NPA (NNPA) ratio improving to 0.31% compared to the previous year.

Management Strategy and Growth Drivers

Kotak’s management continues to build on its identity as a diversified financial conglomerate, utilizing a “One Kotak” approach to capture shifting financial trends through various market cycles. The strategy is anchored by four primary growth engines: Banking & Lending, Capital Markets, Asset Management, and Protection (Insurance).

Operational priorities include:

- Digital Acceleration: The Group is rendering curated digital experiences through platforms like Kotak811 for retail customer acquisition, Kotak Neo for trading, and Kotak fyn for enterprise banking solutions.

- Segment Focus: Curated propositions target specific high-value segments, including HNIs, SMEs, and institutional clients, alongside a focus on “Core India” (the broader unbanked/insufficiently banked population).

- ESG Integration: The Group has scaled its green asset book to over ₹7,900 crore and maintains a focus on financial inclusion, currently serving 2.3 million active women microcredit borrowers.

Equity Analyst Commentary

Institutional research reports from Nirmal Bang and Anand Rathi noted that while credit growth remained stable at 16 percent year-on-year, the compression in margins was a focal point. Analysts attributed the NIM decline to the impact of previous interest rate cuts and shifts in the asset mix toward secured lending.

Guidance & Outlook

The bank has maintained its guidance to grow advances at a rate of 1.5 to 2.0 times the nominal GDP growth. Regulatory filings indicate the bank’s Common Equity Tier-I (CET-I) ratio remains at 21.5 percent, providing a buffer for future balance sheet expansion.

Industry and Macroeconomic Context

As the fourth-largest private sector bank in India by balance sheet size, Kotak Mahindra Bank operates within a regulatory environment currently adjusting to the New Labour Codes, which necessitated specific financial provisions this quarter.

The Group has also undergone structural changes to its portfolio, notably completing the divestment of a 70% stake in its general insurance subsidiary to Zurich Insurance Company in June 2024, shifting that entity from a subsidiary to an associate. The Bank maintains a strong capital cushion with a Consolidated Capital Adequacy Ratio of 23.3%, well above regulatory requirements.