Company is in real estate business (Residential & Commercial) with dominant presence in the Pune and growing presence in Mumbai and Bengaluru. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

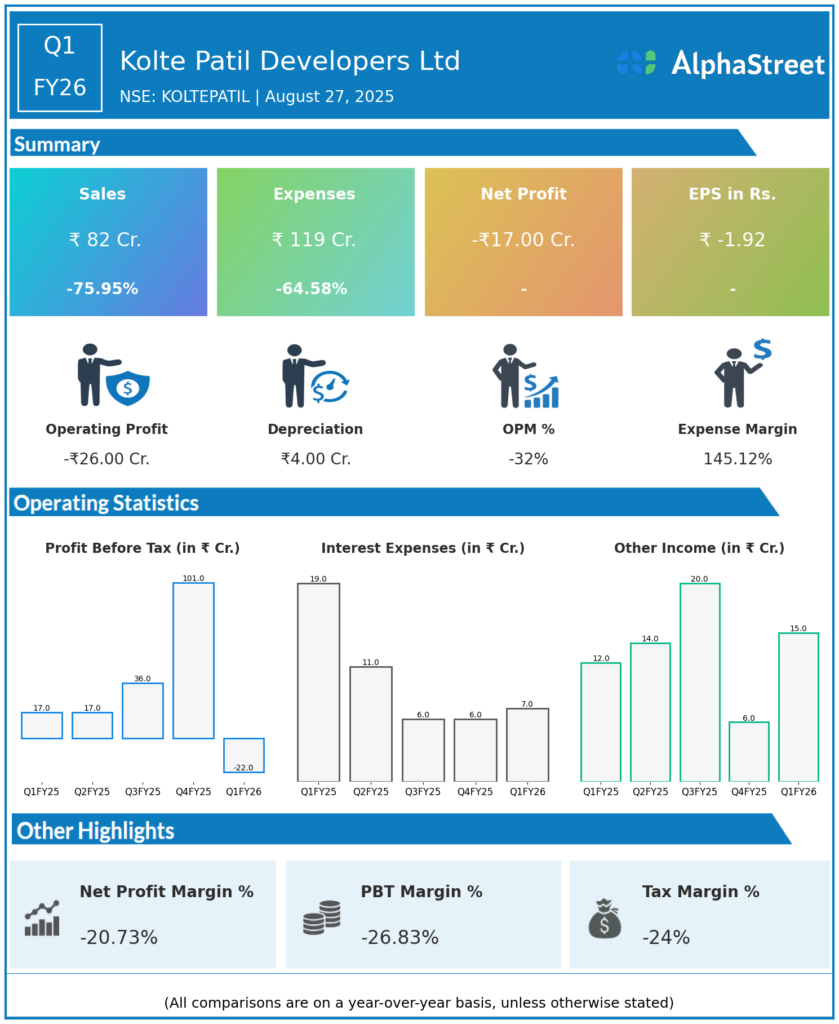

Total Income: ₹82 crores, down 81.7% QoQ from ₹527.71 crores in Q4 FY25 and down 75.9% YoY from ₹350.29 crores in Q1 FY25.

-

Total Expenses: ₹119.27 crores, down 78.6% QoQ and 64.5% YoY.

-

Profit Before Tax (PBT): Loss of ₹22.46 crores, improving QoQ from loss of ₹41.48 crores but down YoY from profit of ₹14.42 crores in Q1 FY25.

-

Profit After Tax (PAT): Loss of ₹16.88 crores, a QoQ improvement from loss of ₹26.18 crores and down from PAT of ₹6.37 crores in Q1 FY25.

-

EPS: Negative ₹1.92, compared to ₹0.80 in Q1 FY25 and negative ₹3.60 in Q4 FY25.

-

Sales Volume: 0.84 million square feet, up 5% QoQ but down 12.5% YoY.

-

Sales Value: ₹616 crores, down 13.3% YoY.

-

Collections: ₹550 crores, reflecting healthy cash flows.

-

Operating Cash Flow: ₹164 crores, down from ₹247 crores in Q1 FY25.

-

Net Debt: Net cash position of ₹320 crores as of June 30, 2025, strengthened by ₹417 crore equity infusion from Blackstone.

Management Commentary & Strategic Overview

-

Management highlighted the accounting impact of the Completed Contract Method (CCM), which causes lumpiness in revenue recognition despite steady collections and execution progress.

-

The Blackstone equity infusion during the quarter has fortified the balance sheet and liquidity, supporting growth plans.

-

The company targets over 30% YoY growth in presales and aims to capitalize on an aggressive launch pipeline of 6–7 million square feet in Pune and Mumbai regions for FY26.

-

Management expressed confidence in recovery and revenue recognition improvement in coming quarters based on project completions and steady demand in residential real estate.

Q4 FY25 Earnings Results

-

Total Income: ₹719 crores.

-

Total Expenses: ₹612 crores.

-

Profit Before Tax (PBT): ₹101 crores.

-

Profit After Tax (PAT): ₹66.18 crores.

-

EPS: ₹8.59.

-

Sales Volume: Approximately 0.8 million square feet.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.