KNR Constructions Ltd, incorporated in 1995, is a Hyderabad-based infrastructure project development company providing EPC services in segments such as roads and highways, irrigation and urban water infrastructure management. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Standalone Revenue: ₹483.32 crores, down significantly from ₹851.19 crores in Q1 FY25.

-

Standalone EBITDA: ₹65.6 crores, down from ₹191.6 crores YoY; EBITDA margin stood at 13.6%.

-

Standalone Net Profit: ₹51.1 crores, down from ₹134.4 crores YoY.

-

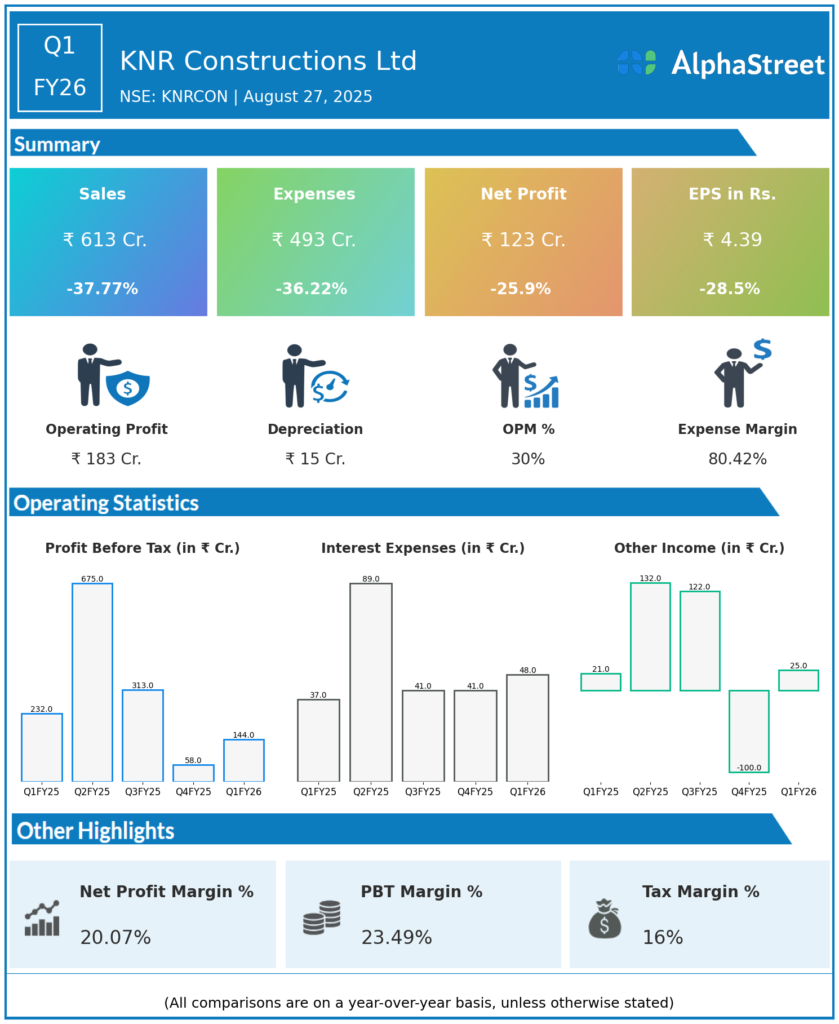

Consolidated Revenue: ₹613 crores, down from ₹985 crores YoY.

-

Consolidated EBITDA: ₹183 crores, down from ₹279 crores YoY; consolidated EBITDA margin 29.9%.

-

Consolidated PAT: ₹123 crores, down from ₹172.6 crores YoY.

-

Net Debt: ₹2,018 crores as of June 30, 2025, up from ₹1,847 crores on March 31, 2025.

-

Working Capital Days: Improved to 69 days from 93 days March 2025.

-

Order Book: ₹8,030 crores as of June 30, 2025, heavily skewed towards the new mining project win from NTPC (~43%) along with roads, irrigation, and pipelines.

-

Revenue Guidance: Revised down to INR ₹2,000-2,500 crores for FY26, from earlier guidance of ₹2,500-3,000 crores.

Management Commentary & Strategic Highlights

-

The muted execution in Q1 FY26 reflects project completions and a slow start for new projects, intensified by a one-month bidding suspension affecting order inflows.

-

The company entered coal mining via a ₹4,800 crore NTPC contract, anticipating minimal revenue in FY26 but ramp-up from FY27 onward.

-

Management highlighted the advanced stage of HAM asset monetization to improve liquidity and reduce debt.

-

Focus on diversifying into metro, railways, and solar sectors, including discussions with partners for metro projects.

-

Despite short-term headwinds, a robust order pipeline and strategic diversification underpin medium-term confidence.

Q4 FY25 Earnings Results

-

Standalone Revenue: ₹851 crores.

-

Standalone EBITDA: ₹175 crores.

-

Standalone Net Profit: ₹75 crores.

-

Consolidated Revenue: ₹975 crores.

-

Consolidated EBITDA: ₹250-270 crores.

-

Consolidated PAT: ₹8 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.