Kitex Garments Limited was incorporated in 1992 and is promoted by Mr. Sabu M Jacob. The company exports cotton and organic cotton garments especially infant wear to US and European markets.

Q2 FY26 Earnings Results

-

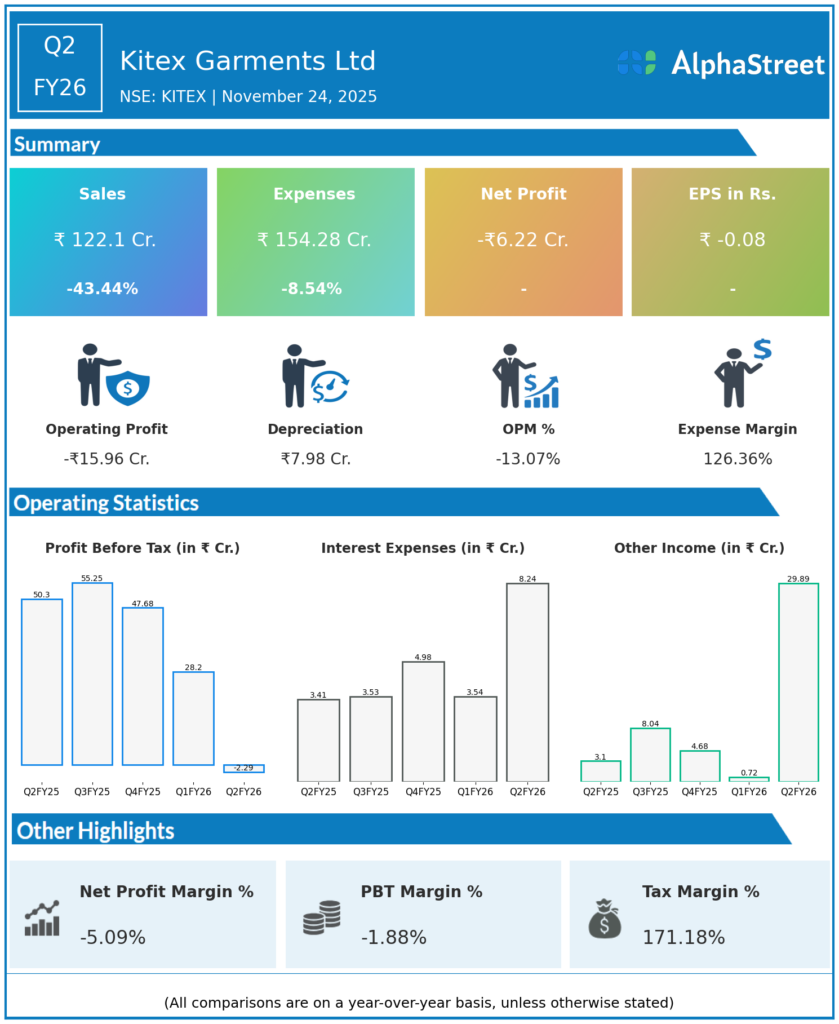

Total Revenue: ₹122 crore, down 31.9% QoQ and 43.3% YoY from ₹197.42 crore in Q1 FY26 and ₹218.98 crore in Q2 FY25 respectively, marking the lowest quarterly revenue in recent history.

-

Net Loss After Tax: ₹6.22 crore, a swing from profit of ₹19.30 crore in Q1 FY26 and ₹36.73 crore in Q2 FY25, reflecting a sharp 132.2% QoQ and 116.9% YoY decrease.

-

Operating Profit (EBITDA excluding other income): Negative ₹15.97 crore, a severe margin drop from positive ₹54.84 crore in Q2 FY25 (operating margin contracted by 38.48 percentage points).

-

Gross Profit Margin declined to 4.65% from 25.26% YoY, indicating intense margin pressure driven by pricing, product mix, and cost rises.

-

Employee costs remained high at ₹41.81 crore despite lower revenues, pointing to fixed cost pressures in a down revenue scenario.

-

Consolidated borrowings increased to ₹1,183.66 crore reflecting leveraged balance sheet conditions.

Management Commentary & Strategic Insights

-

Management highlighted a severe operational and financial downturn, citing loss of orders, pricing pressures, and elevated operating costs as principal challenges.

-

Product diversification efforts and new brand launches (e.g., ‘Little Star’) aim to stabilize revenues and reduce dependence on export volumes.

-

Ongoing cost rationalization and margin recovery initiatives are in focus but expected to take time to restore profitability.

-

Shareholder confidence strained by shrinking profits amidst a challenging global garment export environment.

Q1 FY26 Earnings Results

-

Total Revenue: ₹197.42 crore, up 12% QoQ and 3.6% YoY from ₹193.15 crore in Q1 FY25.

-

Profit After Tax (PAT): ₹19.30 crore, down 29.6% YoY and 2.2% QoQ, indicating early signs of financial issues emerging.

-

EPS: ₹1.04, sharply down from ₹4.10 in Q1 FY25.

-

Operating Profit: ₹4.26 crore, down 11.25% YoY, with margin compression emerging.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.