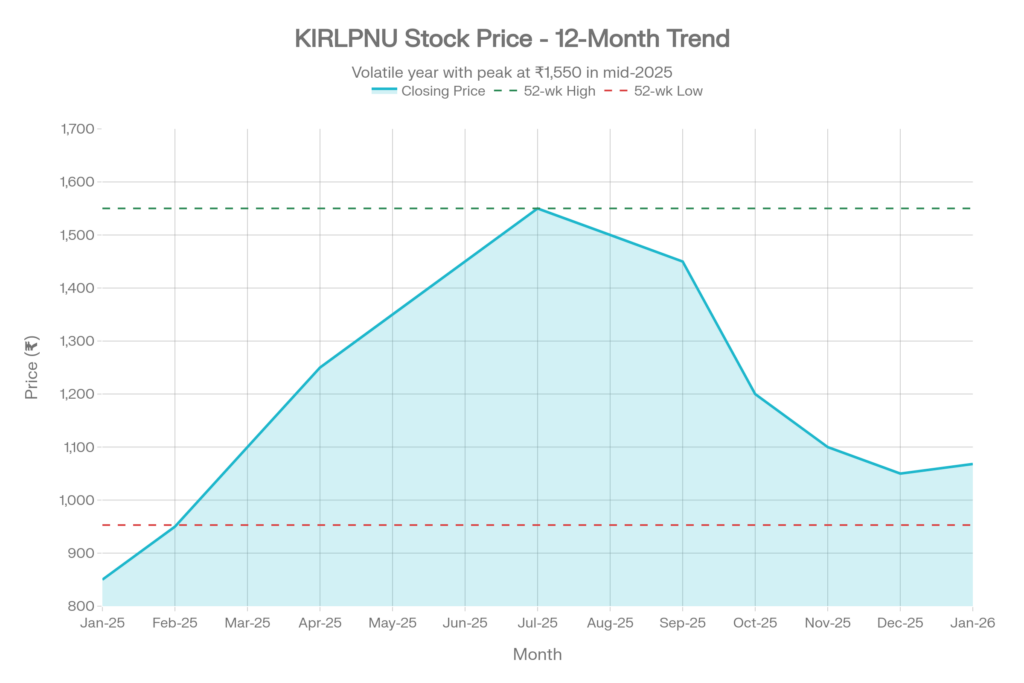

Kirloskar Pneumatic Company Limited (NSE: KIRLPNU, BSE: 505283) reported consolidated revenue of ₹4,069 crores for the December quarter, up 18.68% from ₹3,426 crores in the same period last year, as net profit reached ₹422 crores against ₹364 crores previously. The stock closed at ₹1,068 on January 23, down 4.11% from the previous close, as the company’s market capitalization stands at ₹6,936 crores.

Q3 FY26 Quarterly Results

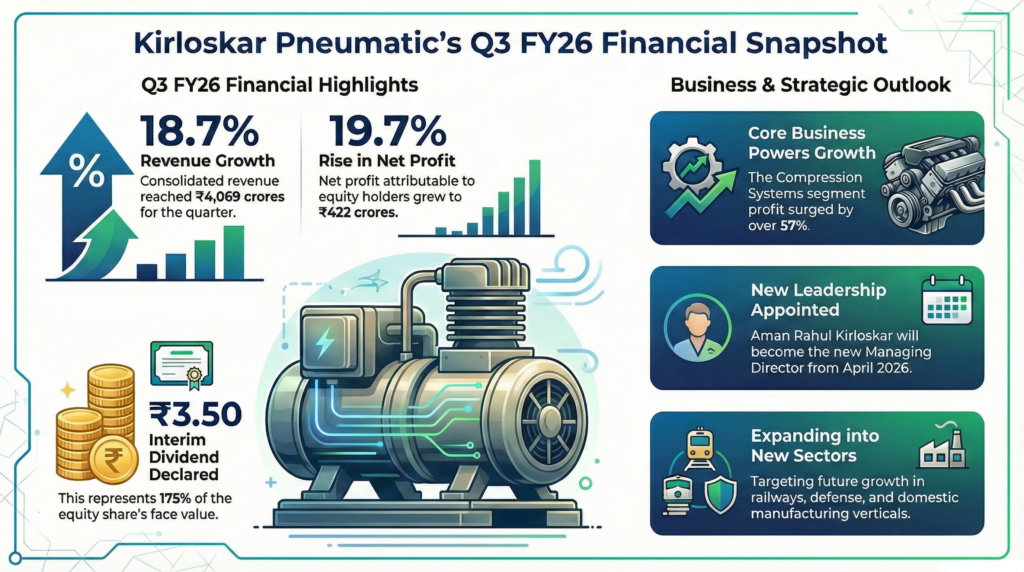

Kirloskar Pneumatic reported consolidated revenue of ₹4,069 crores for the third quarter ended December 2025, representing an 18.68% increase from ₹3,426 crores in the same period last year. Consolidated net profit reached ₹422 crores, up from ₹364 crores, while profit before tax grew 26.04% to ₹605 crores. On a standalone basis, the company reported revenue of ₹4,035 crores and a net profit of ₹431 crores, translating to basic earnings per share of ₹6.65. The Board of Directors declared an interim dividend of ₹3.50 per equity share, which is 175% of face value.

FY2025 Annual Performance Context

For the fiscal year ended March 2025, Kirloskar Pneumatic recorded total revenue of ₹1,640 crores and a net profit of ₹211 crores. The company maintained an operating margin of 19.15% and a net profit margin of 12.88% during that period. The Advanced Compression and Refrigeration (ACR) Special Business Unit achieved record sales exceeding ₹1,600 crores in FY2025. These annual results reflected growth from prior years despite macroeconomic headwinds, demonstrating operational efficiency across the business cycle while establishing a foundation for the performance trends observed during the current fiscal year 2026.

Business and Operations Update

The Compression Systems segment, the company’s core business, generated ₹3,792 crores in revenue during Q3 FY26, a 20.08% increase over the ₹3,158 crores recorded in the year-ago quarter. Segment profit expanded by 57.17% to ₹943 crores. Results included an exceptional item of ₹183 crores related to the statutory impact of new labor codes notified in November 2025. These codes consolidated 29 existing labor laws and adjusted wage definitions for employee benefits. Additionally, Aman Rahul Kirloskar was appointed as Managing Director effective April 1, 2026, to succeed K Srinivasan following a transition period.

Financial Snapshot

Stock Trend

Forward Outlook

Management guidance projects revenue exceeding ₹1,600 crores for the full fiscal year 2026, with potential for double-digit growth. For FY2027, the company expects growth to exceed 20%, supported by a recovery in capital expenditure cycles across key verticals. Strategic expansion is focused on increasing penetration into the defense, railways, and domestic manufacturing sectors, moving beyond traditional oil-and-gas compression. The refrigeration and air-conditioning business segments are scaling faster than anticipated, driven by demand from the food processing, dairy, pharmaceutical, and coal industries as the company targets accelerated growth during the upcoming fiscal year.

Performance Summary

Kirloskar Pneumatic’s nine-month FY26 performance shows total revenue of ₹10,536 crores and a consolidated net profit of ₹1,145 crores. While the company achieved 18.77% year-on-year revenue growth in Q3, operating margins experienced a sequential compression from 15.14% in Q2 to 15.02% due to near-term cost pressures. Following the earnings announcement, the stock closed at ₹1,068 on January 23, a 4.11% decline, with a total market capitalization of ₹6,936 crores. The interim dividend is scheduled for payment on or before February 21, 2026, for shareholders of record as of January 30, 2026. This summarizes the financial trajectory, operational status, and projected performance.