KOEL, one of the flagship companies of the Kirloskar group, manufactures and services diesel engines and diesel generator sets. The company also makes diesel, petrol and kerosene-based pump sets. It has manufacturing units in Pune, Kagal, and Nashik. The company caters to the agriculture, power generation, and industrial sectors.

Q2 FY26 Earnings Results:

-

Standalone Revenue from Operations: ₹1,593 crore, up 35% YoY from ₹1,184 crore in Q2 FY25

-

EBITDA: ₹214 crore, up 45% YoY, with margin expansion to 13.4% from 12.4% YoY

-

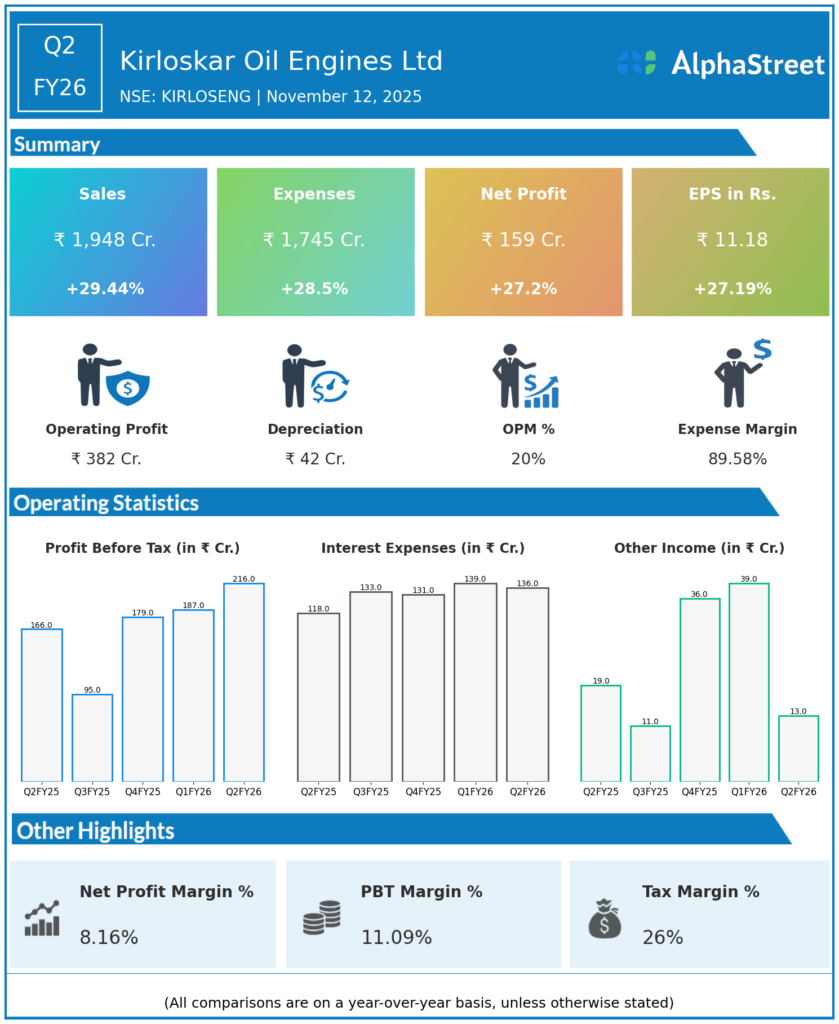

Consolidated Revenue from Continuing Operations: ₹1,948 crore, up 30% YoY

-

Consolidated Net Profit (PAT): ₹159 crore, up 51% YoY from ₹106 crore in Q2 FY25

-

Standalone PAT: ₹135 crore, up 48% YoY

-

Depreciation and interest expenses showed moderate increase reflecting ongoing investments and borrowing costs

-

Strong volume growth across Power Generation, Farm Equipment, and Automotive segments

-

Power Generation segment supported by extensive distribution network and continuous technology innovation

-

Company announced the strategic restructuring of its B2C operations via slump sale to wholly owned subsidiary La-Gajjar Machineries Pvt Ltd

-

Total vehicle sales and construction equipment business showed solid performance with continued market share gains

-

Robust operating cash flow for H1 FY26 exceeding ₹1,000 crore contributing to healthy liquidity position

Management Commentary & Strategic Insights

-

Managing Director Gauri Kirloskar highlighted the company’s best-ever quarterly revenue achievement crossing ₹1,500 crore in a single quarter

-

Emphasized operational excellence and strong brand equity driving double-digit growth across business units

-

Restructuring B2C business aligns with long-term vision to reach $2 billion in top line by 2030

-

Growth supported by innovation in engine and generator technology, plus international market expansions

-

Management remains confident in sustained growth and margin expansion despite macroeconomic uncertainties

Q1 FY26 Earnings Results

-

Standalone Revenue: ₹2,102 crore

-

Standalone PAT: ₹2.54 crore, impacted by transient costs but sequentially improved

-

EBITDA margin remained stable with strong core segment performance

-

Business maintained steady growth momentum with expanding distribution reach and product offerings

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.