Kirloskar Brothers is a part of the Kirloskar Group engaged in the business of engineering and manufacturing of systems for fluid management. The core businesses include large infrastructure projects (Water Supply, Power Plants, and Irrigation), Pumps, Valves, Motors and Hydro turbines.

Q2 FY26 Earnings Results

-

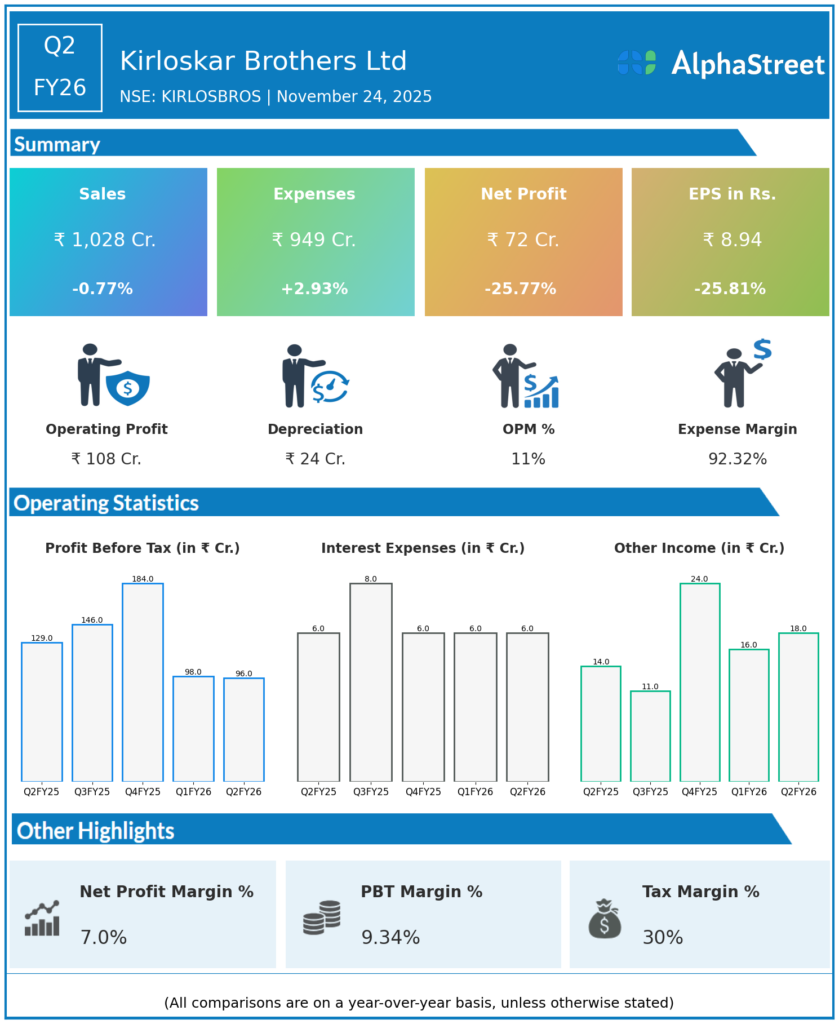

Consolidated Revenue: ₹1,023.80 crore, a slight YoY decline of 0.7% from ₹1,050.10 crore and a QoQ increase of 4.8% from ₹994.90 crore in Q1 FY26.

-

EBITDA: ₹124 crore, with operating margin contracting to 10.55% from 13.72% YoY and 11.41% QoQ, reflecting margin pressures from input costs and operational challenges.

-

Profit After Tax (PAT): ₹72.20 crore, down 25.3% YoY from ₹96.70 crore and up 7% QoQ from ₹67.50 crore.

-

Earnings Per Share (EPS): ₹8.94, down 25.9% YoY, up 6.4% QoQ.

-

Operating profit before other income fell to ₹108.40 crore, the lowest in recent quarters, highlighting margin compression.

-

Employee costs rose slightly YoY to ₹187.4 crore while sales remained relatively flat, indicating some cost absorption issues.

-

Fixed assets at ₹607 crore, investments of ₹268.44 crore reflecting cautious capital posture.

-

On a half-year basis, revenues of ₹2,006.7 crore and consolidated net profit of ₹137.7 crore, modest YoY growth in profits.

Management Commentary & Strategic Insights

-

Management highlighted operational headwinds and input cost inflation as primary reasons for margin contraction and profit decline despite stable revenue.

-

Expectation of margin recovery as volume growth resumes, operating leverage improves, and pricing power strengthens.

-

Focus on order book expansion, especially with infrastructure and irrigation projects potentially catalyzing demand.

-

Working capital optimization and cost control initiatives are ongoing to enhance cash generation.

-

The company’s balance sheet remains strong with zero net debt, providing financial flexibility to capitalize on growth opportunities.

-

Management strategy includes launching new products and entering adjacent segments to diversify revenue streams.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹994.90 crore, down 5.04% YoY from ₹1,031 crore, and down 21% QoQ from ₹1,260 crore in Q4 FY25.

-

PAT: ₹67.50 crore, a 3% decline YoY but a 27% increase QoQ from ₹53 crore in Q4 FY25.

-

EBITDA margin remained stable around 11.41% despite lower revenues.

-

Q1 showed signs of improvement with higher volume execution and stable order inflows

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.