Kirloskar Brothers is a part of the Kirloskar Group engaged in the business of engineering and manufacturing of systems for fluid management. The core businesses include large infrastructure projects (Water Supply, Power Plants, and Irrigation), Pumps, Valves, Motors and Hydro turbines. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

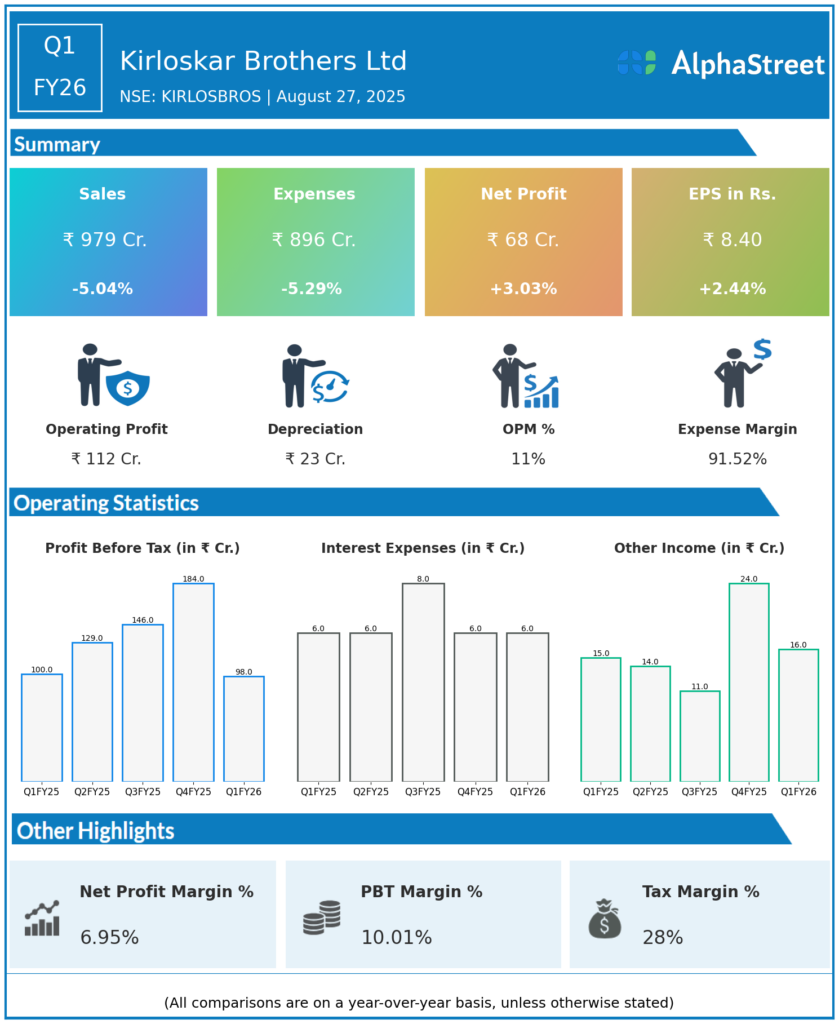

Consolidated Revenue from Operations: ₹979 crores, down 5.04% YoY (Q1 FY25: ₹1,030.90 crores).

-

Profit Before Tax (PBT): ₹127.60 crores, marginally up 0.47% YoY (Q1 FY25: ₹127.00 crores).

-

Profit After Tax (PAT): ₹66.70 crores, up 3.03% YoY (Q1 FY25: ₹65.10 crores).

-

Standalone Revenue: ₹620.60 crores, down 6.7% YoY (Q1 FY25: ₹665.20 crores).

-

Standalone PAT: ₹47.00 crores, up 14.91% YoY (Q1 FY25: ₹40.90 crores).

-

EBITDA Margin: Improved to 13% from 12.3% YoY on operational efficiencies.

-

Order Inflow: ₹1,336 crores, up 9% YoY reflecting strong execution and bidding pipeline.

-

EPS: ₹8.4 consolidated; standalone EPS approx ₹4.20.

Management Commentary & Strategic Insights

-

Management cited revenue pressure from early monsoon, geopolitical instability, and supply chain disruptions but highlighted robust industrial segment demand which offset softer retail pump sales.

-

Continued investments in new product launches including submersible turbine pumps targeted at petrol stations opening new domestic and export market opportunities.

-

Focus on improving margins via cost efficiencies, operational improvements, and selective bidding in growth segments like agriculture, industry, and water engineering.

-

Management expects recovery from Q2 onwards, supported by demand stabilizing in key overseas markets like the US and Thailand affected due to elections.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹1,281 crores.

-

Profit Before Tax (PBT): ₹127 crores approx.

-

Profit After Tax (PAT): ₹138 crores.

-

EBITDA Margin: Around 12.3%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.