KIOCL is a flagship company under the Ministry of Steel, GoI, with Miniratna status. It is an export-oriented unit with expertise in iron ore mining, filtration technology, and the production of high-quality pellets.

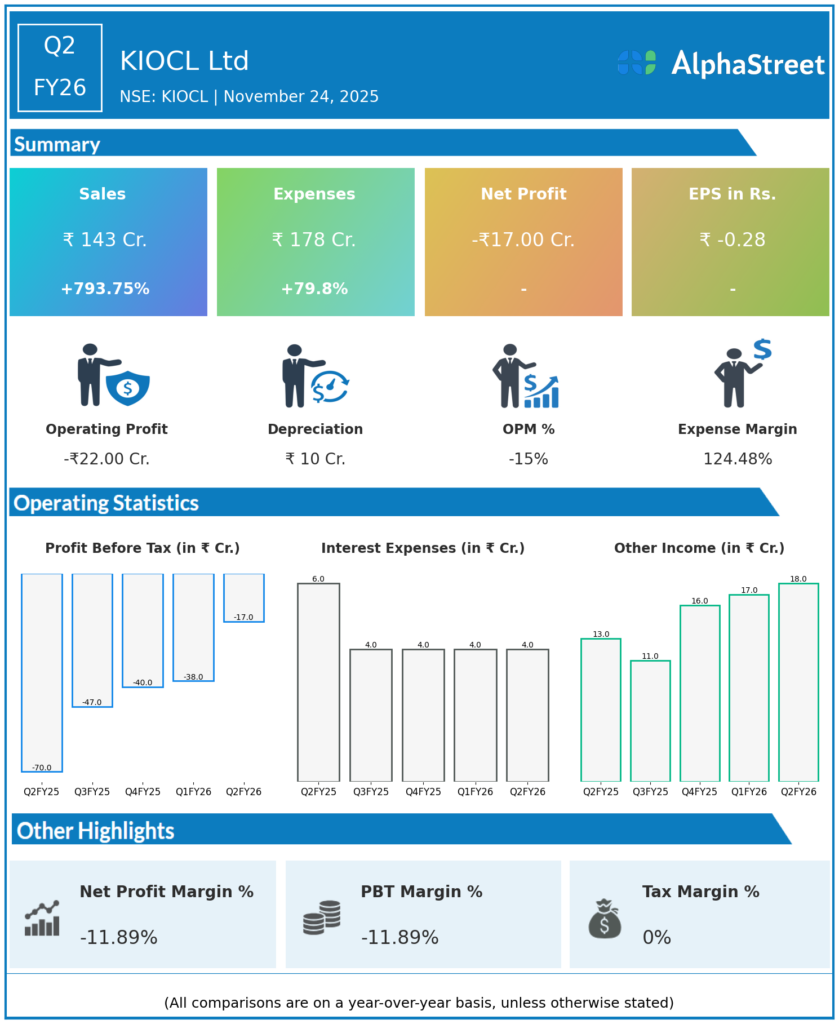

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹142.5 crore, a surge of over 780% YoY from ₹16.1 crore, demonstrating a remarkable recovery in sales volumes and operational performance.

-

Net Loss: ₹17.16 crore (₹171.6 million), significantly reduced by 75% compared to ₹69.21 crore loss in Q2 FY25.

-

Loss Per Share (LPS): ₹0.28, a marked improvement over previous periods.

-

Operating Profit (PBDIT): Still negative at ₹-21.59 crore; operating margin at -15.15%, yet both show material improvement from the previous year.

-

The improved revenue was largely due to operational recovery and better plant utilization, despite the company operating at an overall loss.

-

The improvement led to a change in market sentiment, though the company hasn’t yet reached operating profitability.

Management Commentary & Strategic Insights

-

Management cited strong operational recovery, with renewed focus on cost controls and plant utilization driving revenue growth.

-

The significant narrowing of losses is attributed to enhanced production, better capacity utilization, and reduced fixed costs per unit.

-

Strategic priorities include optimizing operations, expanding the portfolio into operation & maintenance (O&M) services, and pursuing mineral exploration opportunities to diversify and stabilize revenue streams.

-

Exposure to global iron ore price volatility and ongoing headwinds in the pellet sector remain key challenges, but KIOCL Ltd is positioning for continued improvement as the commodity cycle recovers.

-

Market participants are watching for continued operational turnaround and sustainable profitability in upcoming quarters.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹90.9 crore, down 38% YoY from ₹147.4 crore, reflecting continued sectoral softness in iron ore and pellets.

-

Net Loss: ₹37.79 crore, improved from a loss of ₹50.72 crore YoY and sequentially better than earlier quarters.

-

PBDIT: Negative but improving with cost rationalization.

-

Management remains focused on controlling operational costs and securing additional revenues from O&M and mining services.

-

Analyst consensus expects gradual recovery as industry demand picks up and company’s strategic pivots bear fruit.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.