Company Overview:

Kilburn Engineering (BSE: 522101) is a leading provider of specialized process equipment and drying solutions across industries such as tea, fertilizer, and pharmaceuticals. Based in Thane, Maharashtra, India, KEL boasts a state-of-the-art manufacturing facility spanning 30,960 square meters. With a diverse product portfolio including rotary dryers, calciners, and fluid bed dryers, KEL caters to critical applications in chemical, petrochemical, and refinery sectors. Recent acquisition of M.E Energy enhances KEL’s capabilities, positioning it for substantial growth with a robust order pipeline and access to Tier-1 clientele. Despite industry challenges like competition and cyclical nature, KEL’s strategic initiatives promise a bright future.

Recent Financial Result:

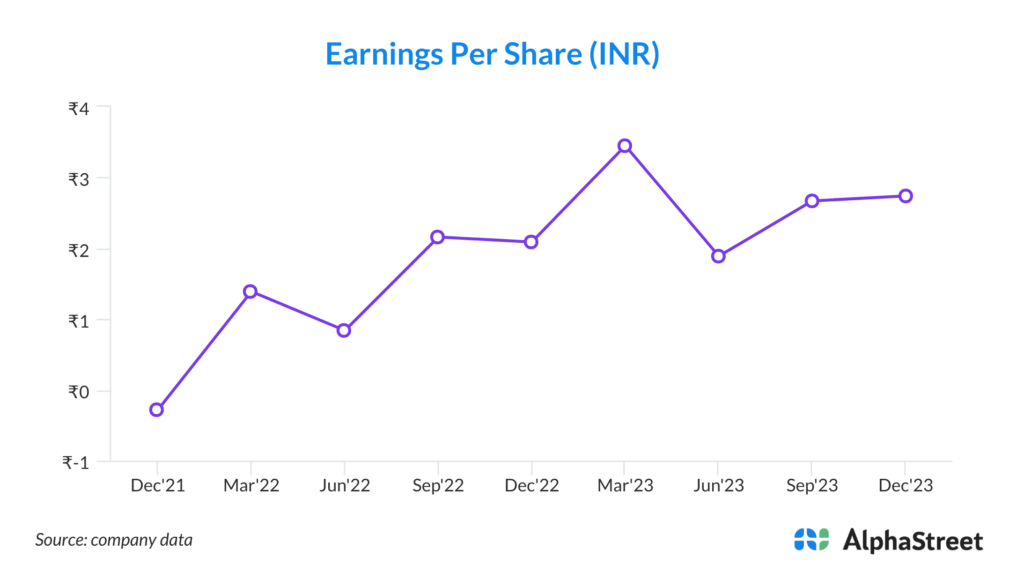

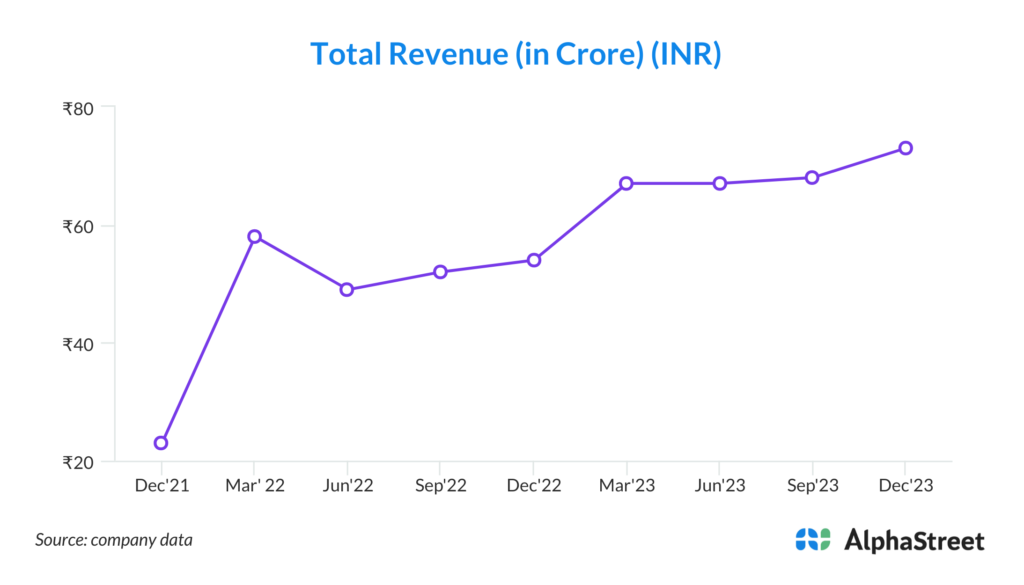

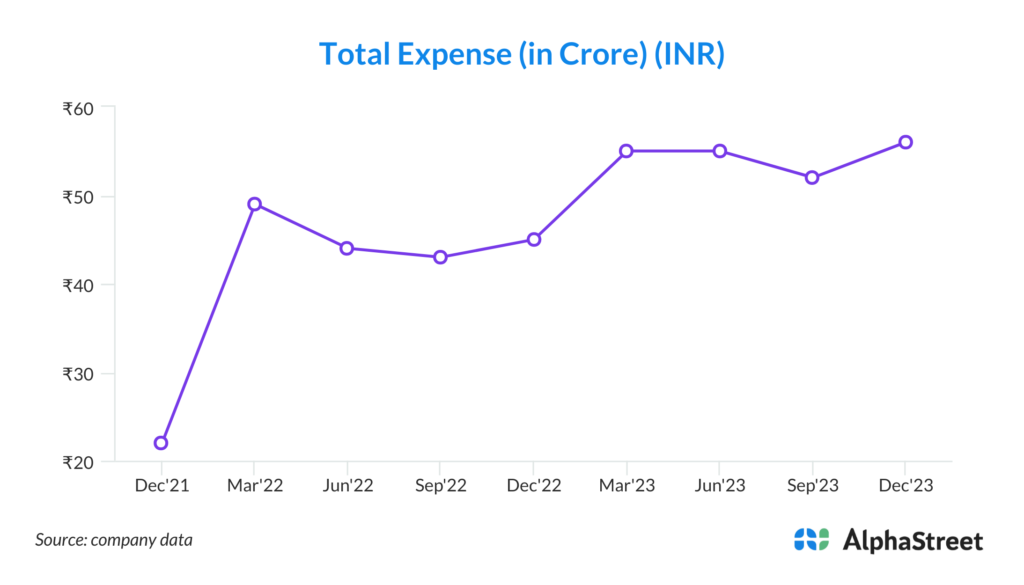

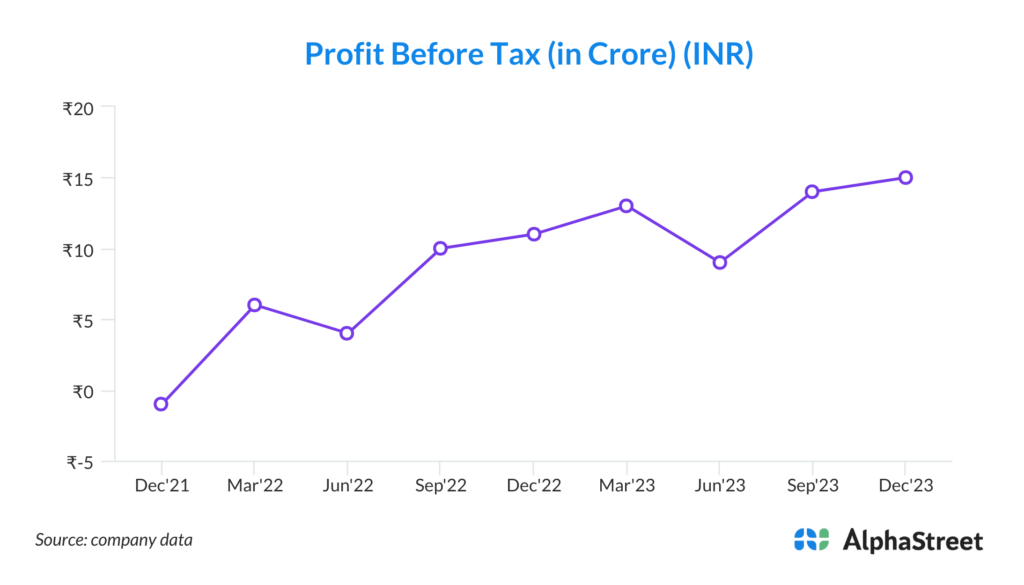

In Q3FY24, KEL demonstrated robust financial performance, marked by significant year-on-year growth across key metrics. The company reported a notable increase in revenue, reaching Rs. 72.8 crore, marking a 35.27% rise compared to the same period last year. Accompanying this revenue growth was a substantial improvement in EBITDA, which stood at Rs. 17.24 crore, reflecting a remarkable 90.5% increase year-on-year. This impressive performance was driven by enhanced EBITDA margins, which expanded by 687 basis points, attributed to effective operating leverage and prudent cost control measures. Additionally, the company’s profitability saw a notable uptick, with PAT reaching Rs. 10.3 crore, a substantial 37.47% increase compared to the corresponding quarter in the previous year. These positive financial results underscore KEL’s resilience and effectiveness in navigating market challenges while capitalizing on growth opportunities in its diversified portfolio of industries served.

Key Strengths of the Company:

1. Diverse Product Portfolio: Kilburn Engineering (KEL) boasts a comprehensive range of specialized process equipment and drying solutions, tailored to meet the unique needs of industries spanning tea, fertilizer, pharmaceuticals, and more. This diversified product portfolio not only caters to a wide array of applications but also mitigates risks associated with reliance on a single industry sector, ensuring resilience in dynamic market conditions.

2. Cutting-edge Manufacturing Facility: With its advanced manufacturing facility located in Thane, Maharashtra, spanning over 30,960 square meters, KEL stands at the forefront of technological innovation in the industry. Equipped with state-of-the-art machinery and infrastructure, the facility enables efficient fabrication, machining, and assembly of equipment, ensuring high-quality products and timely delivery to customers.

3. Strong Market Presence and Brand Recognition: As a market leader in solid, liquid, and gas drying systems, KEL commands a prominent position within its target industries. The company’s longstanding reputation for reliability, innovation, and customer-centric solutions has solidified its brand recognition, fostering trust and loyalty among clients, which further strengthens its competitive advantage.

4. Strategic Acquisition and Integration: KEL’s recent acquisition of M.E Energy, a leading provider of waste heat recovery systems, demonstrates its strategic vision and commitment to enhancing its capabilities. This integration not only expands KEL’s product offerings but also unlocks synergies, driving cost efficiencies, amplified margins, and increased sales opportunities, positioning the company for accelerated growth and market dominance.

5. Robust Financial Performance: With a track record of strong financial performance, KEL consistently delivers impressive results, characterized by revenue growth, improved EBITDA margins, and enhanced profitability. This financial stability not only instills investor confidence but also provides the necessary resources to fuel future expansion initiatives and capitalize on emerging market opportunities.

6. Expertise and Technical Know-how: KEL’s team of highly skilled engineers and technicians possess deep expertise and technical know-how in the design, manufacturing, and installation of specialized process equipment. This technical prowess enables the company to develop innovative solutions, customize products to meet specific client requirements, and maintain a competitive edge in the ever-evolving market landscape.

7. Focus on Innovation and Adaptability: In an era of rapid technological advancements and changing market dynamics, KEL remains committed to fostering a culture of innovation and adaptability. The company continuously invests in research and development initiatives to stay ahead of industry trends, anticipate customer needs, and develop cutting-edge solutions that address emerging challenges, ensuring long-term sustainability and success.

Key risks and concerns for the Company:

1. Intense Competition: KEL operates in a highly competitive landscape, facing rivalry from established players like Walchandnagar Industries and ISGEC, as well as the entry of numerous domestic and international competitors. This heightened competition poses a risk to KEL’s market share and pricing power, necessitating continuous innovation and differentiation strategies to maintain its competitive edge.

2. Raw Material Price Volatility: The company’s long execution periods expose it to the risk of fluctuations in raw material prices, which can adversely impact profit margins. Variations in prices of metals, alloys, and other essential inputs could escalate production costs, affecting the company’s financial performance and profitability.

3. Currency Fluctuations: As a significant portion of KEL’s sales is generated from exports, exposure to currency fluctuations poses a considerable risk. Adverse movements in exchange rates can lead to revenue and profit volatility, impacting the company’s bottom line and financial stability. Effective hedging strategies and proactive risk management are essential to mitigate this risk.

4. Cyclical Nature of Business: Being a provider of capital goods, KEL’s business is inherently cyclical, susceptible to economic downturns and fluctuations in demand. Periods of reduced capital expenditure by industries could lead to a decline in order intake and revenue, impacting the company’s financial performance and growth prospects.

5. Delayed Customer Payments: In a changing economic environment, KEL faces the risk of delayed customer payments, affecting cash flow and liquidity. Delays in receiving payments could strain working capital and hinder the company’s ability to meet its financial obligations and fund operational activities, potentially leading to liquidity challenges.

6. Operational Delays: Execution delays in delivering manufactured products on committed dates pose operational risks for KEL. Factors such as production bottlenecks, supply chain disruptions, or unforeseen technical issues could result in project delays, impacting customer satisfaction and contractual obligations, potentially leading to penalties and reputational damage.

7. Regulatory and Compliance Risks: Compliance with regulatory requirements and adherence to quality standards are paramount for KEL’s operations. Non-compliance with industry regulations or quality standards could lead to legal liabilities, fines, or reputational damage. Keeping abreast of evolving regulatory frameworks and ensuring strict adherence to quality control measures is essential to mitigate regulatory and compliance risks.