Khadim is an Indian footwear company. The headquarters is located in Kolkata, India. The business initially started from a footwear store named KM Khadim & Company in Chitpur. It was acquired in 1965 by the founder Satya Prasad Roy Burman. Khadim was incorporated in the year 1981 and remained a wholesale business until 1993. However, in 1993 Khadim opened its first retail store in Kolkata. The brand has its major presence in East India, but it is also one of the top 3 players in South India. It is the 2nd largest footwear retailer with a retail franchise network in India. It has made its presence across 23 states & 1 union territory. As of March 2022 Khadim has 782 branded retail stores with 627 distributors.

Business Model –The business model of Khadim is mainly classified as the retail division & distribution. The retail business has 782 ‘Khadim’s exclusive branded outlets. The target customer of this sector is mainly the Middle & upper middle income consumers in metros including mini metros. It mainly deals with non-leather sandals, slippers, boots, ballerinas, stilettos, moccasins, sports shoes and accessories. The distribution business has 627 distributors supplying to MBOs across India. The target customers of this segment are mainly Lower- & middle-income consumers in Tier I – III cities, who shop in MBOs. It mainly deals with premium Hawai, PVC, PVC DIP and PU and Stuck On products.

Business Outlook– The Company anticipates a revenue of 800 crores for FY 23 with an EBITDA of 15%. But with the hike of GST from 5% to 12% the price has been affected.

Industry Analysis

The total revenue of the Indian footwear market is expected to grow at a CAGR of 12.83% through 2022 to 2027, reaching nearly US$ 27.84 Billion. This sector has low-cost raw materials, low labour costs, resulting in lower production costs, which have lowered overall prices in the sector.

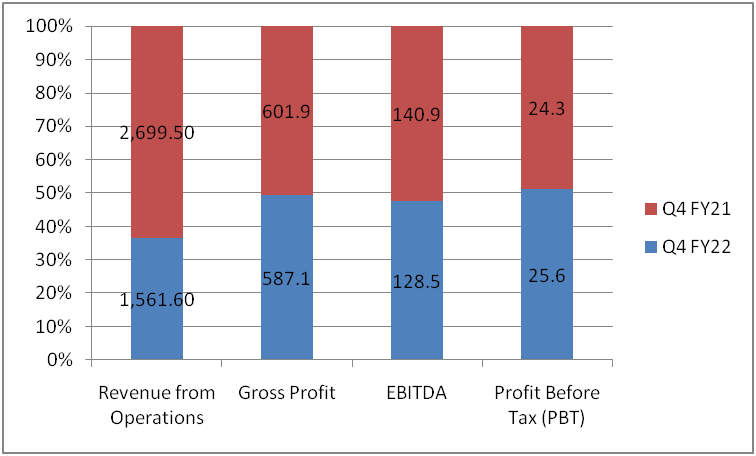

Financial Snapshots (In Rs Million)

Revenue from Operation is Rs 1,561.6 million. Gross margin improved by 1,530 bps year on year to 37.6%. The brand successfully introduced a new range of products in their basket. It strengthens its retail presence in Tier ll &lll cities by opening 22 new retail stores. For FY 2022 revenue stood at Rs 5,911 million with an increase of 14.5% year on year. The Retail and Distribution verticals have grown 15% and 13% respectively. The gross margin has improved to 37.2%, with an increase of 840 basis points. Retail and distribution gross margins stood at 53.3% and 35.4% respectively. PAT was Rs. 26.5 million for Q4 FY 22. For FY 22 PAT is Rs. 64.4 million.

SWOT Analysis

Strength- It is a well recognized brand in India with a wide geographical demography. It successfully diversified its product mix. The wide variety of products has helped to penetrate different customer segments. It has also helped the organization to diversify revenue streams.

Weakness- The company is growing very fast in terms of revenue, but it needs to analyze the various trends within the Services sector and figure out what it needs to do to drive future growth. The company should invest more on building an effective supply chain.

Opportunity- The customer preferences are fast changing so the company needs to diversify the product based on customers’ tastes and preferences. The company also focuses on online space for better management. Other than India, Khadim should expand its business in other Asian countries as well.

Threat- Legal actions impacting the business of Khadim India. These legal procedures are time consuming and had become a long drawn process. Khadim has very little presence in the rural markets and there is a huge competitive pressure from other footwear companies. The company lacks long term contracts with suppliers which can affect the overall supply chain.

Comparative Analysis between Khadim and Bata

| Company | Market Cap (Crore) | ROE % | Debt to equity | Price to book value |

| Khadim | 323.27 | 7.56 | 1.15 | 1.21 |

| Bata | 21,546 | 20.54 | 0.75 | 12.5 |

Bata India Limited is the largest retailer and manufacturer of footwear in the country. It was established in the year 1931 on the other hand Khadim is a dominant player for Eastern & Southern India. It was established in 1981. Now from the investor perspective Bata has been always in a better position compared to Khadim. Bata has less debt equity ratio and higher return on equity.

Business Strategies– On the basis of the analysis, it was noticed that 85% of the footwear industry are dependent on price. The customer mainly prefers shoes in the price range of Rs 500. So major brands target the price range between Rs 499 to Rs 999. So Khadim also followed the same strategy. To grab the market Khadim has two strategies. The foremost strategy is to introduce footwear in the price range of Rs 500. Depending on the nature of taste and preference in metros, non-metros and rural area the products are launched. Hawai Chappals and PVC sandals to economically priced sports shoes will be more preferable in rural areas. Similarly fashionable and stylish shoes like Cleo, British Walker, Sharon will be more preferable in metros and mini metros.