KFin Technologies Limited is a leading technology-driven financial services platform. The company provides services and solutions to asset managers and corporate issuers across asset classes in India and provides several investor solutions including transaction origination and processing for mutual funds and private retirement schemes in Malaysia, the Philippines and Hong Kong. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

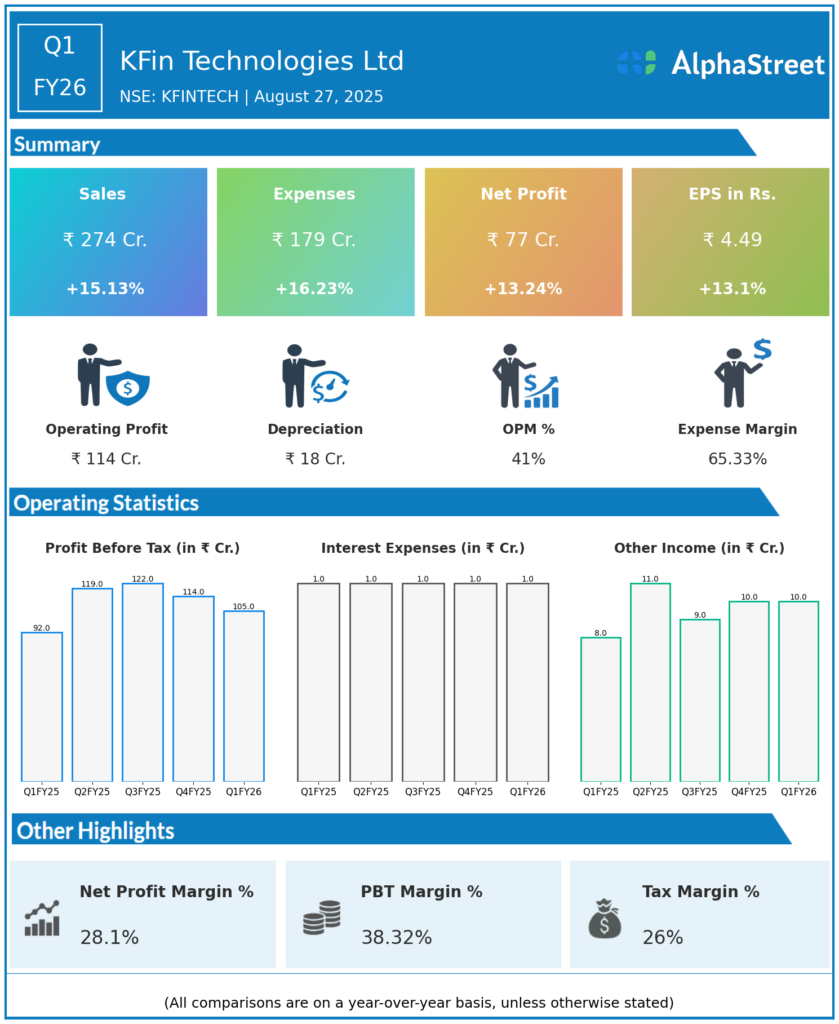

Total Revenue: ₹274 crores, up 15.1% YoY (Q1 FY25: ₹245.65 crores) but down 3% QoQ (Q4 FY25: ₹292.44 crores).

-

EBITDA: ₹123.89 crores, up 14.2% YoY, margin 41.5%.

-

Profit Before Tax (PBT): ₹105.16 crores, up 14.5% YoY (Q1 FY25: ₹91.81 crores), up 10.1% QoQ (Q4 FY25: ₹95.47 crores).

-

Profit After Tax (PAT): ₹77.26 crores, up 13.2% YoY (Q1 FY25: ₹68.07 crores), down 9% QoQ (Q4 FY25: ₹85.05 crores).

-

Earnings Per Share (EPS): ₹4.49, up 13.1% YoY.

-

PAT Margin: 28.2% (Q1 FY25: 27.7%).

-

Cash & Cash Equivalents: ₹750 crores as of June 30, 2025.

-

Domestic Mutual Fund Investor Solutions Revenue: ₹199.10 crores, up 3.4% YoY.

-

Issuer Solutions Revenue: ₹42.40 crores, up 34.6% YoY.

-

Core International & Investor Solutions Revenue: ₹129.4 crores, up 29.3% YoY.

-

SaaS Revenue: ₹33.6 crores, up 39.6% YoY.

-

NPS Subscribers: 1.67 million.

Management Commentary & Strategic Decisions

-

MD & CEO Sreekanth Nadella highlighted broad-based growth, operational excellence, and strategic client wins in mutual fund, SaaS, and international segments.

-

Continued investments in technology, expansion in global platforms, and digital innovations (notably mPowerWealth expansion in the Philippines and GIFT City initiatives) are driving business momentum.

-

Despite sequential dip in profit, management reaffirmed FY26 growth guidance, citing strong order book and pipeline.

-

Company settled a SEBI case during Q1, focusing on regulatory compliance and client trust.

-

Strong liquidity and consistent new client additions are expected to boost leadership in India’s investor solutions market.

Q4 FY25 Results Earnings

-

Total Revenue: ₹283 crores.

-

EBITDA: ₹122.25 crores, margin 43.2%.

-

Profit Before Tax (PBT): ₹95.47 crores.

-

Profit After Tax (PAT): ₹85.05 crores.

-

EPS: ₹4.94.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.