Finance Minister Nirmala Sitharaman today presented the Union Budget for 2026–27, outlining a growth strategy anchored in high public capital expenditure, manufacturing self-reliance, fiscal consolidation and targeted tax reforms. The Budget, with a total outlay of ₹53.5 lakh crore, seeks to balance India’s long-term “Viksit Bharat” ambition with near-term macroeconomic stability.

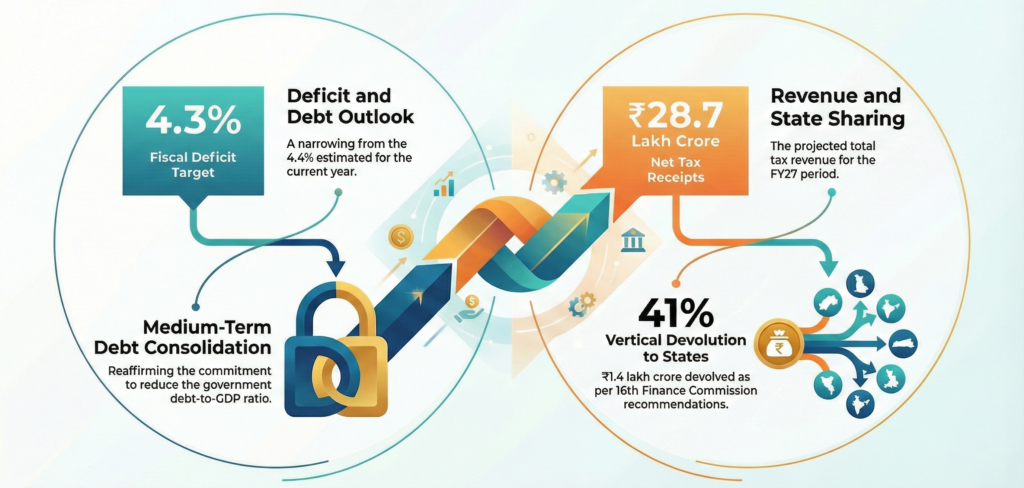

Fiscal Position: Deficit Narrows, Debt Consolidation Continues

The government has pegged the fiscal deficit for FY27 at 4.3% of GDP, marginally lower than the 4.4% estimated for the current year. Net tax receipts are projected at ₹28.7 lakh crore, while ₹1.4 lakh crore will be devolved to states, maintaining the 41% vertical devolution recommended by the 16th Finance Commission. The Centre reaffirmed its commitment to fiscal consolidation, aiming to gradually reduce the government debt-to-GDP ratio over the medium term.

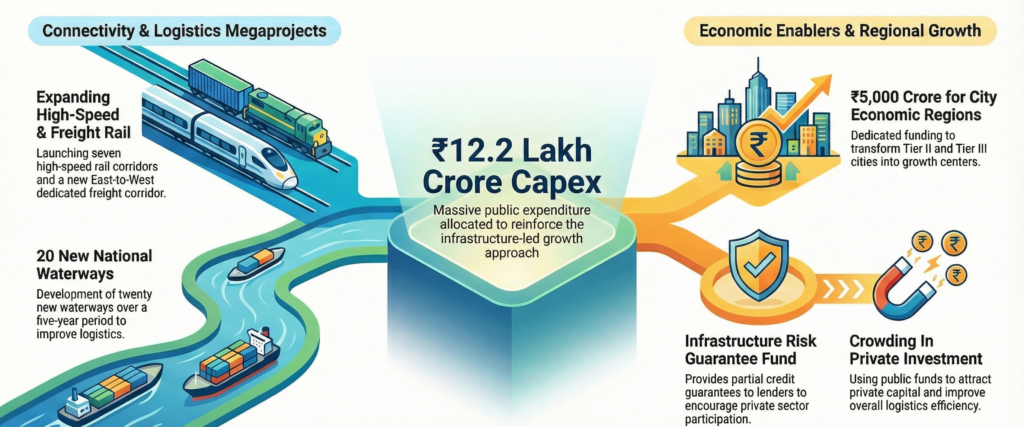

Capital Expenditure: Big Bet on Infrastructure and Connectivity

Public capital expenditure has been increased to ₹12.2 lakh crore, reinforcing the government’s infrastructure-led growth approach. Key initiatives include:

- Seven high-speed rail corridors as growth connectors

- A new dedicated freight corridor from Dankuni (East) to Surat (West)

- Development of 20 new National Waterways over five years

- An Infrastructure Risk Guarantee Fund to provide partial credit guarantees to lenders

- Creation of City Economic Regions with a ₹5,000 crore allocation

These measures aim to crowd in private investment, improve logistics efficiency, and strengthen Tier II and Tier III growth centres.

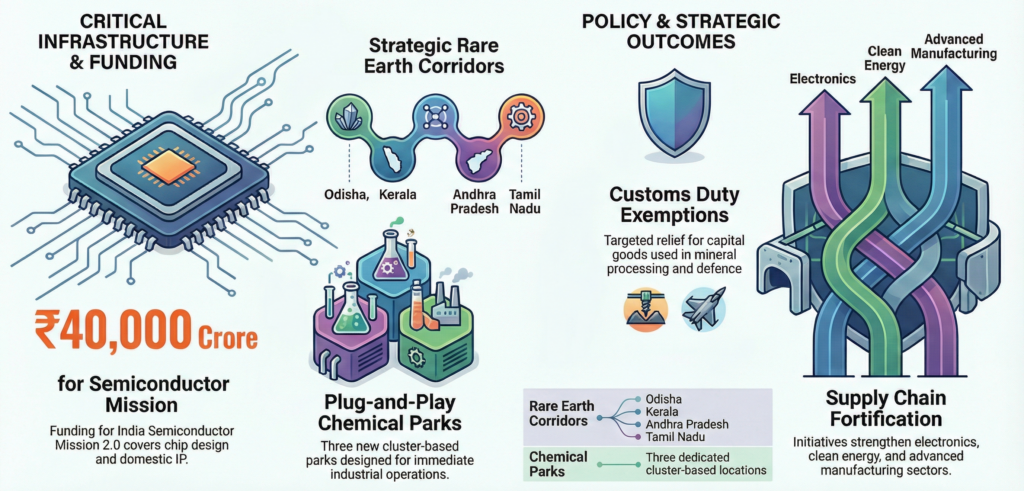

Manufacturing and Strategic Sectors: Self-Reliance in Focus

The Budget places strong emphasis on reducing import dependence across critical sectors. Highlights include:

- India Semiconductor Mission (ISM) 2.0 with ₹40,000 crore outlay to support equipment, materials, full-stack chip design and domestic IP

- Dedicated rare earth corridors in Odisha, Kerala, Andhra Pradesh and Tamil Nadu

- Support for three chemical parks using a cluster-based plug-and-play model

- Customs duty exemptions for capital goods used in critical minerals processing and defence aircraft components

Together, these initiatives are designed to strengthen supply chains in electronics, clean energy, defence and advanced manufacturing.

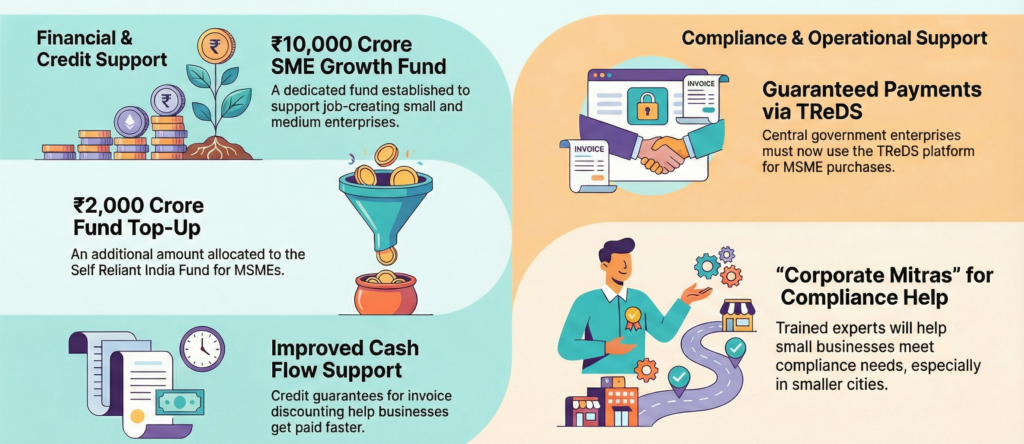

MSMEs and Employment: Liquidity, Credit and Compliance Support

To support job-creating enterprises, the government announced a ₹10,000 crore SME Growth Fund and a ₹2,000 crore top-up to the Self Reliant India Fund. Additional measures include mandatory use of TReDS for CPSE purchases from MSMEs, credit guarantee support for invoice discounting, and training of “Corporate Mitras” to help small businesses meet compliance needs, especially in smaller cities.

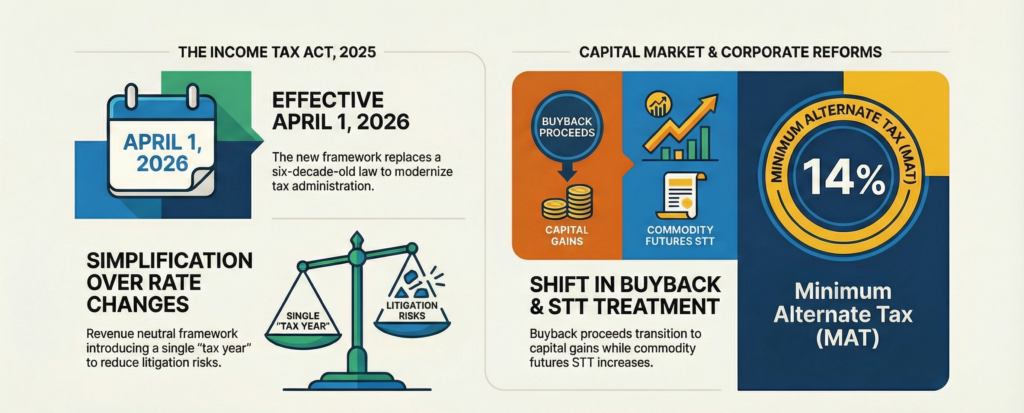

Tax and Financial Market Reforms: Simplification Over Rate Cuts

The Income Tax Act, 2025 will come into force from April 1, 2026, replacing the six-decade-old law. The new framework simplifies provisions, introduces a single “tax year,” reduces litigation risk, and is revenue neutral with no change in tax rates.

On capital markets, buyback proceeds will now be taxed as capital gains, the Securities Transaction Tax on commodity futures has been increased, while the MAT rate has been reduced to 14% and treated as final tax.

Social, Health and Emerging Sectors

The Budget announced:

- ₹20,000 crore over five years for carbon capture technologies

- Five medical tourism hubs and Biopharma Shakti with ₹10,000 crore outlay

- Over 1,000 accredited clinical trial sites nationwide

- Skill and livelihood initiatives for divyangjan, women entrepreneurs (She-Marts), and the AVGC sector

These measures aim to combine social inclusion with future-ready industries.

What It Means for Retail Investors

For investors, Budget 2026 reinforces the long-term theme of infrastructure-led growth, manufacturing self-reliance, and policy stability. While there are no headline personal tax giveaways, continued capex, MSME support and sector-specific incentives could create opportunities across capital goods, logistics, electronics, defence and healthcare over the medium to long term.