Kewal Kiran Clothing Limited was incorporated in 1992. The Company is engaged in manufacturing, marketing and retailing of branded readymade garments and finished accessories. The company has consumers in Asia, Middle East and CIS (Commonwealth of Independent States). Its registered office is in Mumbai.

Q2 FY26 Earnings Results

-

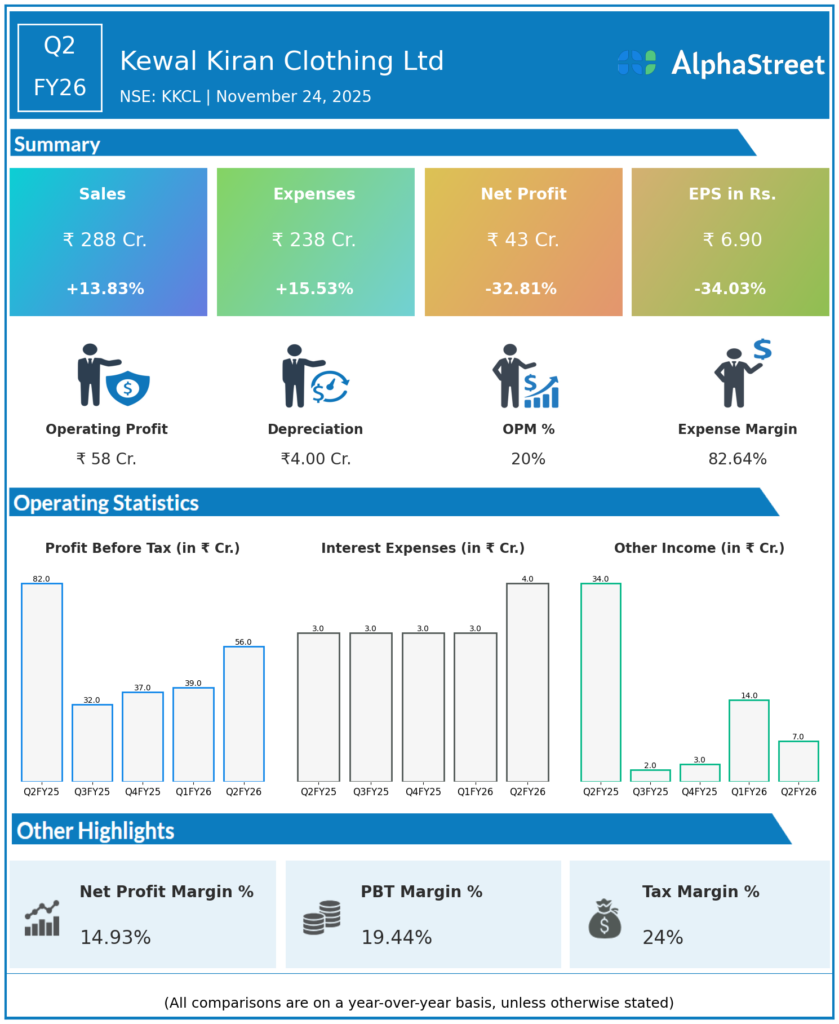

Consolidated Revenue from Operations: ₹288 crore, up 14% YoY from ₹308.2 crore and a strong performance driven by volume growth and higher realizations.

-

Gross Profit grew 15.8% YoY to ₹149.2 crore, with gross margin stable at 42.1%.

-

EBITDA: ₹71 crore, up 11% YoY, with EBITDA margin at 20%, exceeding guidance of 17-18% due to better operating leverage and cost efficiency.

-

Profit After Tax (PAT): ₹43 crore, down 30.1% YoY primarily due to a one-time gain in the previous year’s other income, indicating operational profitability remains strong.

-

Apparel volume rose by 17.3%, and average realization per unit improved by 22.1% YoY, reflecting improved product mix and market penetration.

-

The company added 29 exclusive brand outlets (EBOs) to expand retail footprint.

Management Commentary & Strategic Insights

-

Management attributes robust revenue growth to favorable macroeconomic tailwinds, strong brand resonance, and deep market penetration across urban and semi-urban areas.

-

Strategic focus remains on operational excellence, product innovation, and portfolio diversification to sustain growth momentum.

-

Continued emphasis on expanding retail network and strengthening digital presence to reinforce long-term growth potential.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹233.8 crore, up 54.5% YoY from ₹151.2 crore in Q1 FY25.

-

Gross Profit: ₹98.6 crore, up 43.5% YoY, with gross margin at 42.2%.

-

EBITDA: ₹41.5 crore, up 50.6% YoY with margin at 17.8%.

-

PAT: ₹32 crore, up 27% YoY, reflecting healthy demand and cost management.

-

Management highlighted strong volume growth, new product launches, and market expansion as key drivers.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.