Kewal Kiran Clothing Limited was incorporated in 1992. The Company is engaged in manufacturing, marketing and retailing of branded readymade garments and finished accessories. The company has consumers in Asia, Middle East and CIS (Commonwealth of Independent States). Its registered office is in Mumbai. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

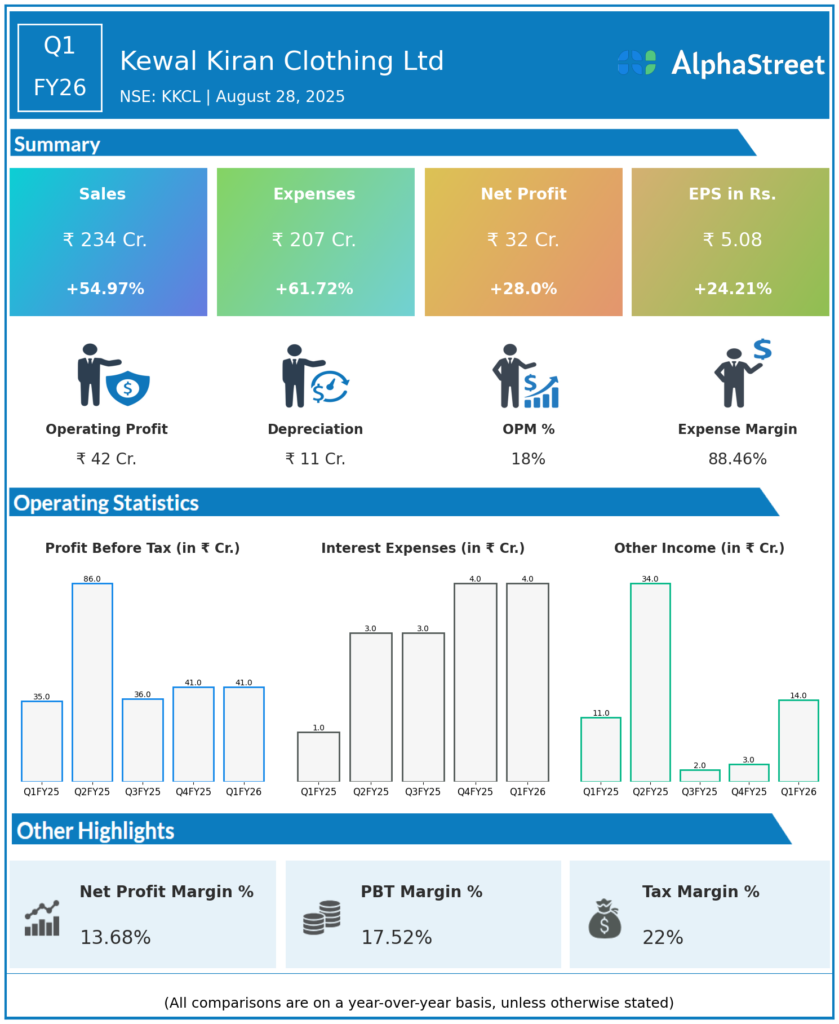

Revenue from Operations: ₹233.8 crores, up 54.9% YoY (Q1 FY25: ₹151.2 crores) and down 18.8% QoQ (Q4 FY25: ₹288.1 crores).

-

Total Income: ₹247.7 crores, up 52.8% YoY and up 8.6% QoQ.

-

Total Expenses: ₹206.4 crores, up 61.7% YoY and up 14.6% QoQ.

-

Gross Profit: ₹98.6 crores, up 43.5% YoY; gross margin 42.2%.

-

EBITDA: ₹41.5 crores, up 50.6% YoY (Q1 FY25: ₹27.6 crores); margin 17.8% (Q1 FY25: 18.2%).

-

Profit Before Tax (PBT): ₹41.2 crores, up 18.5% YoY; down 13.9% QoQ.

-

Profit After Tax (PAT): ₹32.0 crores, up 28% YoY (Q1 FY25: ₹25.23 crores) and down 15.5% QoQ.

-

EPS: ₹5.08 per share, up 24.4% YoY (Q1 FY25: ₹4.10) and down 16.4% QoQ.

-

PAT Margin: 12.9% (Q1 FY25: 16.7%).

-

Store Count: Added 14 new brand outlets in the quarter, taking the total to 623 stores nationwide.

-

Brand Portfolio: Includes Killer, Easies, Lawman Pg3, and Integriti, strengthening appeal to young adults.

-

Spring-Summer Trade Shows: Reported strong trade channel feedback, supporting future growth.

Management Commentary & Strategic Updates

-

Management credited strong results to robust consumer demand, effective market strategies, and increased sales volume—especially in urban and semi-urban retail expansion.

-

The quarter marked significant progress in retail presence, digital initiatives, and product launches, setting the stage for ongoing growth in H2 FY26.

-

Operational focus remains on balancing cost growth and improving channel profitability amid changing consumer trends in fashion and apparel.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹288.1 crores.

-

Profit Before Tax (PBT): ₹41 crores.

-

Profit After Tax (PAT): ₹30 crores.

-

EPS: ₹4.73 per share.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.