Kesoram Industries Limited is a flagship company of B. K. Birla group. The Co is engaged in the manufacturing of Cement and Rayon, TP & Chemicals. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

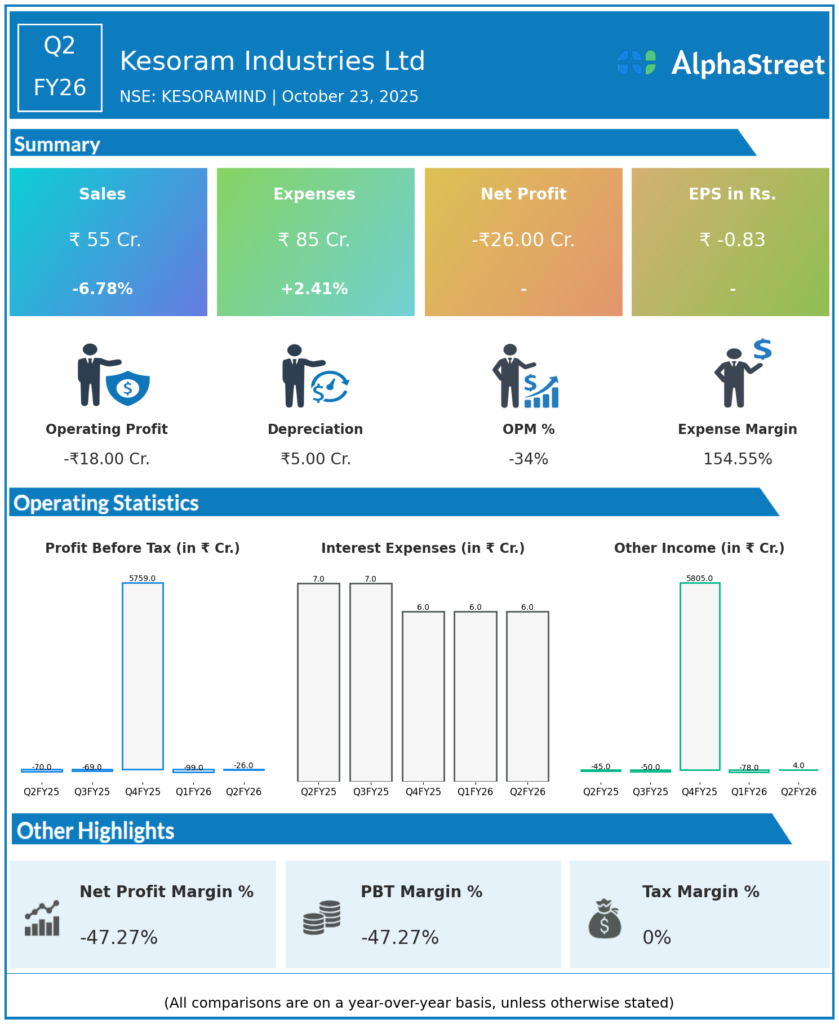

Consolidated Revenue: ₹55.17 crore, down 6.78% YoY from ₹58.71 crore in Q2 FY25, reflecting ongoing transition post-cement demerger.

-

Operating Profit: ₹-14.47 crore, down from -₹10.46 crore in Q2 FY25.

-

Profit After Tax (PAT): Consolidated net loss of ₹25.87 crore, significantly improved from ₹69.92 crore loss in Q2 FY25 but still under pressure due to impairment charges.

-

Standalone Net Loss: ₹111.86 crore in Q2 FY26 resulting from investment impairment on subsidiaries post-divestment of cement businesses.

-

Exceptional Items: ₹108.1 crore in Q2 FY26, mostly from impairment provisions related to subsidiary Cygnet Industries Limited.

-

EPS: Basic and diluted loss per share ₹0.83 compared to loss of ₹2.27 YoY.

Operational and Strategic Highlights

-

Post-demergence, Kesoram Industries primarily operates in Rayon, Transparent Paper, and Chemicals segments.

-

The company is undergoing strategic business rationalization, focusing on core businesses and reviewing investments in loss-making units.

-

The impairment charges and restructuring are indicative of ongoing efforts to improve financial health and optimize asset base.

Management Commentary

-

Management is focused on stabilizing financials post-cement demerger and optimizing operations within the remaining business verticals.

-

Future outlook hinges on operational efficiencies in chemical and fiber segments and potential synergies through subsidiary restructuring.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹60.5 crore.

-

Consolidated Net Loss: ₹127.32 crore largely due to similar impairment expenses.

-

The results reflect a continuation of transition-related challenges with emphasis on structural adjustments for profitability recovery.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.