Incorporated in 1968, KEI Industries Ltd manufactures wires and cables (W&C) like EHV cables, HT cables, LT cables, and sells them in India and overseas. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

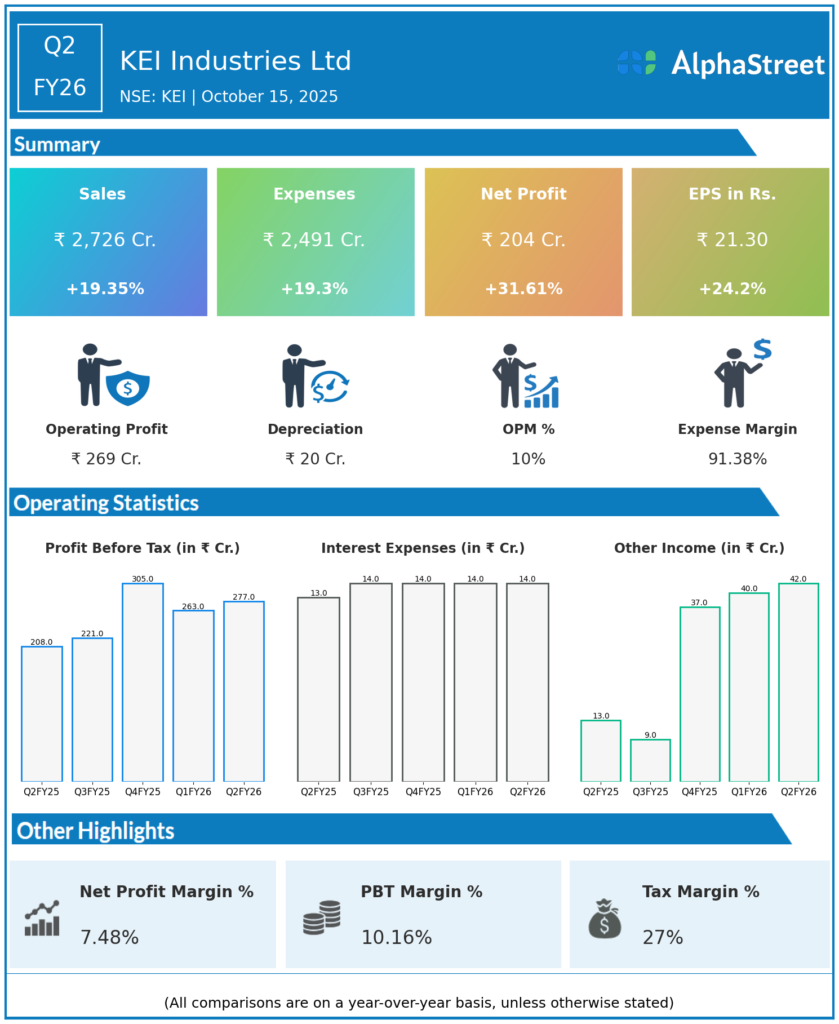

Revenue from operations: ₹2,726 crore, up 19% YoY from ₹2,284 crore.

-

Net Profit (PAT): ₹204 crore, up 31.6% YoY from ₹155 crore in Q2 FY25.

-

EBITDA: ₹312 crore, up 15% from ₹271 crore YoY.

-

EBITDA Margin: 11.1% (stable YoY).

-

EPS: ₹21.3 vs ₹17.15 YoY.

-

Growth Drivers: Institution (B2B) and project business grew 24% YoY, exports advanced 18%, and B2C distribution sustained healthy double-digit expansion; order book reached ₹3,921 crore as of September 30, 2025.

-

Capex: Continue expansion at Sanand Greenfield Project for EHV, HT, LT cables to drive future topline; funding from prior QIP.

-

Dividend: Interim dividend of ₹2/share declared.

Management Commentary & Strategic Updates

-

Management emphasized strong volume growth across institutional, distribution, and export verticals, with premiumization and product mix sustaining margins despite raw material fluctuations.

-

Robust execution in Extra High Voltage (EHV) and High Tension (HT) segments, with exports more than doubling in wire and cable category.

-

Continued investment in capacity and supply chain resilience positions KEI to meet growth in power, infrastructure, and real estate sectors.

-

Healthy order book and strong institutional investor confidence reflect market strength and financial resilience.

-

Capex at Sanand and tech upgrades expected to further improve productivity and future revenue streams.

Q1 FY26 Earnings Results

-

Revenue from operations: ₹2,590 crore, up 25.4% YoY from ₹2,066 crore.

-

Net Profit (PAT): ₹195.7 crore, up 30% YoY.

-

EBITDA: ₹297 crore, up 28% YoY; EBITDA margin stable at 11%.

-

EPS: ₹21.8.

-

Order book: ₹3,921 crore as of June 30, 2025.

-

Growth Driven By: Institutional cables, EHV segment (+47%), and exports (+61%) were significant contributors; B2C distribution maintained majority share.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.