Incorporated in 1968, KEI Industries Ltd manufactures wires and cables (W&C) like EHV cables, HT cables, LT cables, and sells them in India and overseas. Presenting below are its Q1 FY26 earnings.

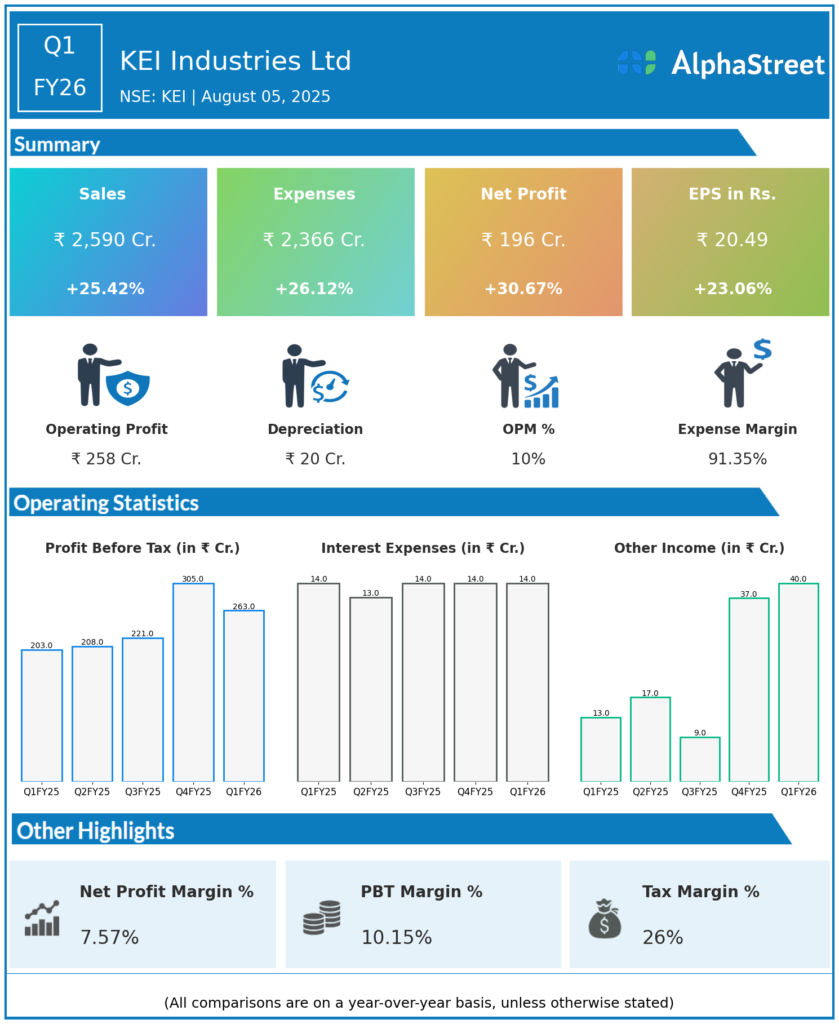

Q1 FY26 Earnings Summary

-

Net Sales: ₹2,590 crore, up 25.42% year-over-year (YoY) from ₹2,065 crore in Q1 FY25.

-

EBITDA: ₹297.6 crore, up 28% YoY; EBITDA margin improved to 11.49% from 11.25% YoY.

-

Profit After Tax (PAT): ₹196 crore, up 30.6% YoY from ₹150.25 crore; PAT margin at 7.56% vs 7.28% last year.

-

EPS: ₹20.49 (vs ₹16.65 Q1 FY25).

-

Segment Highlights:

-

Wires & Cables Revenue: ₹2,477 crore, up 31.8% YoY.

-

Exports Revenue growth: +61% YoY; B2C (distribution) sales up 22% YoY.

-

Stainless Steel Wire Revenue: ₹52.1 crore, down 3.6% YoY.

-

EPC Projects Revenue: ₹99.4 crore, down 56% YoY; share of total revenues declined as company focuses on core B2B and retail.

-

-

Order Book: ₹3,921 crore, with strong pipeline in cables, exports, and infrastructure.

-

Capacity Expansion: The new Sanand facility is expected to begin production by September 2025, providing a runway for further growth.

Key Management Commentary & Strategic Highlights

-

Management described the quarter as one of “robust demand across product segments and geographies,” crediting distribution expansion and a favorable industry cycle.

-

Guidance reaffirmed: 18–19% revenue growth for FY26, maintaining EBITDA margin in the 10.5–11% band; aims for a 20% CAGR over the next 2–3 years as Sanand ramps up.

-

Management remains optimistic on domestic institutional demand (renewables, rail, metro, data centers) and strong export momentum, particularly in cables and wires.

-

Export mix is expected to rise to 17–18% of sales as global opportunities are pursued aggressively.

-

The company continues to prioritize working capital management, technological advancement, and prudent capex (~₹600–700 crore annually).

-

Focus remains on strengthening the brand and B2C distribution, reducing reliance on the low-margin EPC segment.

-

Order book strength provides strong visibility for the remainder of FY26.

Q4 FY25 Earnings Summary

-

Net Sales: ₹2,915 crore, up 25% YoY from ₹2,334 crore in Q4 FY24.

-

EBITDA: ₹338 crore, up 30% YoY; EBITDA margin at 11.61% (Q4 FY24: 11.15%).

-

PAT: ₹227 crore, up 34% YoY from ₹168.5 crore.

-

EPS: ₹18.60, up 21.6% YoY.

-

Wires & Cables Revenue: ₹2,796.8 crore, up 34.5% YoY.

-

EPC Revenue: ₹223.4 crore, down 34.4% YoY.

To view the company’s previous earnings, click here