KEC International is a global infrastructure EPC major. It has presence in the verticals of Power Transmission and Distribution, Railways, Civil, Urban Infrastructure, Solar, Oil & Gas Pipelines, and Cables. It is the flagship Company of the RPG Group.

Q2 FY26 Earnings Results

-

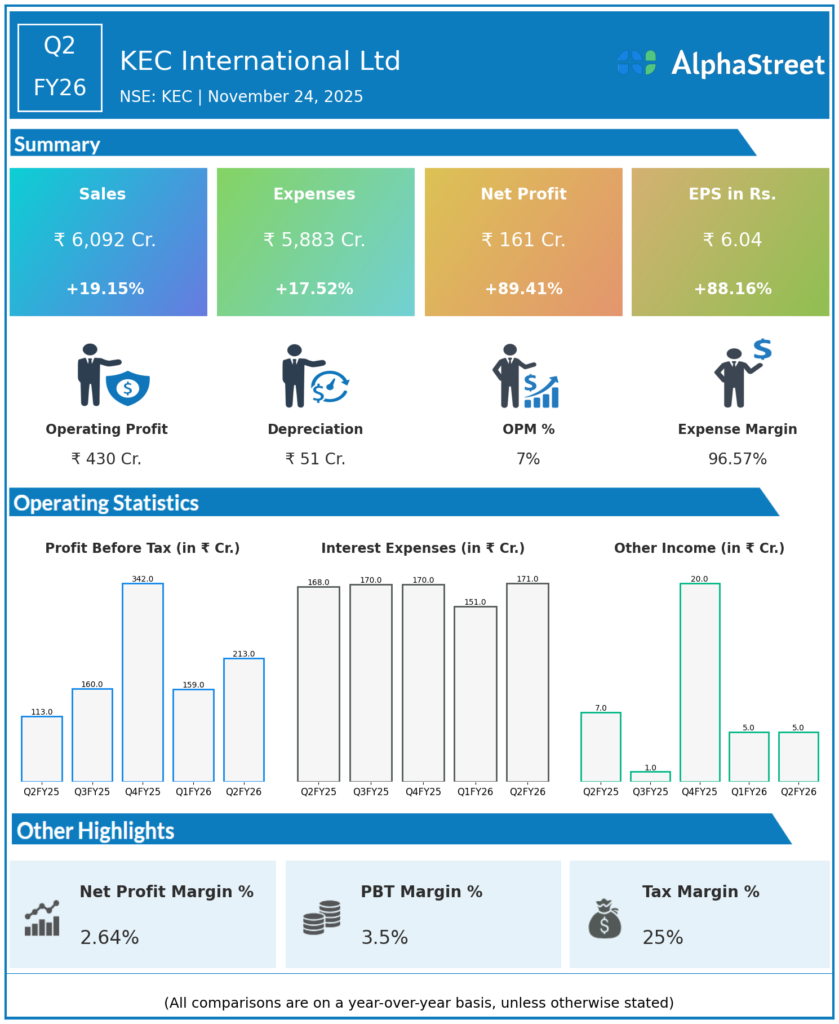

Revenue from Operations: ₹6,092 crore, up 19% YoY from ₹5,113 crore and up 21.3% sequentially from ₹5,022 crore in Q1 FY26, marking record topline growth across core power transmission and infrastructure verticals.

-

EBITDA: ₹430 crore, up 34% YoY from ₹320 crore (margin 7.1%, expansion of 81 bps YoY and 10 bps QoQ).

-

PAT: ₹161 crore, up 88% YoY; PBT doubled to ₹213 crore from ₹113 crore last year.

-

Employee cost: ₹426 crore, up 5.3% YoY, rising well below revenue pace indicating operational leverage and productivity improvements.

-

Consolidated YTD order intake: ₹16,050 crore, up almost 20% YoY, pushing order book past ₹44,000 crore, indicating robust future revenue visibility.

-

Margins in the EPC segment expanded, reflecting pricing discipline despite competitive and inflationary headwinds.

Management Commentary & Strategic Insights

-

Management emphasized strong execution, operational discipline, and effective project selection driving profitability and ROCE improvement.

-

Volume growth was broad-based and supported by robust order inflow, particularly in Transmission & Distribution (T&D), Civil, and Renewables.

-

Focus maintained on working capital management, pricing power, and expansion into higher-margin geographies and segments, including railways and solar EPC.

-

Outlook remains positive: management expects continued double-digit revenue growth and margin stability as execution risks recede and tender pipeline remains active.

-

Debt and capital allocation remain closely managed to support large-scale order execution while maintaining balance sheet strength.

-

Investments in technology, supply chain digitization, and expansion into international markets support future growth plans.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹5,023 crore, up 11% YoY from ₹4,512 crore, but down QoQ from Q4 FY25 due to seasonality.

-

EBITDA: ₹350 crore, up 19% YoY (margin 7%), indicating improved cost management and pricing.

-

PAT: ₹124.6 crore, up 42% YoY, with PAT margin improving to 2.5%.

-

Segment revenue: T&D ₹3,157 crore (+26% YoY), Civil ₹940 crore, Transportation ₹471 crore, Cables ₹383 crore (+5% YoY), Renewables ₹136 crore (+87% YoY).

-

Robust order book of ₹34,409 crore at end Q1, with continued order inflows, supporting revenue visibility.

-

Management maintained a positive outlook for continued top-line and bottom-line growth, backed by broad segment and geographic expansion.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.