KEC International is a global infrastructure EPC major. It has presence in the verticals of Power Transmission and Distribution, Railways, Civil, Urban Infrastructure, Solar, Oil & Gas Pipelines, and Cables. It is the flagship Company of the RPG Group. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

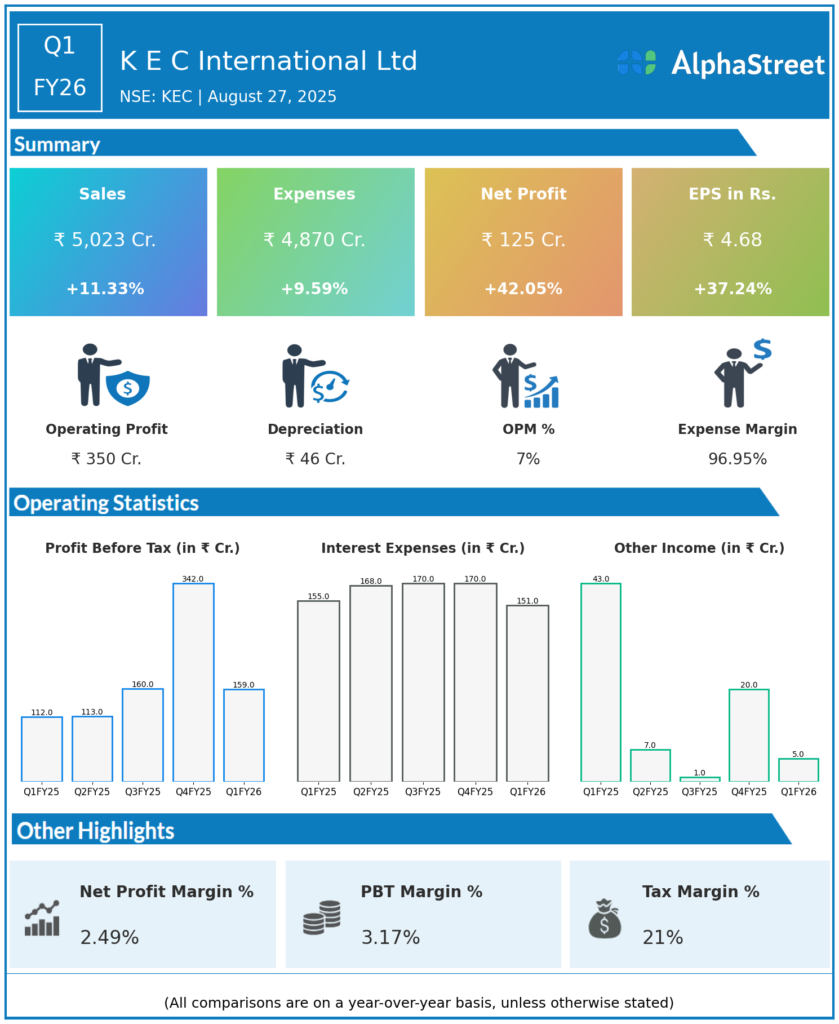

Consolidated Revenue from Operations: ₹5,023 crore, up 11% YoY (Q1 FY25: ₹4,512 crore), but down 18.5% QoQ (Q4 FY25: ₹6,172.6 crore).

-

EBITDA: ₹350 crore, up 19% YoY (Q1 FY25: ₹294 crore); margin improved to 7.0% (Q1 FY25: 6.5%).

-

Profit Before Tax (PBT): ₹158.5 crore, up 41.5% YoY (Q1 FY25: ₹112.0 crore), down 18% QoQ (Q4 FY25: ₹193.3 crore).

-

Profit After Tax (PAT): ₹124.6 crore, up 42% YoY (Q1 FY25: ₹87.6 crore), down 18% QoQ (Q4 FY25: ₹151.8 crore).

-

EPS: ₹4.68, up from ₹3.41 in Q1 FY25.

-

Order Book: ₹34,409 crore as of June 30, 2025, plus over ₹6,000 crore L1 pending, maintaining sector leadership.

-

Net Debt: ₹5,348 crore, reduced by ₹250 crore YoY.

-

Segment Revenue: T&D ₹3,157 crore (+26% YoY), Civil ₹940 crore, Transportation ₹471 crore, Cables ₹383 crore (+5% YoY), Renewables ₹136 crore (+87% YoY).

-

Net Working Capital: 128 days vs 122 days earlier.

Management Commentary & Strategic Decisions

-

MD & CEO Vimal Kejriwal commented on robust YoY growth in revenue (11%), profitability (>40% in PBT, PAT), and improved EBITDA despite sector headwinds like manpower shortages and supply chain volatility.

-

Company maintains FY26 growth guidance of 15% and expects new order inflows and margin improvement amid high execution visibility and order pipeline.

-

Strategic focus on execution excellence, cash flow management, and further deleveraging to maintain financial resilience and operational profitability.

-

KEC continues to diversify by scaling up non-T&D businesses including civil, rail, water, and renewables.

-

The board and management reiterated strong optimism for the sector on the back of a robust order book and healthy tender pipeline.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹6,872 crore (up 11.5% YoY).

-

EBITDA: ₹539 crore (+39% YoY), margin 7.8%.

-

Profit Before Tax (PBT): ₹193.3 crore.

-

Profit After Tax (PAT): ₹268 crore (+76-77% YoY).

-

EPS: ₹10.08.

-

Order Book: ₹34,409 crore; FY25 order intake: ₹24,689 crore, up 36% YoY.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.