“We are pleased with our consistent growth in revenues, traction in order intake, and improving trajectory of profitability. The outlook remains healthy across most of our businesses with the current tender pipeline of over INR1,00,000 crores. With a robust order book plus L1 and strong focus on execution, we are confident of delivering the revenues of over INR20,000 crores with EBITDA margins of 7% for the year.”

-Vimal Kejriwal, MD & CEO

Stock Data

| Ticker | KEC |

| Industry | Infrastructure |

| Exchange | NSE |

Share Price

| Last 5 Days | -1.6% |

| Last 1 Month | 0.7% |

| Last 6 Months | 45.5% |

Business Basics

KEC International Limited, a leading global infrastructure EPC (Engineering, Procurement, and Construction) company, operates with a focus on innovation, engineering excellence, and sustainable growth. The company’s business fundamentals are rooted in its diversified portfolio of infrastructure projects, encompassing power transmission and distribution, railways, civil construction, and more.

One of the central pillars of KEC International’s business strategy is its proficiency in power transmission and distribution. The company specializes in the design, construction, and maintenance of high-voltage transmission lines and substations. KEC’s expertise contributes significantly to the expansion and modernization of electrical grids, enabling efficient electricity distribution and accessibility. In addition to the power sector, KEC International actively participates in the development of railway infrastructure. The company undertakes rail electrification, signaling, and construction of railway bridges and tunnels, contributing to the enhancement of transportation connectivity and efficiency.

KEC International’s commitment to innovation is evident in its adoption of advanced construction technologies and engineering solutions. The company invests in research and development to enhance project efficiency, safety, and environmental sustainability. This focus on innovation enables KEC to execute complex projects efficiently and adhere to stringent quality standards. Financially, KEC International demonstrates prudent management by balancing profitability and growth. The company’s strategies include efficient project execution, diversification into related sectors, and the cultivation of long-term relationships with clients and partners.

Q1 FY24 Financial Performance

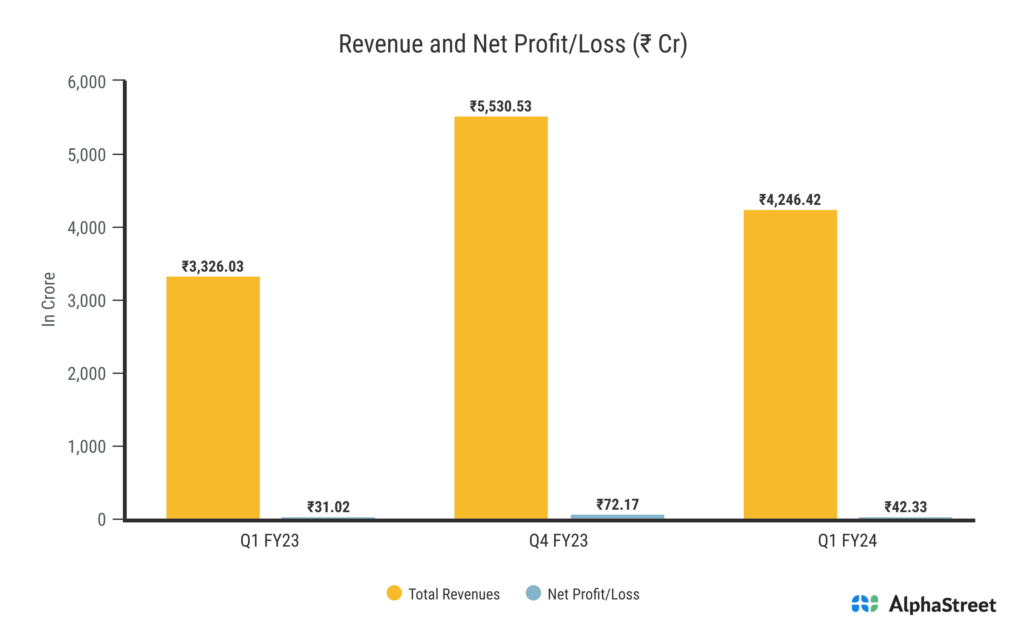

K E C International reported Revenues for Q1FY24 of ₹4,246.42 Crores up from ₹3,326.03 Crore year on year, a rise of 27.91%. Consolidated Net Profit of ₹42.33 Crores up 35.48% from ₹31.02 Crores in the same quarter of the previous year. The Earnings per Share is ₹1.65, up 36.36% from ₹1.21 in the same quarter of the previous year.

The company witnessed a 30% growth in year-to-date (YTD) order intake, with new orders totaling INR 4,500 crores. The order book stood at a robust INR 30,125 crores as of June 30, 2023, reflecting a 27% increase compared to the previous year. Despite a 25% growth in revenue over the trailing 12 months, KEC International reduced its net working capital by 22 days to 126 days as of June 30, 2023. The net debt, including acceptances, decreased by more than INR 350 crores, standing at INR 5,714 crores.

Business Segment Highlights

Transmission & Distribution (T&D): KEC International’s T&D business reported revenues of INR 2,188 crores, marking a significant growth of 33%. The company secured substantial orders across domestic and international markets, including prestigious repeat orders and expansion into the European market.

Railways: The railway business achieved a revenue of INR 764 crores, demonstrating an 8% growth. It also secured orders exceeding INR 750 crores, with a notable foray into international markets, specifically a signaling and telecommunication project in Bangladesh.

Civil: The civil business continued its high-growth trajectory with revenues exceeding INR 950 crores, a remarkable 60% increase. The segment strengthened its order book with multiple orders in industrial, residential, and commercial building sectors.

Oil and Gas Pipelines: The business recorded revenues of INR 104 crores, reflecting a growth of 13%. The focus remains on building qualifications to expand the addressable market.

Cables: The cable business achieved revenues of INR 389 crores and launched a transformation program to enhance profitability. This included ramping up the PVC plant for cost advantages and developing new products.

Company’s Future Outlook

With a strong order book and L1 position, KEC International is well-positioned to leverage growth opportunities across its diversified business segments and capitalize on the promising infrastructure development landscape in India and international markets. The company also highlighted its commitment to working capital management and scaling up businesses like oil and gas pipelines while focusing on ESG initiatives and profitability enhancements in the cable business. KEC International’s continued growth and strategic initiatives demonstrate its resilience and ability to adapt to evolving market dynamics.