Executive Summary

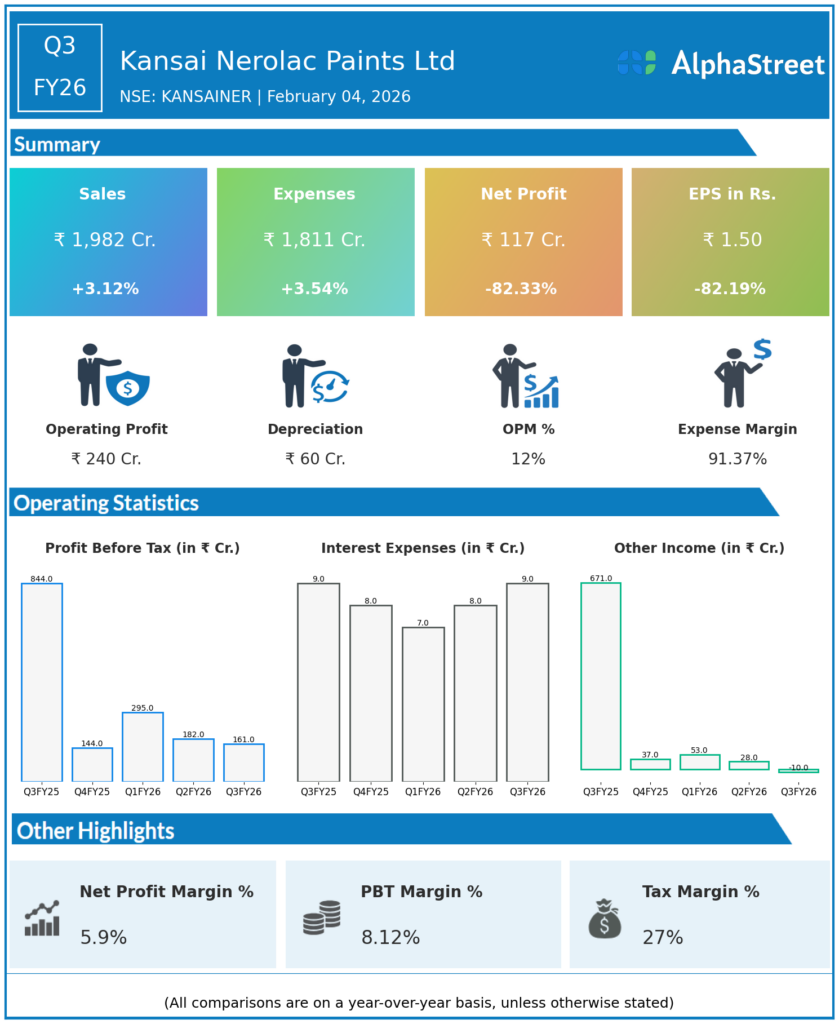

Kansai Nerolac Paints Ltd reported Q3FY26 revenues of ₹1,982 crore, up 3.12% YoY, but consolidated net profit plunged 82.33% to ₹117 crore primarily due to ₹44.72 crore exceptional charges from new Labour Codes implementation. Industrial coatings grew strongly from automotive demand while decorative paints faced subdued festive season volumes.

Revenue & Growth

Revenues increased modestly to ₹1,982 crore (standalone ₹1,907 crore) from ₹1,922 crore YoY, driven by 3.5% industrial coatings growth led by automotive OEMs benefiting from GST rate cuts. Total expenses rose 3.54% YoY to ₹1,811 crore amid stable raw material prices despite forex volatility.[scanx]

Profitability & Margins

Consolidated net profit collapsed to ₹117 crore from ₹662 crore due to ₹44.72 crore Labour Codes gratuity/leave provisions; adjusted PAT at ₹131-162 crore showed resilience. EBITDA margins contracted 46 bps to 13% with EPS down 82.19% to ₹1.50 from ₹8.42.cnbctv18+1

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

9M revenue up 1.9% to ₹5,866 crore but PAT down 44.4% to ₹499 crore post-exceptional items. Industrial strength offset decorative weakness; stable RM costs support margin recovery ahead.