Executive Summary

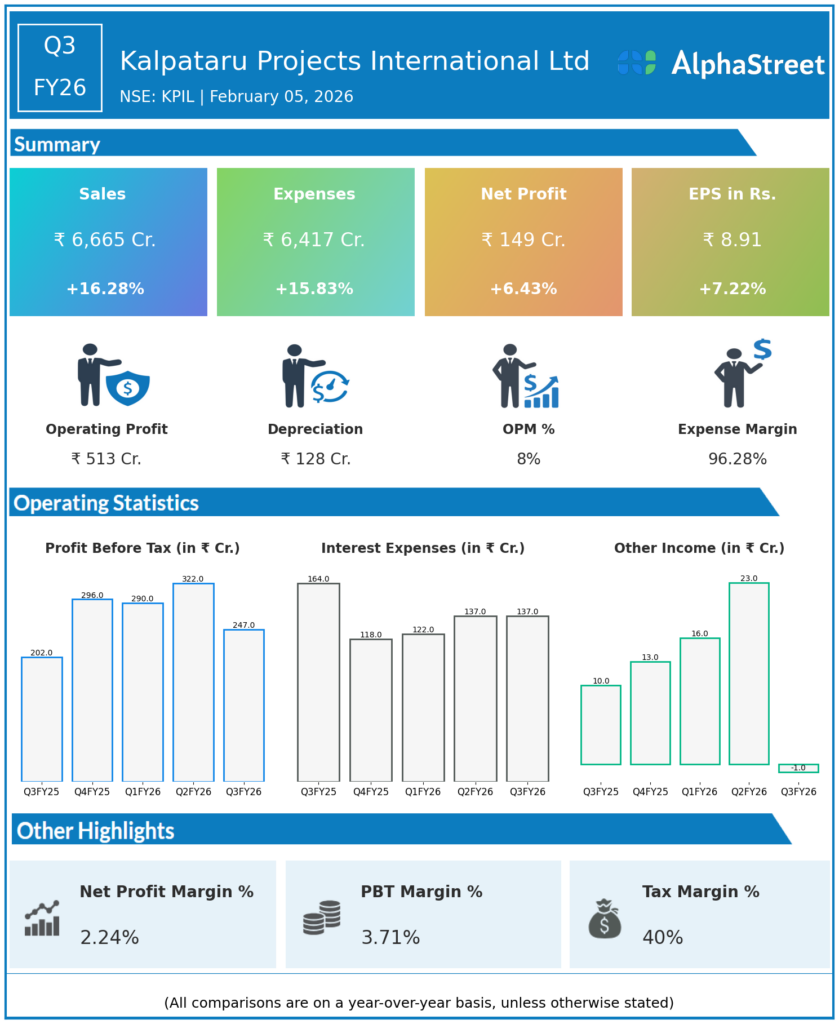

Kalpataru Projects International Ltd reported Q3FY26 revenues of ₹6,665 crore, up 16.28% YoY, with consolidated net profit increasing 6.43% to ₹149 crore. EPC execution momentum across power T&D, oil & gas pipelines, and railways drove topline growth despite modest profitability gains from stable margins.

Revenue & Growth

Revenues expanded to ₹6,665 crore from ₹5,732 crore YoY, reflecting 16.3% growth primarily from EPC segment (₹6,574 crore, +17% YoY). Total expenses rose 15.83% YoY to ₹6,417 crore, closely tracking revenue expansion amid project execution scale-up.

Profitability & Margins

Consolidated net profit grew 7.2% YoY to ₹152 crore from ₹142 crore, though down 36.6% sequentially due to margin pressures. EBITDA increased 7.3% to ₹514 crore at stable 7.7% margins (down 90 bps QoQ); EPS rose 7.22% to ₹8.91.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26. ₹63,287 crore order book provides strong revenue visibility across T&D and B&F segments.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

9M revenue up 24% to ₹19,365 crore with PAT +44% to ₹606 crore; FY26 order inflows at ₹19,456 crore. January 2026 orders worth ₹1,782 crore and Vindhyachal road asset sale enhance strategic positioning.