Kalpataru Projects International Limited (NSE: KPIL), the global engineering firm, announced solid quarterly results supported by robust order inflows and the completion of highway asset divestments, despite margin constraints in its water and Brazilian operations. Management confirmed the company remains on track to achieve its full-year growth and profitability targets while strengthening the balance sheet.

The company reported consolidated revenue of ₹6,665 crores for the third quarter of fiscal year 2026, a 16% increase compared to the same period the previous year. The results reflect steady execution across the company’s core segments, particularly in transmission and distribution (T&D), oil and gas, and urban infrastructure. While the company saw a significant 37% year-over-year rise in consolidated profit before tax (before exceptional items) to ₹277 crores, net profit growth was more tempered at 7% for the quarter, reaching ₹149 crores.

Capital Discipline

Asset monetization and capital discipline were key drivers during the quarter. KPIL completed the divestment of its Vindhyachal road asset (VEPL) in January 2026 at an enterprise value of approximately ₹799 crore, generating cash inflows of around ₹600 crore. Within its road BOOT portfolio, the company issued a termination notice for the Wainganga Expressway (WEPL) citing contractual defaults by the National Highways Authority of India, with toll operations handed over effective September 30, 2025. Separately, the Board authorized additional funding support of up to $5 million for subsidiary Kalpataru IBN Omairah Company Limited to support its international operations.

Execution Update

KPIL continues to deploy its execution capabilities across large-scale energy and infrastructure projects spanning six business verticals. The company is currently executing a large pipeline project in Saudi Arabia and remains active in metro rail, including two underground metro projects in India. In the residential segment, it is executing a single development of around 14 million sq ft, while also expanding its presence in data centers and airport projects across India and the Maldives. KPIL maintains in-house transmission tower manufacturing capacity of 240,000 MTPA and has commissioned more than 9,000 track kilometers of railway lines since inception.

Financial Performance

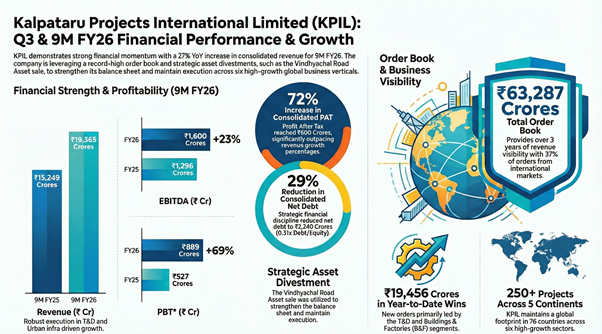

The consolidated financial results for Q3 FY26 show a core EBITDA of ₹513 crores, up 7% year-over-year, though the EBITDA margin contracted to 7.7% from 8.4% in the prior-year quarter. For the nine-month period ended December 31, 2025, consolidated revenue reached ₹19,365 crores, a 27% increase over the previous year. Standalone performance was stronger, with revenue growing 20% to ₹5,788 crores in Q3 FY26 and profit after tax rising 34% to ₹211 crores.

The company recorded an exceptional item of ₹29.48 crores during the quarter related to the incremental impact of new labor codes notified by the Government of India. On the balance sheet, consolidated net debt was reduced significantly, falling 29% sequentially to ₹2,240 crores, resulting in a net debt-to-equity ratio of 0.31x. Standalone net working capital days improved to 97 days from 112 days a year earlier.

Business Outlook & Strategy

Management’s strategy focuses on maintaining a diversified business mix and improving financial discipline through efficient working capital management. The consolidated order book stands at ₹63,287 crores as of December 31, 2025, providing revenue visibility for approximately three years. Year-to-date order wins reached ₹19,456 crores, with an additional ₹7,000 crores in projects where the company is the lowest bidder (L1) or favorably placed. KPIL aims to achieve its stated growth targets for FY26, supported by improved collections in the water business starting in January 2026.

Growth Drivers

KPIL’s performance is aligned with structural themes such as the energy transition, urban infrastructure build-out, and digitalization. The company is positioning to participate in opportunities across renewable energy storage, mass-transit systems and data-center infrastructure, against the backdrop of a large global infrastructure investment pipeline through 2040. Within its core markets, transmission and distribution (T&D) in India and overseas remains a key growth driver, while domestic urban infrastructure activity continues to be supported by metro rail expansion.

Investment Thesis: (Bull vs. Bear)

Bull Case

- Strong Order Visibility: A ₹63,287 crore order book with ₹19,456 crore in new wins YTD provides high revenue predictability.

- Deleveraging Progress: Completion of the Vindhyachal road asset sale and a 29% sequential reduction in consolidated net debt strengthens the balance sheet.

- Segment Diversification: Exceptional growth in Oil & Gas (+56% YoY) and Urban Infra (+79% Y-o-Y) offsets volatility in other sectors.

Bear Case:

- Margin Compression: Consolidated EBITDA margins declined 70 basis points year-over-year in Q3 FY26, impacted by the closure of legacy projects in Brazil.

- Operational Headwinds: The water business saw a 26% revenue decline in Q3 due to delayed fund releases from clients in Uttar Pradesh and Jharkhand.

- Regulatory Costs: New labor code implementations led to an exceptional charge of ₹29.48 crores, with further impact monitoring required.