Company Overview

Kajaria Ceramics is India’s largest manufacturer of ceramic and vitrified tiles and ranks among the world’s top manufacturers. The company operates in manufacturing and trading of ceramic tiles and offers a diverse range of products catering to residential, commercial, and industrial needs. Presenting below its Q2 FY26 Earnings Results.

Q2 FY26 Earnings Results

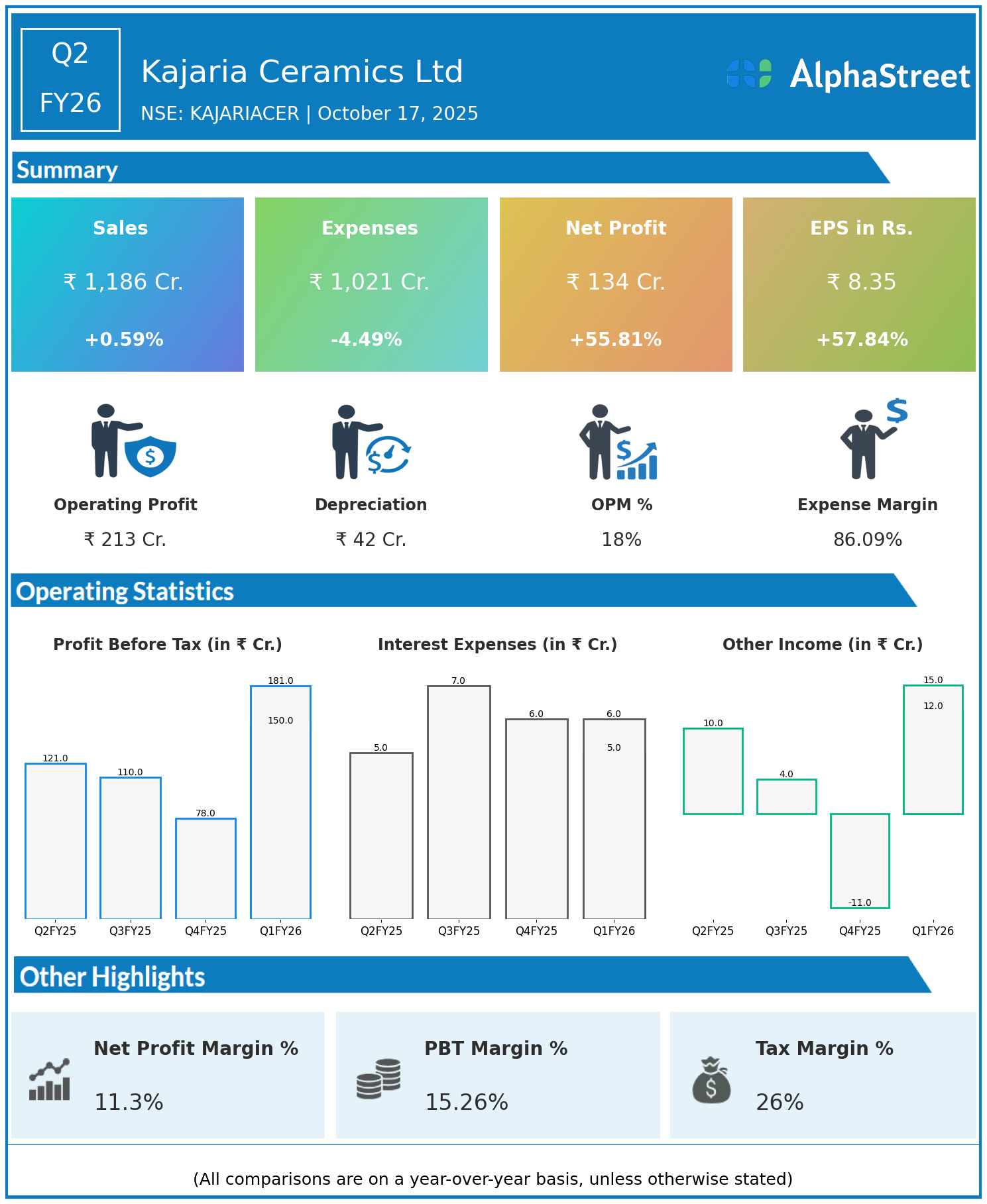

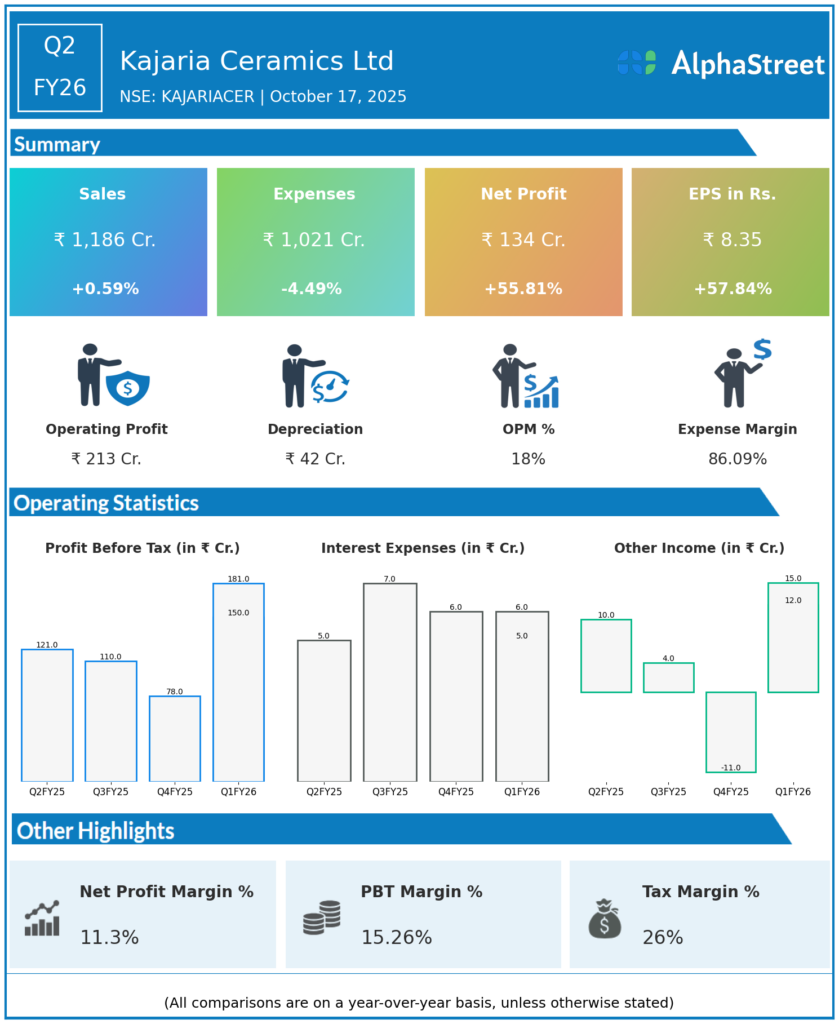

Kajaria Ceramics Ltd reported revenues of ₹1,186 crore in Q1 FY26, slightly up by 0.59% from ₹1,179 crore in the corresponding period last year. Total expenses decreased by 4.49% year-on-year to ₹1,021 crore from ₹1,069 crore. Consolidated net profit surged impressively by 55.81% to ₹134 crore compared to ₹86 crore a year ago. Earnings per share rose sharply by 57.84% to ₹8.35 from ₹5.29 YoY.

Operational & Strategic Update

- Revenue growth was marginal due to slower tile volume expansion and a decline in plywood sales after business restructuring.

- The company reported a substantial expansion in EBITDA margin to 16.72% from 15% a year prior, reflecting improved cost efficiency and absence of previous-year losses from discontinued plywood business.

- Employee costs reduced, and interest charges increased slightly but remained well-managed.

- Kajaria is supporting growth through focused product innovation, penetrating new markets, and strengthening distribution networks.

- The company continues to invest in sustainable manufacturing while boosting capacity utilization at key plants.

Outlook

Kajaria Ceramics is poised to maintain operational momentum driven by margin expansion and steady domestic demand recovery. Strategic initiatives to optimize costs, improve product quality, and enhance customer engagement will support long-term profitability. The company’s focus remains on leveraging market leadership, innovation, and efficient manufacturing to capitalize on the growing tile market in India and exports.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.