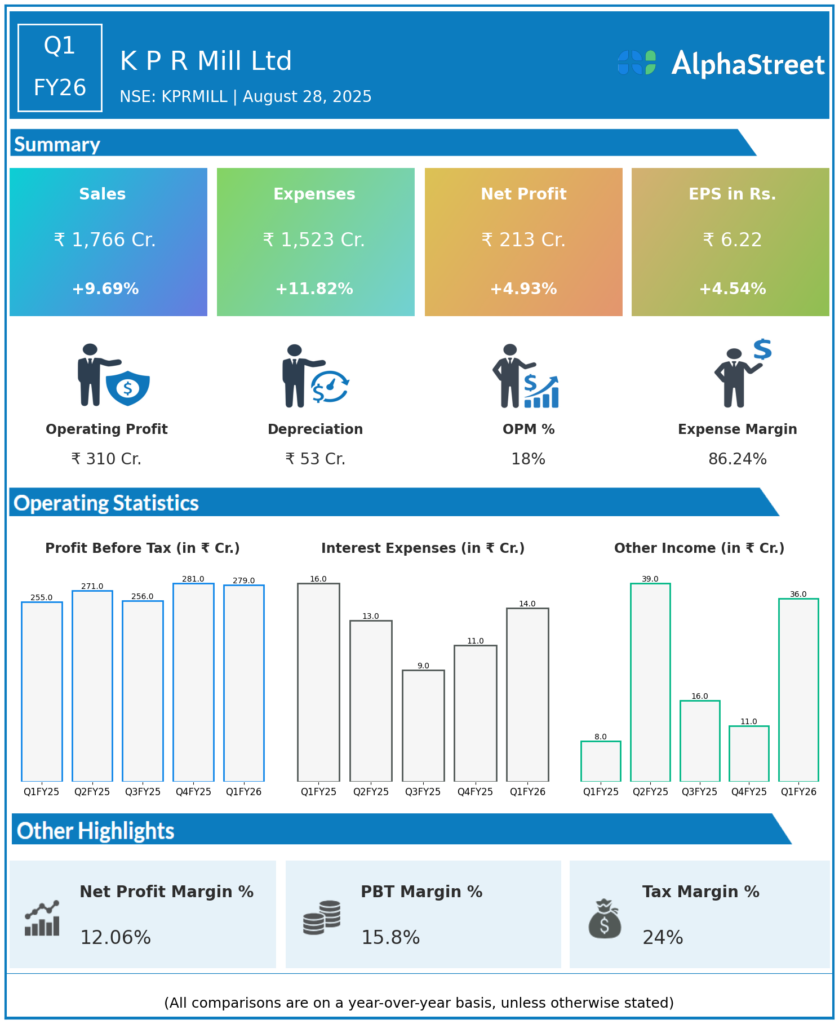

K.P.R. Mill is engaged in one of the largest vertically integrated apparel manufacturing Companies in India. The Company produces Yarn, Knitted Fabric, Readymade Garments and Wind power. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹1,766 crores, up 5.5% QoQ (Q4 FY25: ₹1,708.61 crores) and up 9.6% YoY (Q1 FY25: ₹1,617.41 crores).

-

EBITDA: ₹346.23 crores, up 7.4% YoY (Q1 FY25: ₹322.49 crores); EBITDA margin 19.2% (Q1 FY25: 19.9%, Q4 FY25: 19.3%).

-

Profit Before Tax (PBT): ₹279.10 crores, up 9.4% YoY (Q1 FY25: ₹255.10 crores), steady QoQ (Q4 FY25: ₹277.91 crores).

-

Profit After Tax (PAT): ₹212.70 crores, up 4.9% YoY (Q1 FY25: ₹203.31 crores), nearly flat QoQ (Q4 FY25: ₹213.61 crores).

-

EPS: ₹6.22, up 4.54% YoY (Q1 FY25: ₹6.00), down 1.6% QoQ (Q4 FY25: ₹6.30).

-

Total Expenses: ₹1,523.15 crores, up 11.8% YoY (Q1 FY25: ₹1,362.31 crores).

-

Tax Expense: ₹66.40 crores, up 28.2% YoY.

-

Sugar Division Revenue: ₹161 crores; Garment Sales: ₹959 crores; Yarn & Fabric Sales: ₹475 crores; Ethanol Sales: ₹92 crores.

-

Net Debt / Equity: 0.00 as of Q1 FY26, company remains virtually debt-free.

Management Commentary & Strategic Highlights

-

Management noted resilient performance across all segments led by increased domestic and export garment sales.

-

Strong cash generation and robust vertical integration have enabled efficiency gains, steady margins, and the ability to absorb sectoral headwinds.

-

Focus remains on scaling up high-margin garment exports, sugar, and ethanol segments while maintaining cost discipline and technology investment for productivity.

-

The company confirmed continuation of healthy dividend payouts and no material debt exposure, supporting future growth.

Q4 FY25 Earnings Results

-

Total Income: ₹1,769 crores.

-

EBITDA: ₹343.84 crores; margin 19.3%.

-

Profit Before Tax (PBT): ₹277.91 crores.

-

Profit After Tax (PAT): ₹205 crores.

-

EPS: ₹5.98.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.