Jubilant Foodworks Limited, the owner of Domino’s Pizza franchise in multiple South Asian countries, reported a 6.3% increase in Q1FY24 revenues driven by healthy orders. This growth was despite a 74.3% drop in net profit due to one-time costs and high ingredient prices. By increasing sourcing efficiency and introducing new products, the company is addressing declining margins. In addition to adding more Domino’s restaurants, Jubilant is also growing its Popeyes, Dunkin’, and Hong’s Kitchen franchises. While international operations in Bangladesh and Sri Lanka showed strong system sales growth and store expansion, Domino’s digital push saw impressive user growth.

Stock Data

| Ticker | JUBLFOOD |

| Industry | Restaurant |

| Exchange | NSE |

Share Price

| Last 5 Days | 3.9% |

| Last 1 Month | 3.7% |

| Last 6 Months | 14.6% |

Business Basics

Jubilant Foodworks Limited is a major Indian food service company that owns and operates the Domino’s Pizza franchise in India, Nepal, Sri Lanka, and Bangladesh. The Domino’s Pizza brand, which is well-known in India, is widely used in both urban and rural areas. The business has made technological investments to enhance its delivery capabilities and customer experience, making it a popular option with customers. In response to shifting consumer preferences, the company has added a number of new products and menu options under the Domino’s Pizza brand. Jubilant Foodworks’ multi-brand and multi-nation expansion strategy has allowed it to penetrate new market segments and drive growth. The company is in a strong position to continue diversifying its portfolio beyond the Domino’s Pizza brand because of its track record of successfully launching and growing new brands.

Q1 FY24 Financial Performance

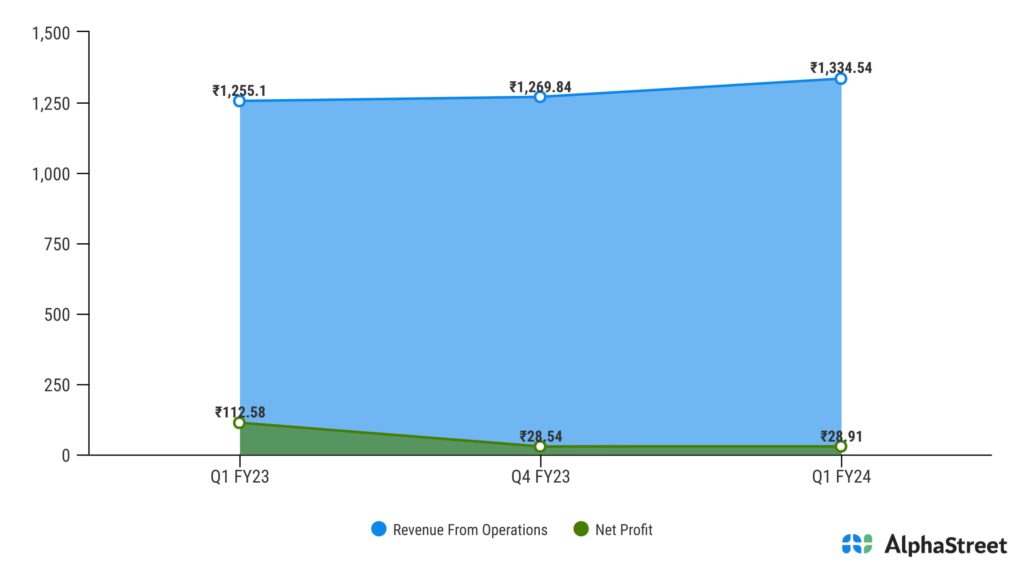

Jubilant Foodworks Limited reported Revenues from operations for Q1FY24 of ₹1,334.540 Crores up from ₹1,255.1 Crore year on year, a rise of 6.3%. The growth was driven by healthy orders in this quarter. The consolidated Net Profit of ₹28.91 Crores down 74.3% from ₹112.58 Crores in the same quarter of the previous year. The Net Profit was down due to one time cost (loss of associates) of ₹40.81 Crore. The Profit also affected by elevated prices of key ingredients. The Earnings per Share is ₹0.44, down 74.27% from ₹1.71 in the same quarter of the previous year.

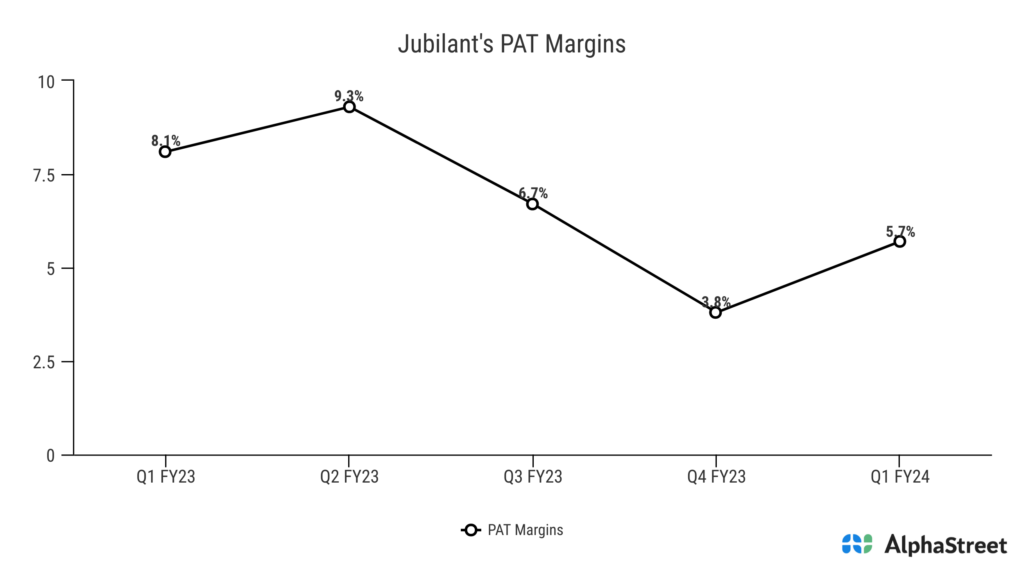

Jubilant’s Declining Margins

Jubilant Foodworks’ profitability has witnessed a decline in its PAT margin, with figures dropping from 8.1% in Q1FY23 to 5.7% in Q1FY24. The management of the company addressed this worrying trend and clarified the various underlying factors. Despite continuing to struggle with the problem of high prices for essential ingredients, management reported that the sequential price increase had stopped. They emphasized that cheese prices continue to be noticeably high and that a recent increase in vegetable prices may present short-term risks.

The management has increased efforts to boost sourcing effectiveness, localize ingredient sourcing, and investigate new vendor alliances. Without lowering the quality of their offerings, these actions taken together have improved their cost base. Notably, the business has also reacted quickly to market demands for new products. However, amidst these challenges, the company has managed to exhibit resilience in its financial performance. The gross margin increased by 75 basis points sequentially to remain stable at 76.0%. The EBITDA margin also showed improvement, increasing to 21.1%, up 97 basis points from the prior quarter.

Dominos has introduced a range of new products that cater to a diverse price spectrum, including a budget-friendly spicy pizza range that starts at just Rs. 179. We should anticipate tight margins in the upcoming quarters until there is a downward trend in ingredient prices.

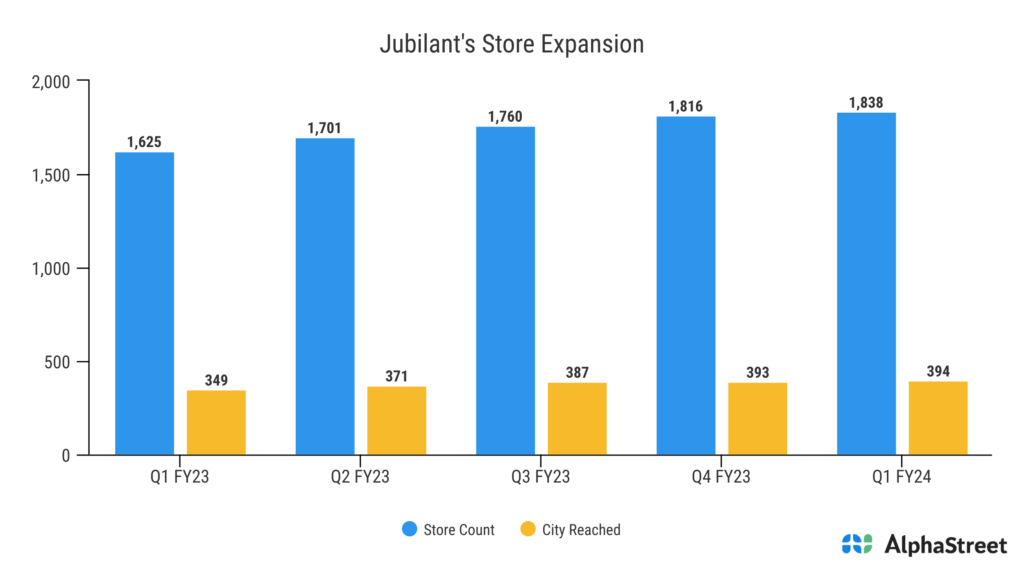

Jubilant’s Multi-brand Store Expansion

Jubilant Foodworks has opening 23 additional Domino’s locations, the company increased the size of the Domino’s India network to an impressive 1,838 locations spread across 394 cities. Popeyes, their another brand, added four new restaurants to mark its expansion in a calculated move. This expansion reached two new cities, Manipal and Coimbatore, thereby significantly increasing Popeyes’ presence. Furthermore, the brand’s increased accessibility through popular food aggregators such as Swiggy and Zomato resulted in an increase in delivery orders, increasing its market share. Hyderabad became the company’s fifth operational city, further increasing its geographic reach.

Dunkin’ took advantage of the rising popularity of coffee by expanding its selection of coffee by adding two new international flavors. The brand opened a new store in this quarter, exemplifying a total of nine coffee-centric stores under its banner. The brand’s alignment with the growing coffee culture remains apparent. Hong’s Kitchen, which specializes in Indian-styled Chinese cuisine, continued to experience strong revenue growth. The quarter witnessed the addition of two new stores in Delhi, solidifying its presence across three cities and amassing a total of 15 outlets.

Update On Dominos’ Digital Push & International Business

Domino’s Cheesy Rewards exhibited a remarkable growth of 23.5% quarter-over-quarter, reaching an impressive 16.8 million users. This surge was underpinned by substantial increases in user cohorts across the spectrum of low, medium, and high frequencies. The quarterly app downloads increased to 10 million and MAU(App) at 10.3 million. To improves conversion and drives frequency, the company launched re-order widget this quarter in Dominos mobile app. This enables user to quickly reorder their favourite customized order.

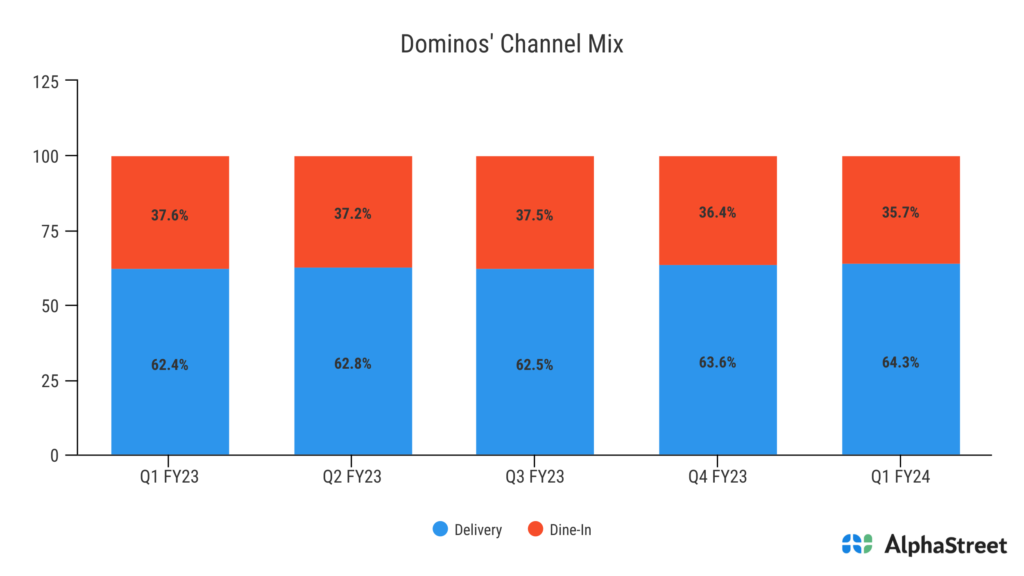

During Q1 FY24, the Delivery channel experienced an increase in revenue, growing by 8.4% year-on-year. This growth was primarily driven by an increase in the number of orders, although it was partially offset by a decrease in the average order value. On the other hand, the Dine-In channel saw its revenue remain relatively flat. While there was growth in the number of orders placed for dine-in, this increase was offset by a decline in the average ticket size, indicating that customers may have spent less per visit compared to the previous year.

Turning to international operations, in Sri Lanka, the company observed a system sales growth of 13.1%. Notably, the company extended its reach by inaugurating two new stores, culminating in a network total of 50 stores. In Bangladesh, system sales grew by 69.6% and the network expanded to 20 stores.

QSR Industry In India

The Quick Service Restaurant (QSR) sector is one of the industries with the fastest growth rates, both in India and internationally. Research and Markets predicts that from 2021 to 2025, the QSR market in India will grow at a strong compound annual growth rate (CAGR) of more than 18%. The QSR market experienced a significant uptick between FY 2016 and FY 2020, growing at a rate of 17.27%. According to projections, its value will reach roughly INR 827.63 billion by FY 2025. This increase can be attributed to changing lifestyles, rising disposable income, shifting consumer dining preferences, and a thriving online food delivery ecosystem.

Jubilant Foodworks, which has a sizable 14% market share in the combined QSR segment, which includes chained and independent outlets, has successfully carved out a significant niche in this booming market. This demonstrates their impressive industry presence and influence. The QSR industry is poised to grow as it continues to develop, with both chain and standalone QSRs expected to contribute equally to the sector’s growth in the near future.