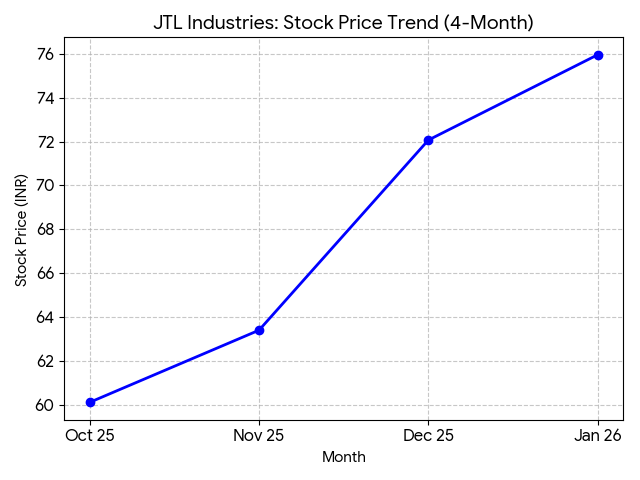

JTL Industries Ltd (NSE: JTLIND; BSE: 534600) reported its third-quarter financial results for the 2026 fiscal year following a board meeting on Saturday. In trading on January 23, the final session prior to today’s Republic Day holiday, shares of JTL Industries closed at ₹75.96 on the National Stock Exchange (NSE), representing a decline of 1.40%.

Market Capitalization

The company’s market capitalization stood at ₹2,995 crore (approximately $360 million) based on the closing price of the most recent trading session.

Latest Quarterly Results

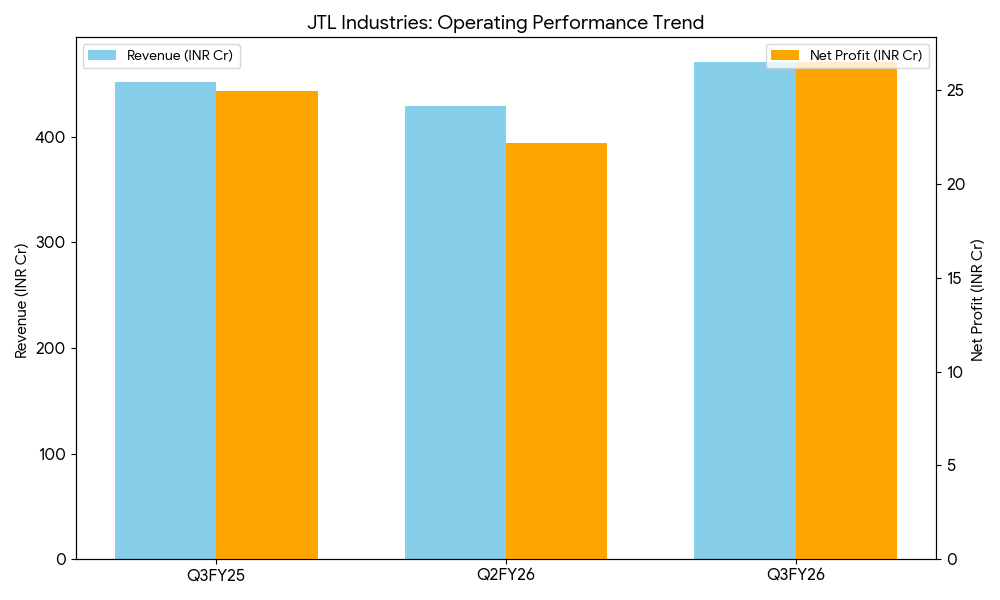

For the quarter ended December 31, 2025 (Q3 FY26), JTL Industries reported a consolidated total revenue of ₹470.52 crore, an increase of 4.2% compared to ₹451.58 crore in the corresponding quarter of the previous year. On a sequential basis, revenue rose 9.1% from ₹429.30 crore in Q2 FY26.

Net profit for the period was ₹26.49 crore, up 6.2% year-over-year from ₹24.94 crore. Sequentially, net profit increased 19.5% from ₹22.16 crore. Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) reached ₹38.6 crore, a 9.97% increase year-over-year. The EBITDA margin expanded to 8.2%, up from 7.8% in Q3 FY25.

Segment Highlights:

- Steel Products: Core volumes reached approximately 84,000 metric tons (MT) for the quarter.

- Value-Added Products (VAP): The company reported an EBITDA per ton of ₹4,270, indicating a recovery in margins attributed to a higher mix of value-added products and galvanized steel pipes.

Business & Operations Update

The company confirmed the continued implementation of Direct Forming Technology (DFT) across its manufacturing facilities, which allows for the production of customized hollow sections without roll changes. JTL Industries is currently executing an expansion plan to increase its annual manufacturing capacity to 10 lakh metric tons per annum (MTPA). During the quarter, the company secured a significant order from Punjab State Transmission Corporation Limited (PSTCL) for the manufacture of 220kV transmission tower materials.

M&A or Strategic Moves

JTL Industries previously announced the acquisition of a 95% stake in RCI Industries, a move aimed at expanding its product portfolio into the copper and non-ferrous segments. The company also integrated assets from Chetan Industries Limited to strengthen backward integration and optimize raw material procurement.

Equity Analyst Commentary

Institutional coverage from firms including Axis Direct and Emkay Global has noted the company’s focus on increasing the share of value-added products to 40% of total sales. Analysts highlighted that while volumes in earlier periods were impacted by regional flooding in Punjab, the recovery in EBITDA per metric ton remains a key metric for operational efficiency.

Guidance & Outlook

Management has maintained a sales volume guidance of 4.5–5.0 lakh metric tons for the full 2026 fiscal year. Market participants are monitoring the completion of the Mangaon plant expansion, which is expected to bring the company’s total capacity to 2.25 million tonnes by the end of FY27.

Performance Summary

JTL Industries’ stock declined 1.40% to ₹75.96 ahead of the market holiday. Third-quarter revenue rose 4.2% to ₹470.52 crore, while net profit grew 6.2% to ₹26.49 crore. Operational margins improved to 8.2%, supported by a recovery in the value-added product segment.