Company Overview

JSW Infrastructure Ltd is a leading player in maritime services providing cargo handling, storage, and logistics solutions. The company operates key port and terminal facilities handling bulk and containerized cargo in India. Presenting below its Q2 FY26 Earnings Results.

Q2 FY26 Earnings Results

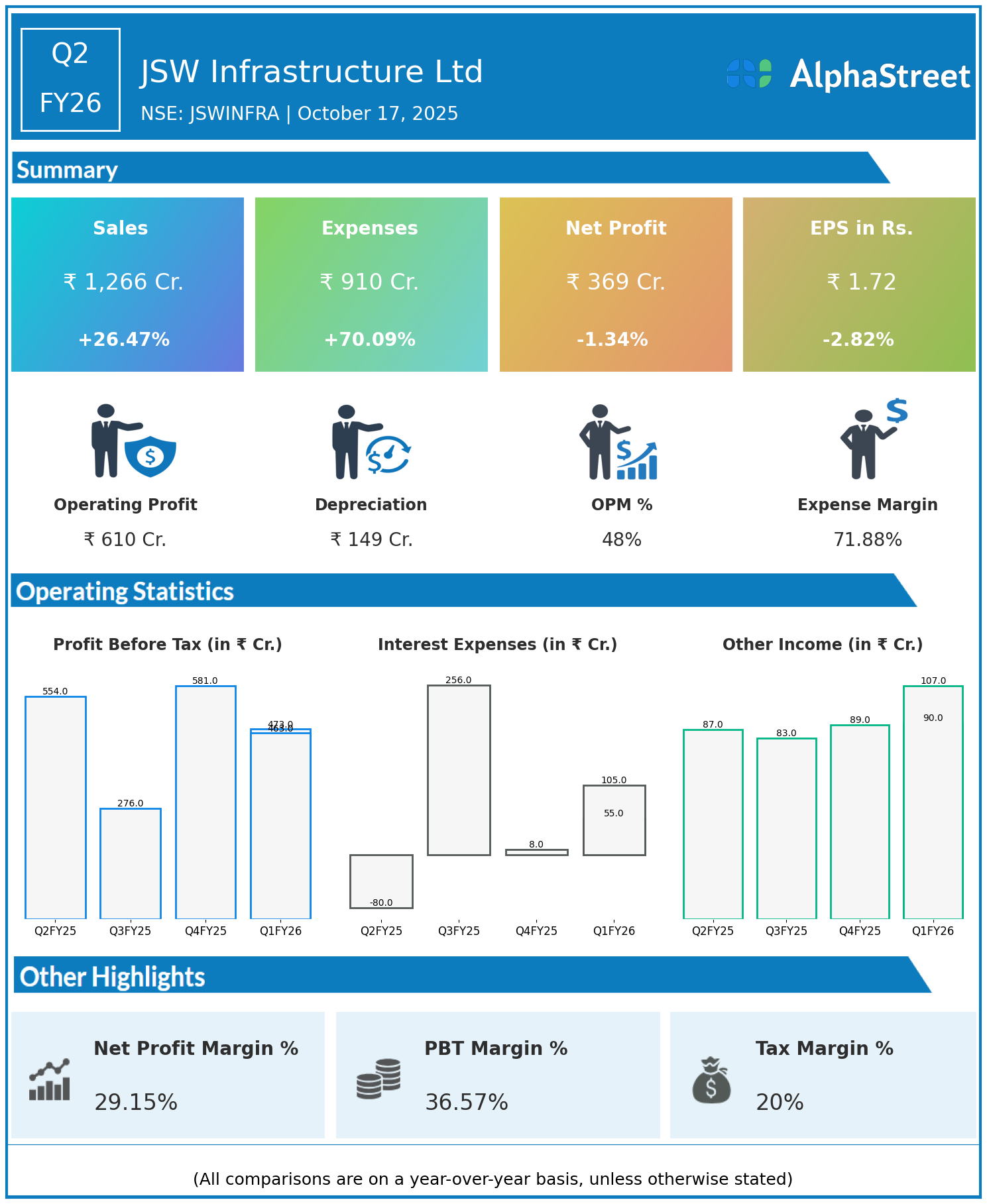

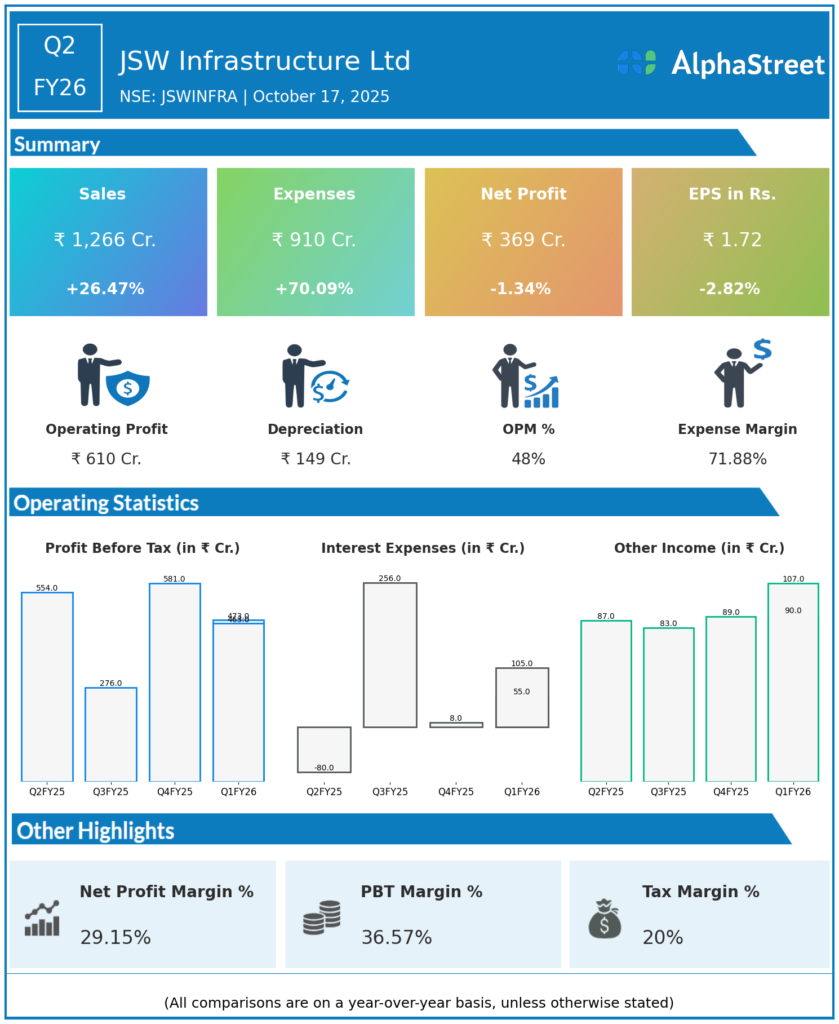

JSW Infrastructure reported consolidated revenues of ₹1,266 crore for Q1 FY26, marking a significant 26.47% year-on-year increase from ₹1,001 crore. Total expenses surged 70.09% to ₹910 crore from ₹535 crore in the prior year, due to increased operational and maintenance costs. Despite this rise in expenses, consolidated net profit narrowly declined by 1.34% to ₹369 crore from ₹374 crore. Earnings per share dropped 2.82% to ₹1.72 compared to ₹1.77 year-on-year.

Operational & Strategic Update

- Cargo volumes handled increased by 5% year-on-year to 29.4 million tonnes, driven by strong throughput at coal terminals and interim operations at Tuticorin and Jawaharlal Nehru Port Authority (JNPA) liquid terminal.

- Operating EBITDA grew 13% year-on-year to ₹581 crore, with margins moderate due to higher expenses.

- The Logistics Operations division, recently expanded through the acquisition of Navkar Corporation Limited, contributed ₹138 crore in revenue, diversifying the company’s portfolio.

- The company has outlined a growth strategy aiming to expand capacity from 177 million tonnes per annum (mtpa) to 400 mtpa by FY30 through brownfield expansions, greenfield developments, and strategic acquisitions.

- Cash and cash equivalents stood at ₹4,360 crore as of September 2025, with net debt of ₹1,810 crore and a healthy net debt-to-operating EBITDA ratio of 0.75x.

Outlook

JSW Infrastructure expects continued growth supported by infrastructure spending and capacity expansions. With improved cargo volumes, diversified operations, and a strong balance sheet, the company is well-positioned for long-term value creation in India’s port and logistics sectors.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.