Stock Data:

| Ticker | NSE: JSWENERGY |

| Exchange | NSE |

| Industry | ENERGY |

Price Performance:

| Last 5 Days | +8.94 % |

| YTD | +49.46 % |

| Last 12 Months | +46.42 % |

Company Description:

JSW Energy is a leading power generation company in India, committed to delivering sustainable and reliable energy solutions. With a diversified portfolio encompassing thermal, hydro, wind, and solar power generation, the company plays a pivotal role in meeting the nation’s energy needs. Leveraging state-of-the-art technology and a commitment to environmental stewardship, JSW Energy is at the forefront of India’s transition to cleaner and greener energy sources. Their strategic focus on renewable energy, operational excellence, and innovative solutions positions them as a key player in the dynamic energy sector, contributing to India’s growth while minimizing the environmental footprint.

Critical Success Factors:

1. Diverse Energy Portfolio: JSW Energy’s strength lies in its diverse energy portfolio, which encompasses various energy sources. This diversification helps the company manage risks associated with fluctuations in fuel prices and market dynamics. By having a mix of thermal, hydro, wind, and solar power generation assets, JSW Energy can adapt to changing energy market conditions and cater to different segments of the energy market.

2. Renewable Energy Focus: JSW Energy’s strategic focus on renewable energy sources, such as wind and solar power, is a significant strength. As the global shift towards clean and sustainable energy solutions accelerates, the company’s investments in renewables position it well to tap into the growing demand for green energy. This focus not only aligns with environmental sustainability goals but also provides a competitive edge in a changing energy landscape.

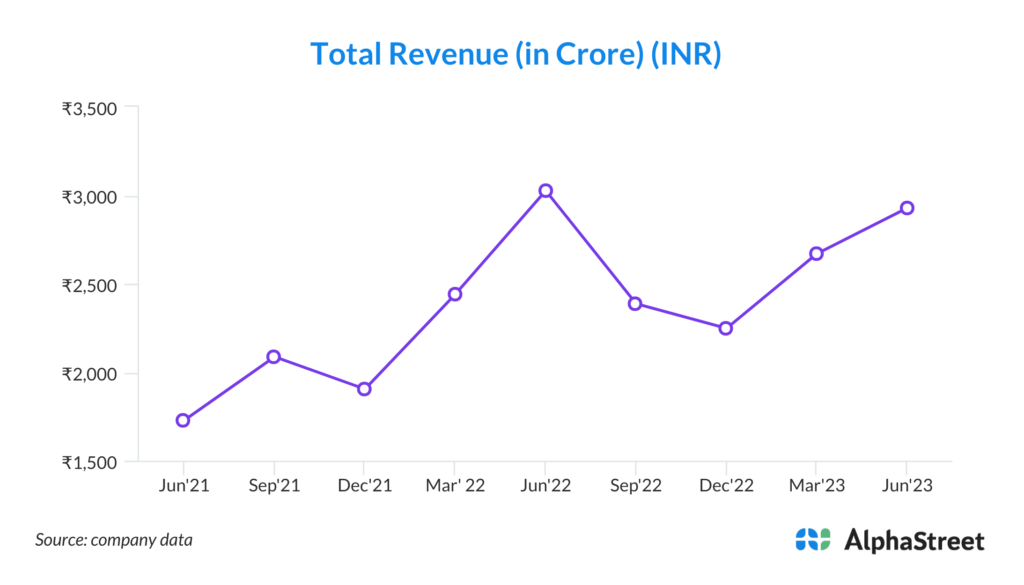

3. Capacity Addition: JSW Energy’s ongoing efforts to expand its energy generation capacity are a testament to its commitment to meeting the increasing demand for power in India. The addition of 5.8 GW of capacity in the last quarter underscores the company’s growth trajectory. This expanded capacity not only contributes to revenue growth but also strengthens the company’s position in the energy sector.

4. Improving Power Demand: Despite challenges like muted power demand in the past, JSW Energy has demonstrated resilience by adapting to changing market conditions. The reported improvement in power demand, particularly in the months of June and July, reflects the company’s ability to respond to dynamic market factors. This adaptability is a valuable strength in the energy industry, where demand patterns can be influenced by various external factors.

5. Hydropower Assets: JSW Energy’s hydropower assets, while affected by lower water flow during the reporting period, are considered strengths. These assets contribute to the company’s diversified energy mix and provide a clean and sustainable source of electricity. Despite temporary challenges related to water flow, the company’s hydropower assets are secured under long-term power purchase agreements (PPAs), ensuring stable revenue streams and reducing exposure to market volatility.

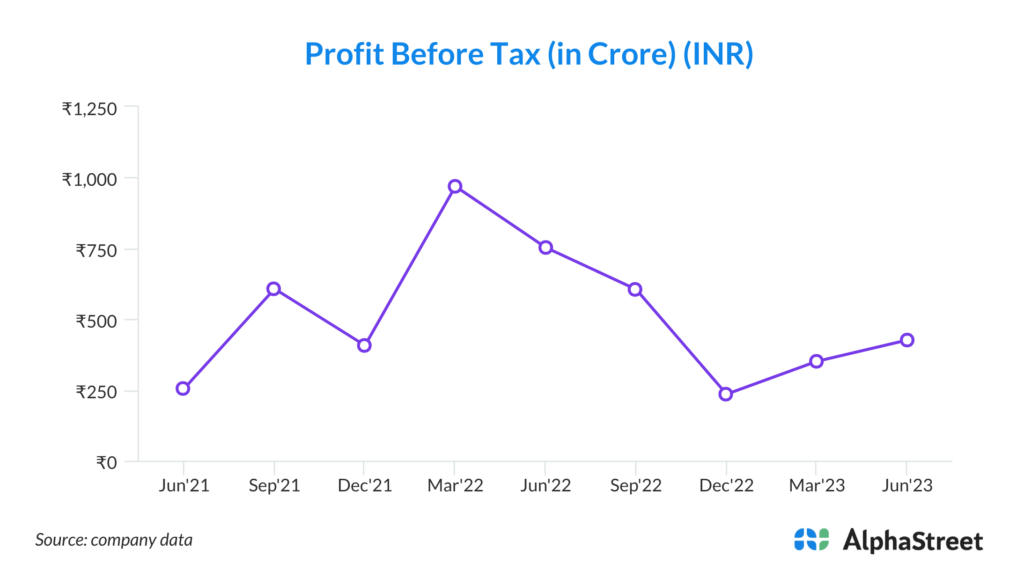

6. EBITDA Growth: The company’s reported EBITDA growth of 18% year-on-year is indicative of its operational efficiency and profitability. This financial performance demonstrates JSW Energy’s ability to manage costs effectively and optimize its operations, contributing to its overall strength in the energy sector.

7. Strong Cash Flow: The company’s strong cash flow generation, as evidenced by its ability to reduce net debt on Mytrah portfolio, is a key strength. Effective cash flow management allows JSW Energy to invest in new projects, service its debt obligations, and fund its growth initiatives while maintaining financial stability.

8. Focused Expansion: JSW Energy’s focus on expanding its renewable energy assets, as seen in the wind and solar projects’ performance, is in line with global and national renewable energy goals. The company’s efforts to enhance machine availability, achieve higher generation, and improve EBITDA from these projects indicate a proactive approach to sustainable energy generation and profitability.

Key Challenges:

1. Market Volatility: JSW Energy operates in a dynamic energy market, and fluctuations in energy prices and demand can significantly impact its revenue and profitability. Rapid changes in market conditions, driven by factors such as economic downturns, regulatory shifts, or geopolitical events, pose a substantial risk. The company must have robust risk management strategies in place to mitigate the impact of market volatility.

2. Environmental Regulations: The energy sector faces increasing scrutiny and stringent environmental regulations, particularly concerning emissions and pollution control. Non-compliance with these regulations could lead to penalties and operational disruptions. JSW Energy must continuously invest in technology and processes to ensure compliance and minimize the risk of regulatory non-compliance.

3. Renewable Energy Dependency: While JSW Energy’s focus on renewable energy is a strength, it also introduces risks associated with the intermittent nature of renewable sources, such as wind and solar. Variability in weather conditions can affect energy generation, potentially leading to revenue fluctuations. The company should invest in energy storage solutions and backup capacity to address this concern.

4. Financing Challenges: Expanding energy capacity, especially in renewables, requires significant capital investment. JSW Energy’s ability to secure financing at favorable terms is crucial. Market conditions, interest rate fluctuations, and changes in investor sentiment can affect financing options. The company must maintain a healthy balance between debt and equity and manage its debt profile effectively.

5. Operational Risks: Operating a diverse portfolio of energy assets, including thermal, hydro, wind, and solar plants, entails various operational risks. Equipment failures, maintenance issues, and natural disasters can disrupt energy generation and impact revenue. Effective asset management, preventive maintenance, and disaster preparedness are essential to mitigate these risks.

6. Competition: The energy sector in India is highly competitive, with multiple players vying for market share. Intense competition can exert downward pressure on energy prices and profitability. JSW Energy needs to differentiate itself through innovation, operational excellence, and customer-focused solutions to maintain its competitive edge.

7. Regulatory Changes: Frequent changes in energy policies and regulations can impact the company’s operations and financial outlook. Shifts in government policies related to tariffs, subsidies, and power purchase agreements can affect revenue streams. JSW Energy must closely monitor and adapt to regulatory changes to minimize risks.

8. Climate Change and Natural Disasters: Climate change-related events, such as extreme weather conditions and rising sea levels, can pose significant risks to energy infrastructure, particularly hydropower assets. Additionally, natural disasters like floods, earthquakes, or cyclones can damage power generation facilities. JSW Energy should invest in climate resilience and disaster recovery measures to protect its assets.