Jindal Steel & Power Limited is one of India’s leading steel producers with significant interests in both the steel and mining sectors. The group also has an extensive global presence through subsidiaries in Australia, Botswana, Indonesia, Mauritius, Mozambique, Madagascar, Namibia, South Africa, Tanzania, and Zambia. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

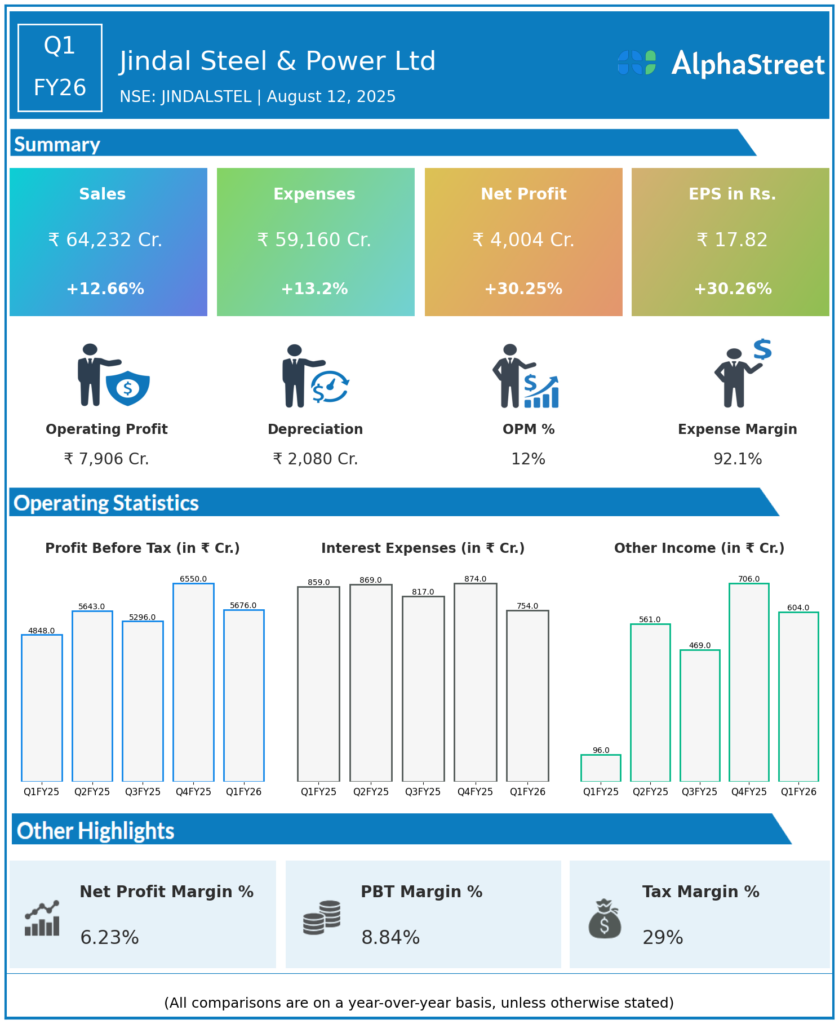

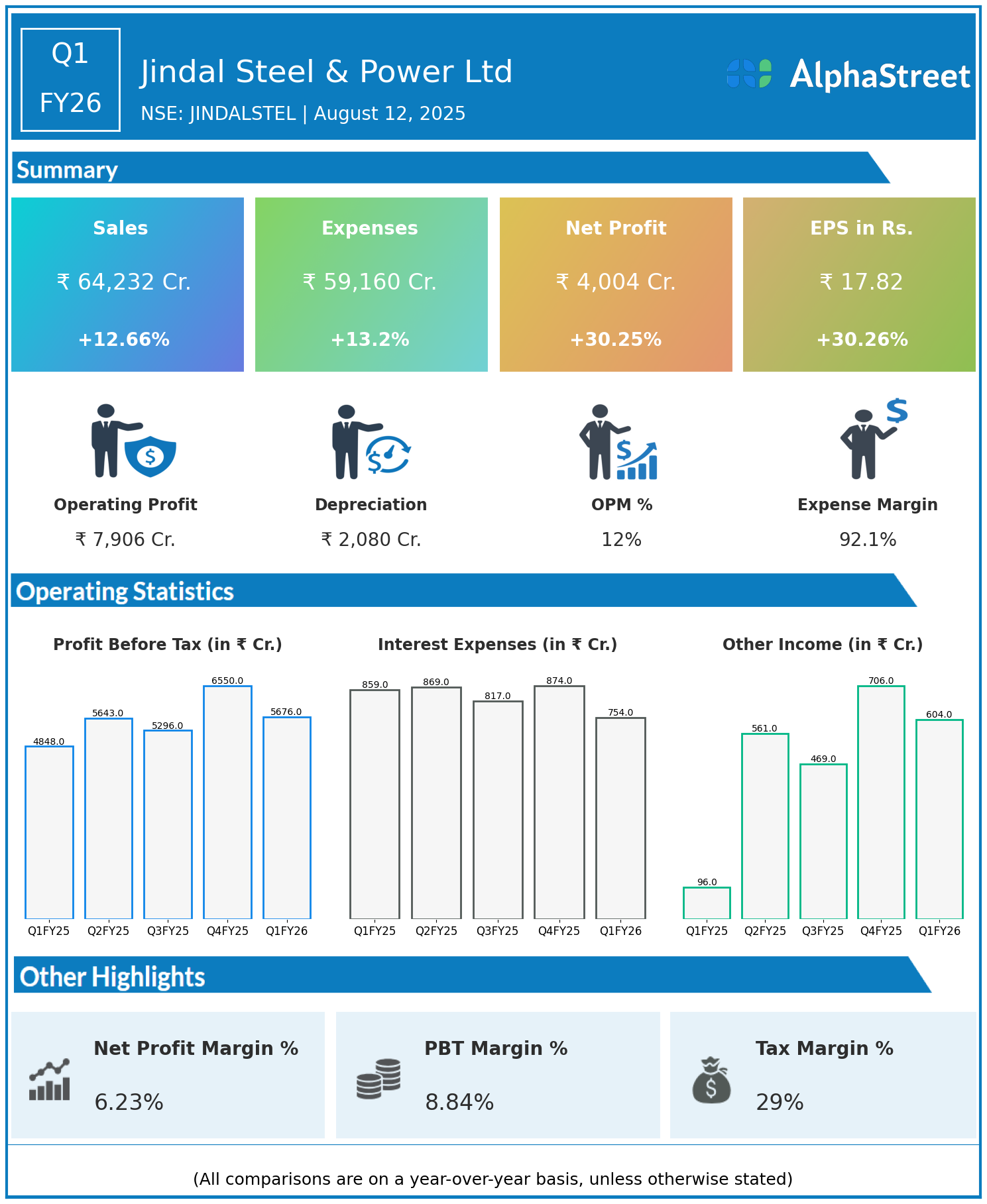

- Revenue: ₹64,232 crore, up 12.66% year-on-year (YoY) from ₹57,013 crore in Q1 FY25.

- Total Expenses: ₹59,160 crore, up 13.2% YoY from ₹52,261 crore.

- Consolidated Net Profit (PAT): ₹4,004 crore, up 30.25% from ₹3,074 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹17.82, up 30.26% from ₹13.68 YoY.

Operational & Strategic Update

- Strong Revenue Momentum: The near 13% revenue growth was supported by steady demand for steel products in domestic and export markets, as well as firm pricing in select segments.

- Cost Alignment: Total expenses grew broadly in line with revenue, reflecting higher raw material costs, elevated energy prices, and logistics expenses due to increased production volumes.

- Significant Profit Growth: Net profit and EPS surged over 30%, aided by improved operating margins, better cost efficiencies, and enhanced product realisations.

- Global Presence Advantage: The company’s diversified geographic footprint provides access to key raw materials and export markets, mitigating country-specific risks and enabling competitive sourcing.

- Strategic Focus: Ongoing investments in capacity expansion, value-added product development, and sustainability initiatives are aimed at strengthening the company’s long-term growth prospects.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results reflect Jindal Steel & Power Ltd’s ability to deliver robust profit growth despite cost pressures. The company’s integrated operations, export diversification, and efficiency improvements have helped it maintain a competitive edge in the global steel sector.

Looking Ahead

Jindal Steel & Power Ltd expects sustained growth driven by strong infrastructure demand in India, capacity expansion projects, and value-accretive initiatives in mining. The company’s focus on high-margin segments, operational excellence, and global market penetration is anticipated to support continued profitability and shareholder value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.