Company Overview

Jio Financial Services (JFSL), originally incorporated as Reliance Strategic Investments Private Limited in 1999 and rebranded in July 2023, is an NBFC-ND-SI registered with the RBI. JFSL operates as a holding company for its consumer-facing subsidiaries: Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), Jio Payment Solutions Limited (JPSL), and the joint venture Jio Payments Bank Limited (JPBL). Presenting below its Q2 FY26 Earnings Results.

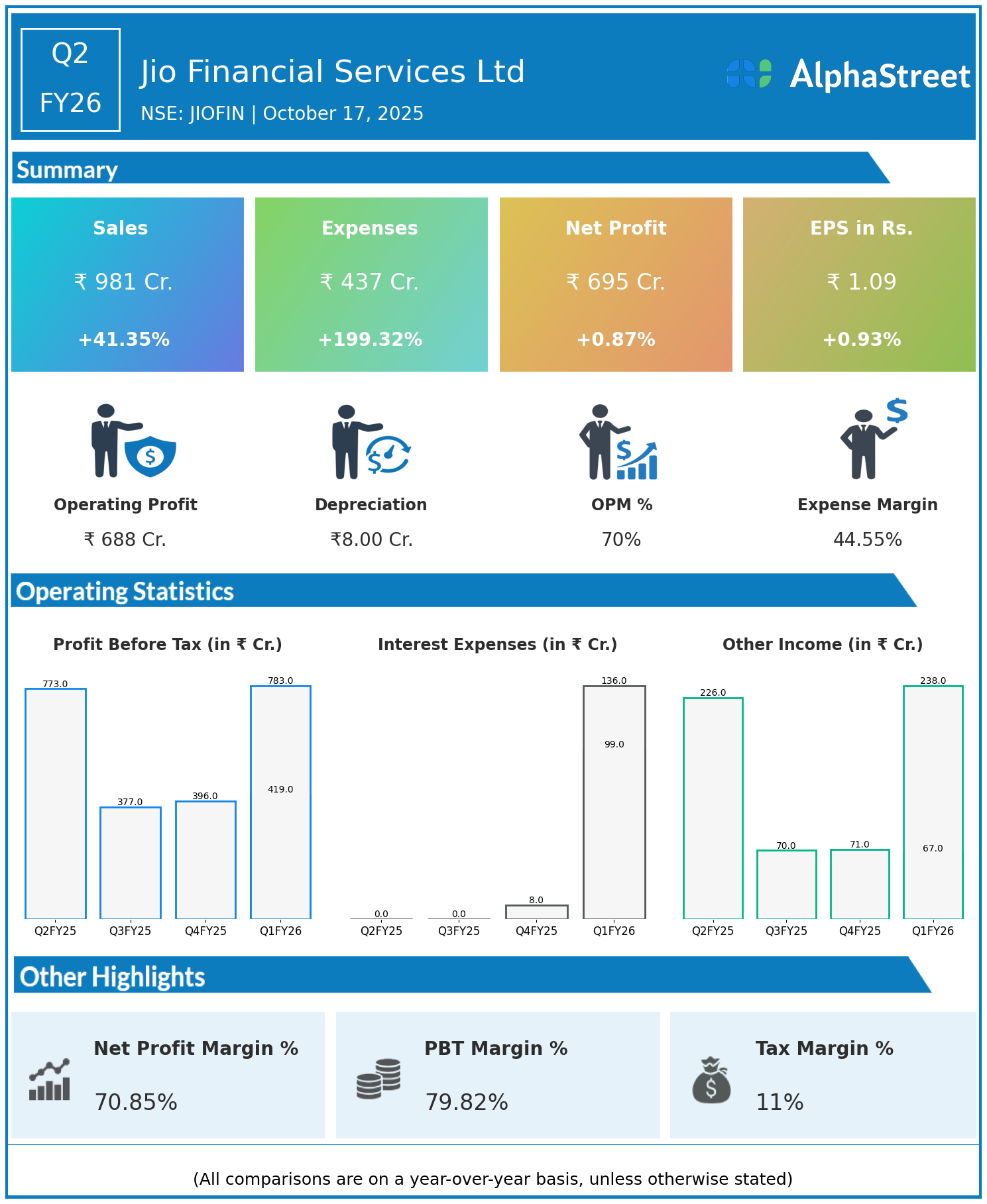

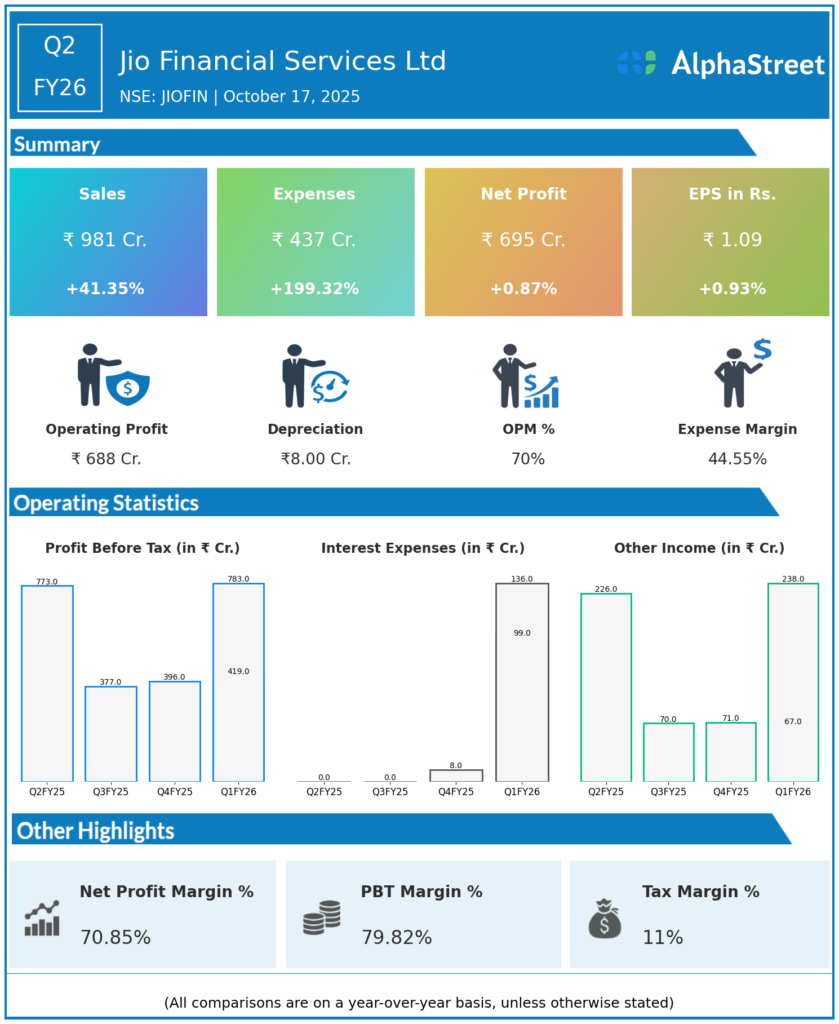

Q2 FY26 Earnings Results

JFSL reported revenues of ₹981 crore for Q1 FY26, a significant year-on-year increase of 41.35% from ₹694 crore. Total expenses rose sharply by 199.32% to ₹437 crore from ₹146 crore, largely due to increased investments and operational costs. The consolidated net profit was ₹695 crore, showing a marginal rise of 0.87% from ₹689 crore during the same period last year. Earnings per share (EPS) grew slightly to ₹1.09 from ₹1.08.

Operational & Strategic Update

- The revenue growth was primarily driven by strong performance across lending and payment businesses.

- JFSL acquired a 14.96% stake in Jio Payments Bank Ltd from SBI, making it a wholly-owned subsidiary, which had 2.58 million customers and a deposit base of ₹358 crore as of June 2025.

- The company made significant investments in payments and financial services platforms to scale operations and expand customer reach.

- Assets under management (AUM) for Jio Credit Limited stood at ₹11,665 crore, showing robust growth from ₹217 crore a year prior.

- JFSL expanded its physical presence to 11 cities and is investing in AI-powered fintech innovations and digital financial services.

Outlook

Jio Financial Services aims to leverage its expanding ecosystem and strong capital base to drive growth in retail financial services, payments, and lending. The company is focused on customer acquisition, integration of digital platforms, and cross-selling products to enhance value. Despite near-term margin pressures, the strategic investments and strong market positioning are expected to sustain long-term profitability.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.