J.B. Chemicals and Pharmaceuticals Limited (JBCPL), established in 1976, stands as one of India’s prominent pharmaceutical firms with a strong integrated presence in both domestic and global markets. Renowned for its commitment to affordable, high-quality medicines, JBCPL continues to build trust among healthcare professionals and patients across geographies.

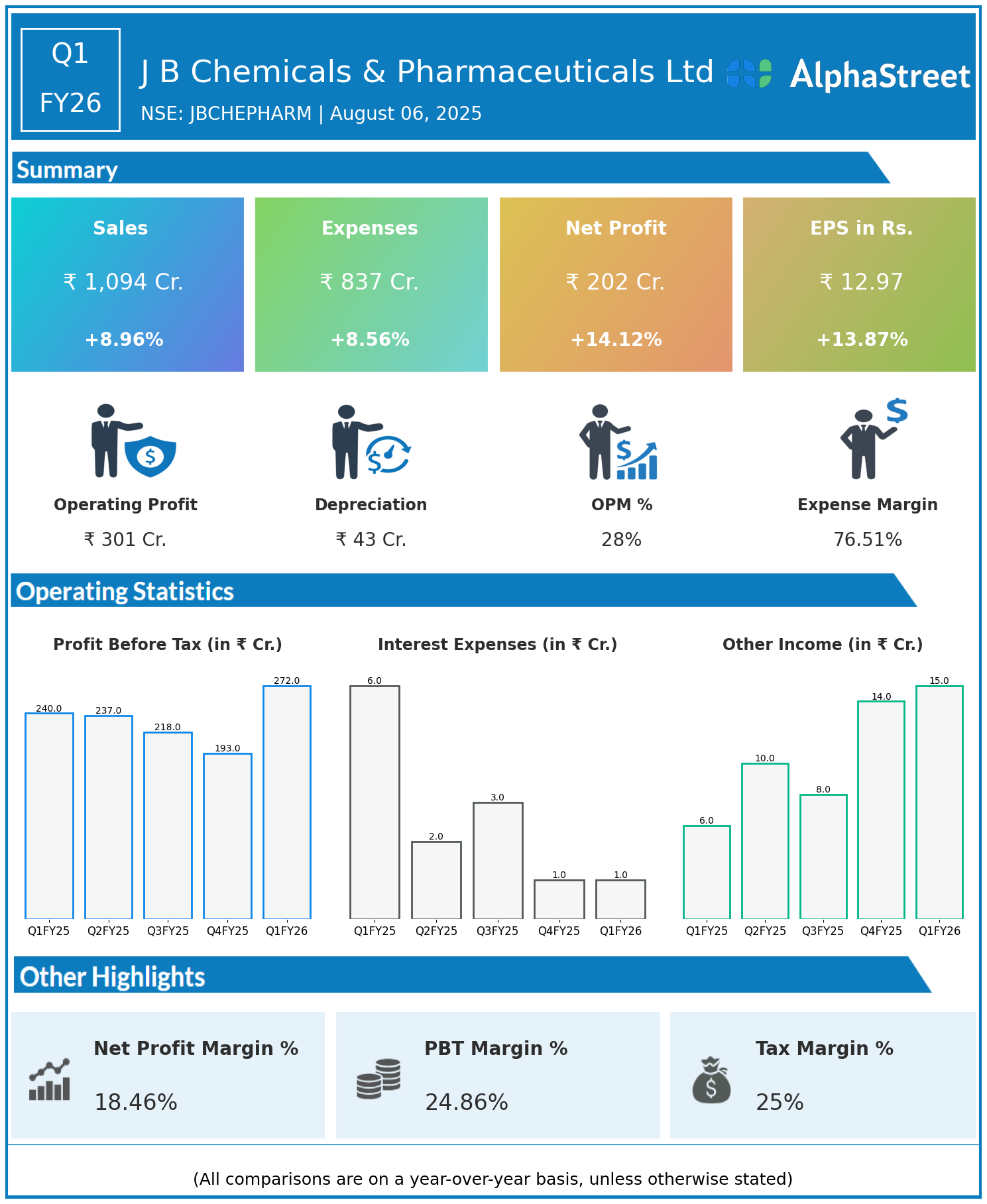

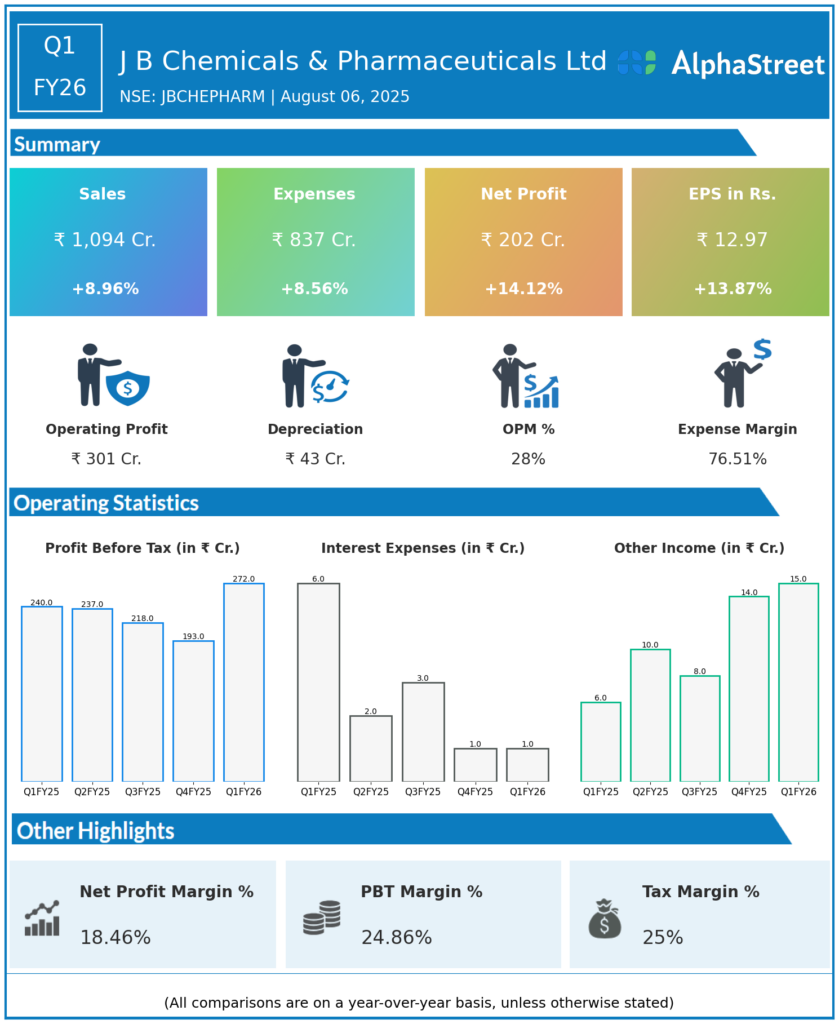

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹1,094 crore, up 8.96% year-on-year (YoY) from ₹1,004 crore in Q1 FY25.

- Total Expenses: ₹837 crore, up 8.56% YoY from ₹771 crore.

- Consolidated Net Profit (PAT): ₹202 crore, up 14.12% from ₹177 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹12.97, up 13.87% from ₹11.39 YoY.

Operational & Strategic Update

- Robust Revenue Growth: The nearly 9% topline increase reflects strong sales momentum in core therapeutic areas, bolstered by steady demand in India and key international markets. Portfolio expansion and deepening of existing brands have contributed to overall growth.

- Expense Management: Total expenses rose broadly in line with revenues, indicating effective cost management across manufacturing, R&D, marketing, and distribution, which helped preserve operating margins.

- Profitability Expansion: Net profit and EPS grew at a faster pace than revenue, signifying improved margin performance and disciplined execution, supported by a favorable product mix and operational efficiencies.

- Product Portfolio & Market Focus: JBCPL continues to strengthen its market position in cardiovascular, gastrointestinal, and anti-infective therapies, with a growing presence in the US, Russia/CIS, South Africa, and other regulated markets.

- Innovation & R&D: Ongoing investment in research and launching differentiated formulations have enhanced the product pipeline, contributing to competitiveness in both acute and chronic therapeutic categories.

- Global Reach: The company’s international business remains a critical growth driver, benefiting from expanded regulatory approvals, quality certifications, and penetration across emerging and developed markets.

Corporate Developments

Q1 FY26 marks another successful quarter for J B Chemicals & Pharmaceuticals Ltd, combining healthy revenue gains with a strong uptick in profit—evidence of resilient demand, robust cost controls, and effective strategic execution.

Looking Ahead

JBCPL is well-positioned to capitalize on emerging healthcare needs in India and abroad through portfolio expansion, continued investment in R&D, and new market entries. The company’s emphasis on quality, affordability, and sustainable growth should continue to deliver value for stakeholders through FY26 and beyond.