Current Status Overview

Le Travenues Technology Limited operates as ixigo, an online travel technology company in India. The company provides digital booking services for flights, trains, and buses. It remains publicly listed and continues to report quarterly financial results. Operations are focused on domestic and international travel demand. The company maintains a notable presence in the Indian travel technology market.

Share Price Performance

The company’s shares traded around ₹218.9 in January 2026. The stock has experienced volatility over the past year. Price movements reflect earnings announcements and sector trends. Travel demand recovery has influenced market activity. No official share price guidance has been issued.

Revenue Performance

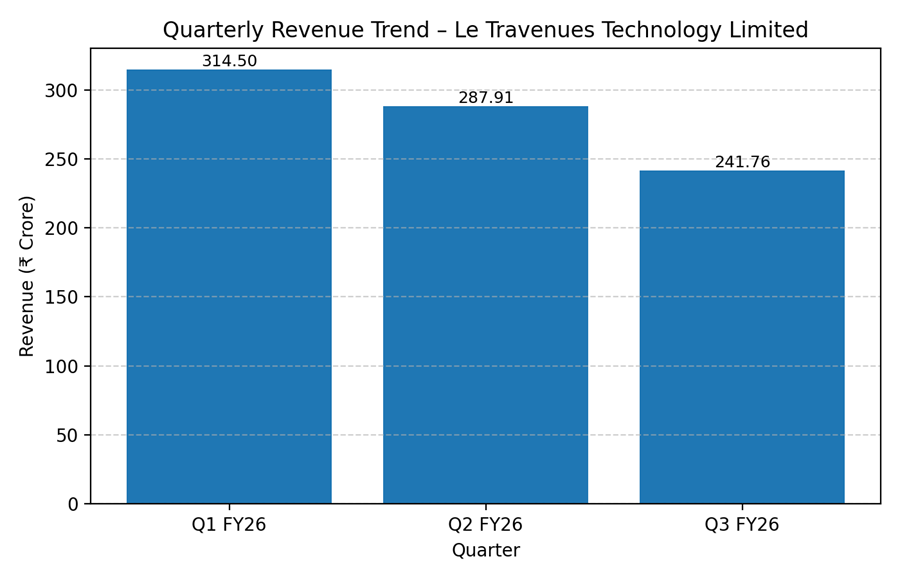

The company reported consolidated revenue across the last three quarters. Revenue for Q1 FY26 was approximately ₹314.5 crore. Q2 FY26 revenue stood at ₹287.91 crore. Q3 FY26 revenue was reported at ₹241.76 crore. Revenue performance reflects seasonal travel demand patterns.

Revenue Chart

Market Analysis

Le Travenues Technology Limited operates in the Indian online travel services industry. The sector includes multiple digital travel platforms and aggregators. Competition remains strong across pricing and customer acquisition. Mobile usage and digital payments support industry expansion. Macroeconomic conditions continue to influence travel demand.

Analyst Commentary

Publicly available analyst coverage remains limited. No consolidated analyst consensus has been disclosed. Broker commentary has primarily focused on quarterly earnings. Target price disclosures are not consistently available. Analyst visibility remains constrained.

Mergers & Acquisitions

None reported. No recent mergers or acquisitions have been announced. No divestments have been disclosed. The corporate structure remains unchanged. Growth initiatives continue internally.

Outlook

The company has not issued formal forward-looking guidance. Future performance depends on travel demand trends. Macroeconomic factors may affect booking volumes. Technology investments remain ongoing. The outlook remains uncertain.