“We are making great progress on our sustainability journey and are in the process of commissioning Post Consumer Recyclate (PCR) and Multi-Layered Plastic (MLP) recycling facilities in Mexico and Poland. UFlex has recycled more than half a million tons of Multi-Layer mixed Plastic Waste (MLP) so far.”

– Mr Ashok Chaturvedi, Managing Director, Concall- Q3FY22

Stock Data:

| Ticker | UFLEX |

| Exchange | BSE and NSE |

| Industry | Packaging |

Price Performance:

| Last 5 days | +1.8% |

| YTD | -27.1% |

| Last 1 year | -37.05% |

Company Description:

Uflex Ltd (Uflex) is one of India’s leading flexible packaging companies with large capacities of plastic film and packaging products which provide end to end flexible packaging solutions. Since its inception in 1983, Uflex has grown from strength to strength providing end-to-end solutions to clients across over 140 countries. It has successfully integrated its operations from manufacturing of polyester chips, plastic films (BOPET, BOPP & CPP), laminates, and pouches to all types of packaging and printing machines thus offering complete flexible packaging solutions. Headquartered in Noida it has packaging film manufacturing facilities in India, Dubai, Mexico, Poland, Egypt and USA. It is the world’s largest supplier of polyester films for flexible packaging applications.

Product Portfolio:

- Flexible Packaging:

Company manufactures a vast range of plastic flexible packaging products. Its product portfolio includes Biaxially Oriented Polyethylene Terephthalate (BOPET), Biaxially Oriented Polypropylene (BOPP) films, Cast Polypropylene (CPP) films, Printing & Coating Inks, adhesives, facilities for Holography, Metallization & PVDC coating, Gravure Printing Cylinders, Gravure Printing, Lamination and Pouch formation.

- Engineering Activities and Other:

Under this segment, the company manufactures major packaging, printing and allied machines for customers across various industries.

Presence Across Value Chain:

The company has presence across the complete value chain of flexible packaging business and manufactures various main/ basic as well as various intermediary products for the end customers.

Key Clients:

Company has got clients from across the world. Its key clientele includes Coca Cola, Nestle, Mondelez International, Amul, Perfetti, GlaxoSmithKline, PepsiCo, Loreal, ITC, Britannia, P&G, etc.

Customer Concentration:

The company has a well diversified customer base; Its top customer accounts for 12% of revenues and its top 5 customers’ accounts for only ~22% of revenues.

Geographical Revenue Breakup:

The company has a strong global sales and distribution network and caters to 150+ countries in the world. Presently, the domestic customers account for 39% of revenues and the International customers account for the rest 61% of revenues.

Manufacturing Capabilities:

Uflex is one of the largest manufacturers of the packaging films in the world, with operations spread across nine countries: India, the UAE, Mexico, Egypt, Poland, the US, Russia, Nigeria and Hungary.

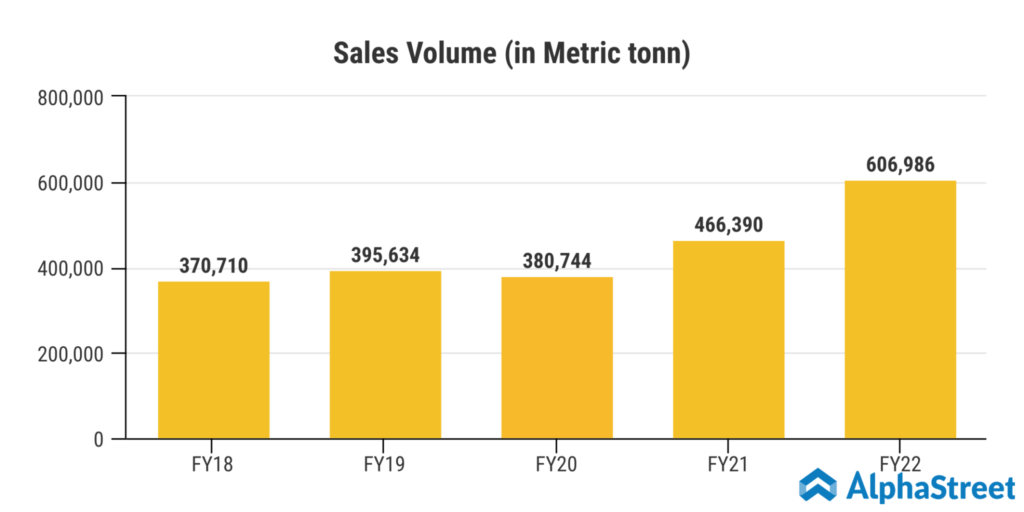

The company operates a cumulative capacity of 5,91,000 TPA, including biaxially-oriented polypropylene (1,49,000 TPA), biaxially-oriented polyethylene terephthalate (3,50,000 TPA) and cast polypropylene (CPP) films (29,000 TPA).

Capex:

During FY21 and FY22, the company planned a capex of over INR 21.0 billion, its net debt proceeds were INR 12.0 billion. These includes investments in various projects:

- Cast polypropylene (CPP) facility with a capacity of 18,000 tonnes per annum (TPA) in Russia is estimated to be around INR 3.0 billion. The projects shall be funded through a cumulative debt of about INR 2.4 billion, while the balance shall be funded through internal accruals. The projects are likely to commence operations in September 2023.

- Capex of around INR 5.9 billion towards a greenfield project for setting up 1,68,000 TPA polyethylene terephthalate (PET) chip plant at Panipat, Haryana. These projects shall be funded through a combination of debt and internal accruals, and are likely to commence operations in March 2024. The agency believes the backward integration, i.e. PET manufacturing will allow the company to obtain control over supplies and improve efficiency.

Income Tax Search:

The Income Tax Department conducted search operations at various locations of Uflex from 21 February 2023 to 27 February 2023. As informed by the company to stock exchanges, full cooperation was extended by all employees to the Income tax officials, all books of accounts were found to be in order and nothing incriminating was seized by the search team.

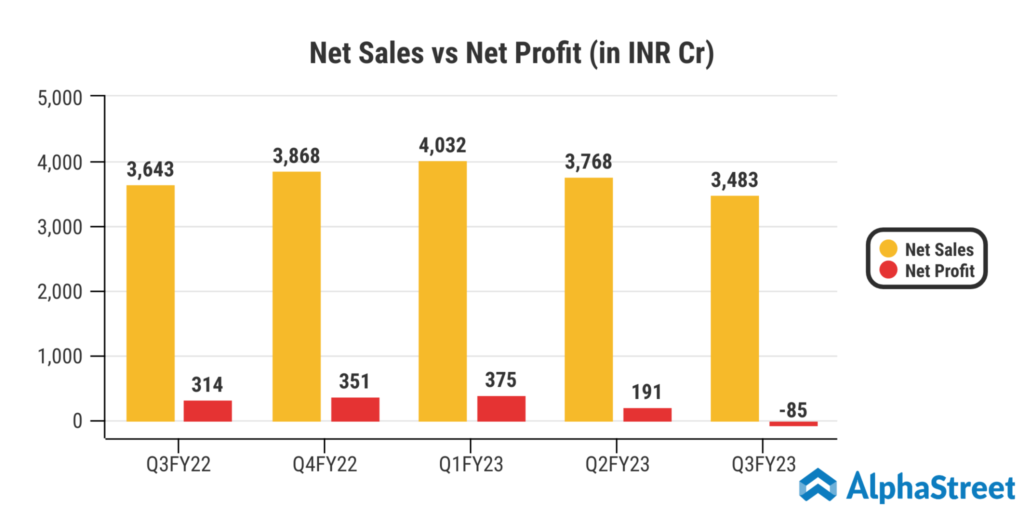

Financials:

What we like:

- Low per capita packaging consumption in India:

Historically, the Indian supply chain has been selling goods mostly in loose form or in conventional packing of paper bags/wrap etc. A very small fraction of the retail consumption of goods is sold as packaged goods. In India, the packaging penetration has been very low or insignificant compared to the developed countries where anything and everything is sold in packed form whether it is raw, semi-finished or finished forms. With the change in economic condition, lifestyle of people & launch of organized retail etc. The demand for packaged goods is expected to rise dramatically.

- Marquee clients with long standing relations:

Uflex has always been deploying the latest technologies to offer innovative and compatible packaging products to customers and attain a high degree of operational excellence. Its emphasis on product innovations, quality enhancement together with competitive price and quick deliveries makes it a preferred vendor. Key customers of Uflex include some of the biggest companies in India as well as MNC companies with global operations.

- Aseptic Liquid Packaging – Duopoly To Boost Top-Line And Margins:

Aseptic Liquid Packaging optimizes the shelf life of the products such as juices, non aerated alcoholic beverages and highly perishable liquid consumables like milk and other dairy products. Uflex has set up a 7 billion-pack facility at Sanand, Gujarat at an investment of ~INR 580 Cr. The production capacity in the 1st stage was 3.5 billion packs, which today has increased to 7 billion packs in a short period of time.

At present, the global market for aseptic liquid packaging is ~300 billion packs. Tetra Pak is the largest player in this segment and supplies close to 180 billion packs, followed by Great view Aseptic Packaging Company, which supplies 21 billion packs yearly and is present in China, Switzerland and Germany,.

The market for liquid packaging in India is about 10 bn packets and is growing at a CAGR of 20%. Tetra pack has the monopoly here, with an 80% market share. The rest is served through imports, mainly from China.

Customers do not have any pricing power as Tetra Pack dictates the terms. Hence, Uflex is positioning itself as a second source of supply and therefore will not get into a price war. It is an intelligent move by the company, which has helped it ensure an enduring position in the market, which has a huge potential (the Indian market is 1/30th of the global market). This move is conversely better than having a brief phase of earning quick gains by undercutting.

Uflex is also combining its rich experience in the packaging industry and offering value added products in Aseptic like holography, which makes the product much more attractive and provides better branding to the companies. Uflex’s competitors do not offer holographic packaging in aseptic packaging.

Factors to consider:

- The players have minimal control over price determination in the film business, because of the industry facing intense competition. The industry also lacks customer stickiness, as customers have many options to choose from numerous industry players. These factors could have a negative impact on the margins.

- The industry has low entry barriers especially in polyester film business which means that new entrants with huge cash can even make a significant market share.

- Since the company mostly caters to the FMCG brand hence any slowdown in the FMCG sector might affect its bottom line.

- The steady rise in debt from INR 1935 Cr in 2012 to INR 5379 Cr in 2022 is among the major concerns for the company though the company has managed itself significantly by keeping the debt to equity ratio in check. Also the promoters have 4.2% of its shares pledged.