Shares of IRM Energy Ltd (IRMENERGY) rose 9.0% to ₹245.70 in Thursday’s trading session following the release of third-quarter fiscal 2026 results. The stock saw strong buying interest after net profit significantly outpaced revenue growth, reflecting improved operational efficiency. Despite the intraday surge, the stock remains under pressure on a yearly basis, reflecting broader caution in the city gas distribution (CGD) sector.

Company Description

IRM Energy Ltd is an Indian city gas distribution company engaged in the development, operation, and expansion of local natural gas networks. The company provides Compressed Natural Gas (CNG) for the transport sector and Piped Natural Gas (PNG) for domestic, commercial, and industrial consumers. Its operations are concentrated in geographical areas (GAs) across Gujarat, Punjab, Tamil Nadu, and the Union Territory of Daman and Diu, holding exclusive marketing rights for periods ranging from five to eight years in its core territories.

Market Performance and Valuation

- Current Stock Price: ₹251.00 (Close Feb 5, 2026)

- Market Capitalization: Approximately ₹1,031 crore

- 52-Week Context: The stock has traded between a high of ₹394.00 and a low of ₹229.00. Over the past 12 months, shares have declined roughly 20%, significantly underperforming the benchmark NIFTY 50 index.

- Valuation: IRM Energy trades at a trailing P/E ratio of 22.82x. While this is higher than the sector median of 19.02x, the multiple is supported by the company’s recent earnings momentum and status as a small-cap growth player in the regulated utility space.

Third Quarter and Nine-Month FY2026 Results

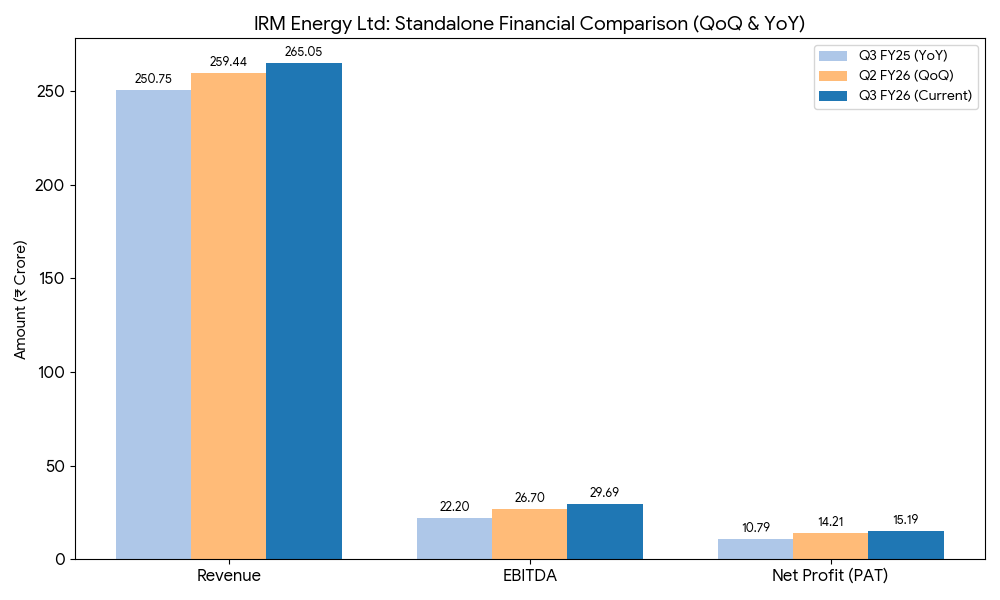

IRM Energy reported standalone results for the quarter ended December 31, 2025:

- Q3 Revenue: ₹265.05 crore, up 5.7% year-over-year from ₹250.75 crore.

- Q3 EBITDA: ₹29.69 crore, a 33.7% increase year-over-year. EBITDA margins expanded to 11.20% from 8.85% in the prior-year period.

- Q3 Net Profit (PAT): ₹15.19 crore, rising 40.8% year-over-year, aided by lower interest costs and improved volume mix.

- 9M FY2026 Performance: Revenue for the first nine months stood at ₹786.98 crore, an 11.1% increase. Net profit for the period reached ₹43.67 crore, up 2.8% year-over-year.

- Volume Mix: Total gas volumes for Q3 rose 5% to 56.07 mmscm. CNG volumes grew 21%, while Industrial PNG volumes saw a 14% decline due to competitive fuel pricing.

Analyst Forecasts and Sector Outlook

Analyst consensus for FY2026 remains cautiously optimistic, with revenue expected to reach approximately ₹1,055 crore. However, long-term earnings growth is forecast at 24.7% per annum over the next three years as new GAs in Tamil Nadu (Namakkal and Tiruchirappalli) reach operational maturity.

- Macro Pressures: The sector faces headwinds from the gradual reduction in domestic APM (Administered Pricing Mechanism) gas allocation, forcing companies to rely more on costlier imported Liquified Natural Gas (LNG).

- Company-Specific Challenge: A key risk involves the high concentration of industrial customers in Gujarat who are prone to switching to alternative fuels (propane or fuel oil) if natural gas price spreads narrow.

Geopolitical Risk and Trade Policy

As a domestic-focused utility, IRM Energy has limited direct exposure to international trade tariffs. However, it remains highly sensitive to geopolitical volatility affecting global LNG spot prices. Any disruption in Middle Eastern supply chains or shifts in India’s import policy could impact input costs, as the company increasingly sources regasified LNG to meet industrial demand.

SWOT Analysis

| Strengths | Weaknesses |

| Strong 21% growth in high-margin CNG segment. | Decline in Industrial PNG volumes (-14% in Q3). |

| Healthy balance sheet with low Debt-to-Equity (0.08). | Significant 1-year stock underperformance (-20%). |

| Opportunities | Threats |

| Expansion into new high-potential GAs in Tamil Nadu. | Reduction in domestic gas allocation from the government. |

| Potential for margin expansion as infra utilization rises. | Volatility in global LNG prices affecting procurement costs. |