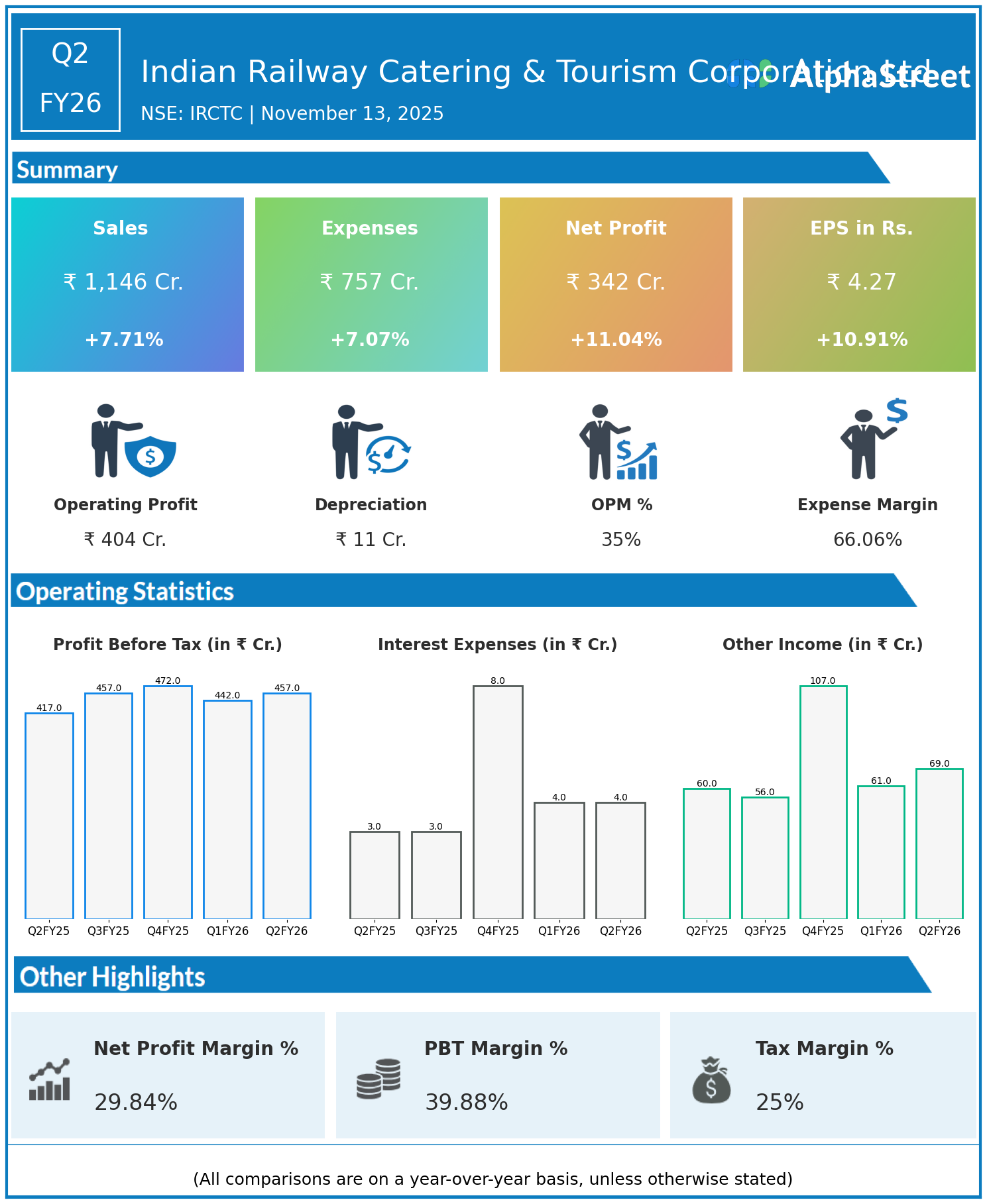

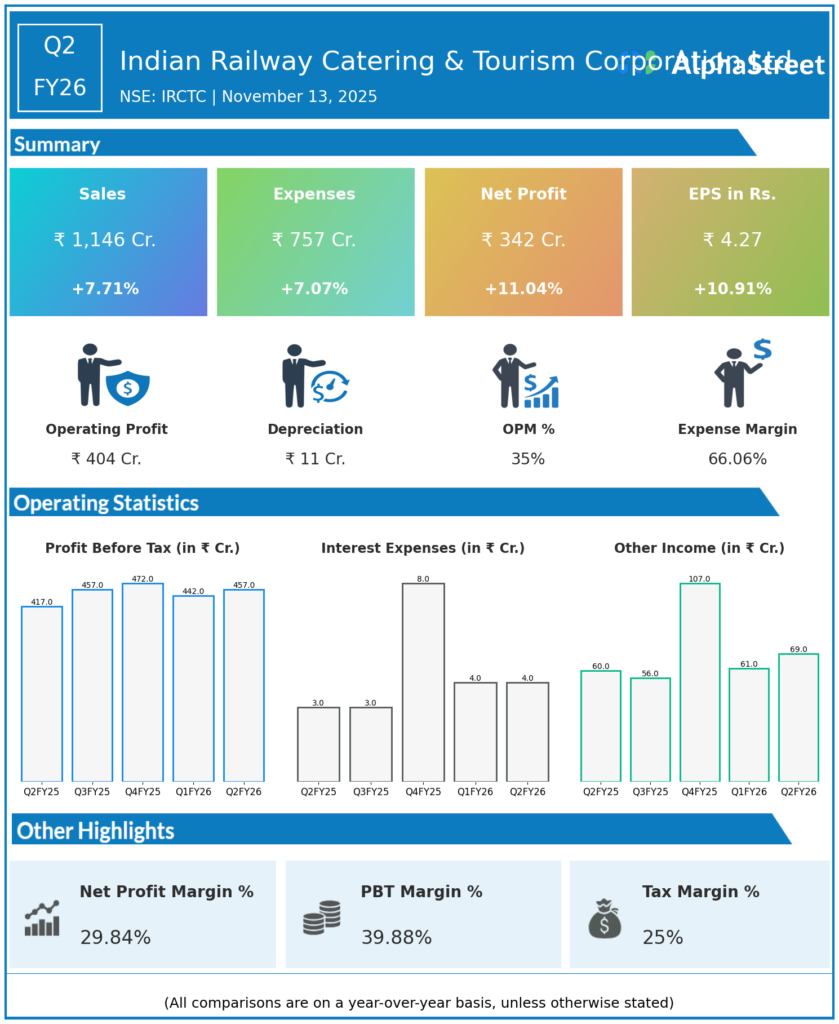

Indian Railway Catering & Tourism Corporation Ltd (IRCTC), a Navratna PSU authorized for online railway ticketing, catering, and packaged drinking water services, reported steady financial results for Q2FY26.

Financial Highlights:

- Revenues increased 7.71% year-on-year to ₹1,146 crore from ₹1,064 crore.

- Total expenses rose 7.07% to ₹757 crore from ₹707 crore.

- Consolidated net profit rose 11.04% to ₹342 crore from ₹308 crore.

- Earnings per share grew 10.91% to ₹4.27 from ₹3.85.

The company’s growth was supported by higher internet ticketing volumes, expanded catering services, and packaged drinking water sales. Operational efficiency contributed to margin improvement despite expense growth.

Outlook:

IRCTC continues to leverage its monopoly in rail-based services and expands its tourism portfolio while focusing on digital initiatives to capture emerging opportunities and enhance shareholder value.

For a detailed earnings analysis and updates, follow Indian Railway Catering & Tourism Corporation Ltd on the AlphaStreet India News Channel.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.