Ion Exchange (India) Limited is a leading provider of comprehensive water and environment management solutions, serving diverse sectors with expertise ranging from pre-treatment and process water treatment to wastewater management, recycling, zero liquid discharge, sewage treatment, packaged drinking water, and desalination.

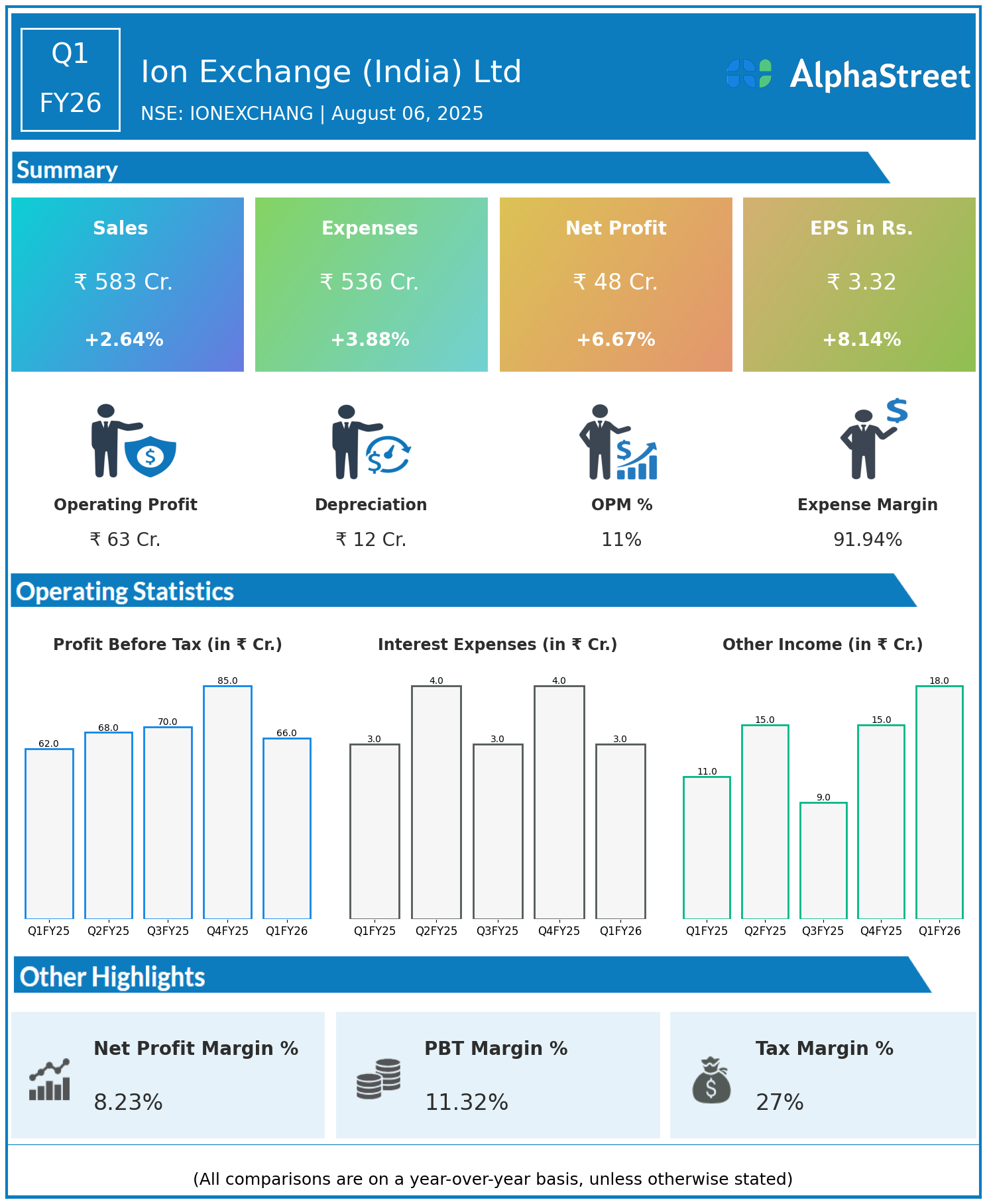

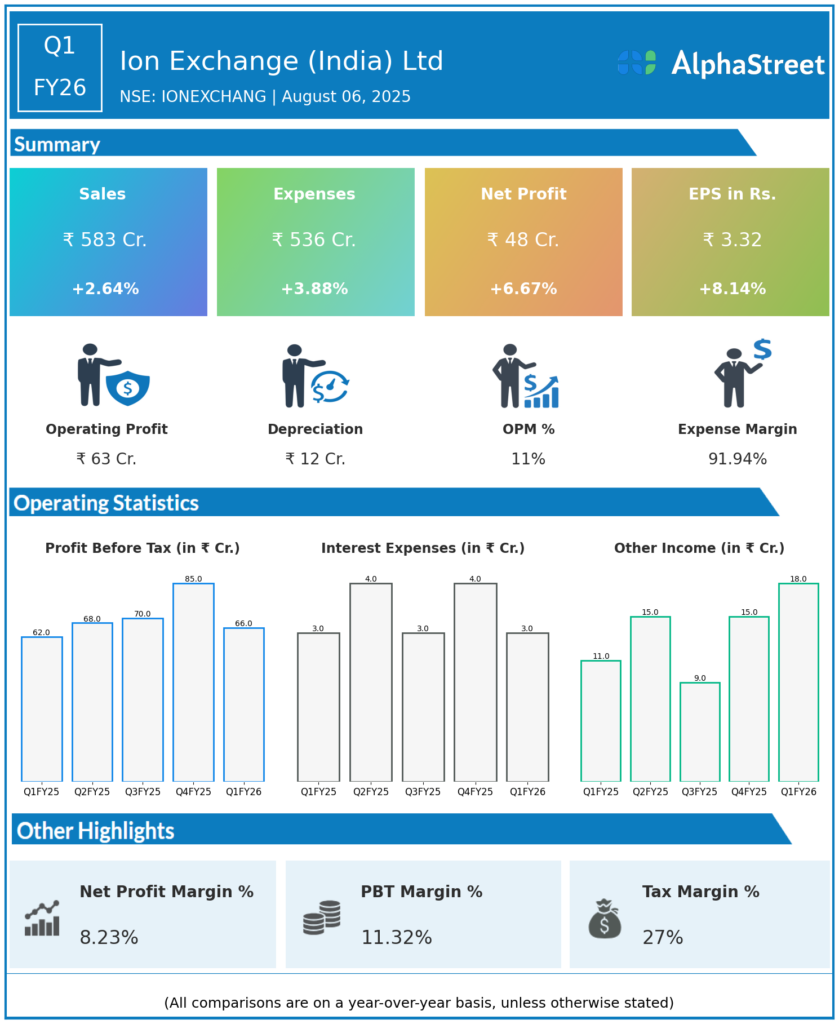

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹583 crore, up 2.64% year-on-year (YoY) from ₹568 crore in Q1 FY25.

- Total Expenses: ₹536 crore, up 3.88% YoY from ₹516 crore.

- Consolidated Net Profit (PAT): ₹48 crore, up 6.67% from ₹45 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.32, up 8.14% from ₹3.07 YoY.

Operational & Strategic Update

- Steady Revenue Growth: The modest increase in revenue reflects continued demand for the company’s water treatment, recycling, and environmental solutions across industrial, municipal, and residential sectors.

- Expense Management: While total expenses increased by a slightly higher rate than the topline, effective cost controls and operational discipline helped Ion Exchange maintain robust margins.

- Profitability Trends: Net profit and EPS rose faster than revenues, demonstrating underlying strength in operational efficiency, improved project execution, and a favourable product-service mix.

- Business Focus & Diversification: Ion Exchange continues to expand its solution portfolio addressing critical needs such as zero liquid discharge, industrial water reuse, and advanced desalination, supported by innovation and strong client engagement.

- Strategic Initiatives: The company focuses on broadening its reach in core industrial markets and high-potential segments such as packaged drinking water and smart, automated water management systems.

- Sustainability Leadership: Investment in environmentally efficient processes and sustainable water solutions remains central, positioning Ion Exchange as a preferred partner in India’s water transformation and stewardship efforts.

Corporate Developments

Q1 FY26 highlights Ion Exchange’s ability to sustain growth and improve profit margins despite a challenging environment marked by inflation and project complexities. The results reflect the company’s operational resilience, technological leadership, and trusted client relationships.

Looking Ahead

Ion Exchange (India) Ltd is well-placed to benefit from rising industrial and municipal demand for advanced water solutions, regulatory pushes for sustainability, and increasing green infrastructure investments. Ongoing focus on innovation, cost optimization, and expanding the solutions portfolio is expected to drive value creation and margin expansion through FY26 and beyond.