Company Overview:

Intense Technologies Ltd, incorporated in 1990, is focused on developing software products for data analytics and providing tech-enabled services to organizations. The company operates primarily in customer communications, data management, and process automation sectors. Presenting below its Q2 FY26 Earnings Results.

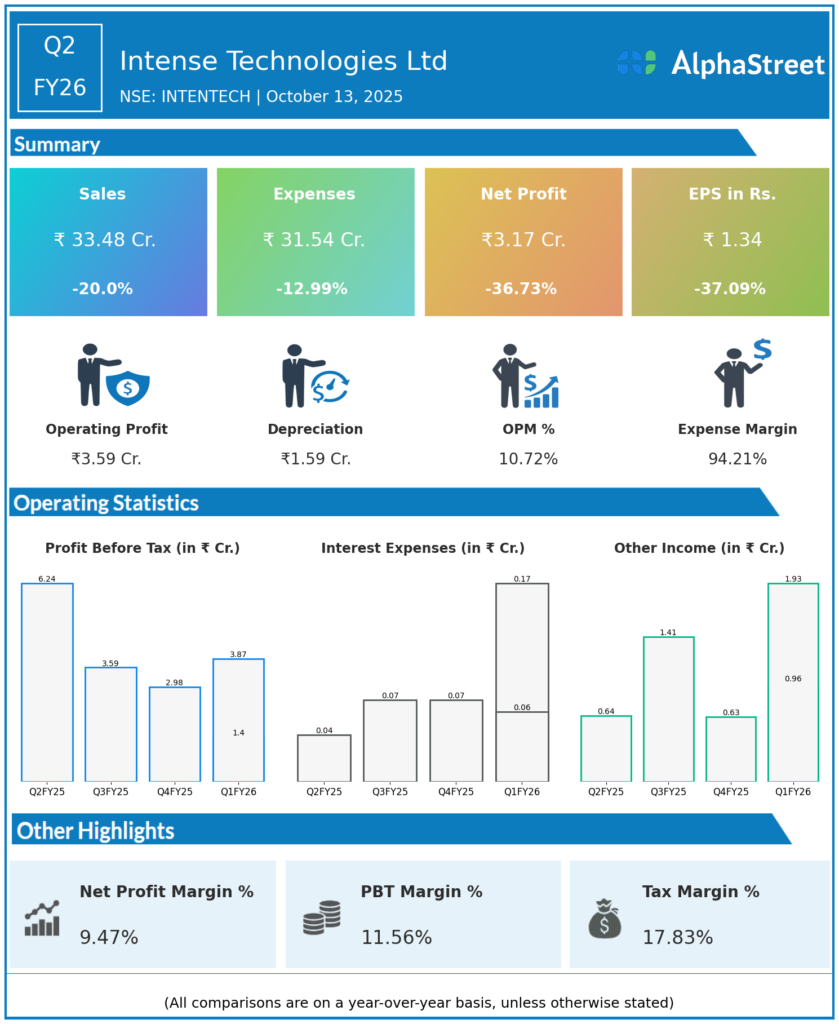

Financial Highlights for Q2 FY26 Earnings

- Revenue: ₹33.48 crore, down 20.0% year-on-year from ₹41.85 crore

- Total Expenses: ₹31.54 crore, down 12.99% year-on-year from ₹36.25 crore

- Consolidated Net Profit (PAT): ₹3.17 crore, down 36.73% year-on-year from ₹5.01 crore

- Earnings Per Share (EPS): ₹1.34, down 37.09% from ₹2.13 in the same quarter of the previous year

Performance Insights:

- The decline in revenue was primarily due to the conclusion of a major 5-year managed services contract.

- Despite the revenue drop, the company secured four new high-value BFSI clients, including a significant win in Saudi Arabia, aiding geographic expansion.

- EBITDA margins compressed to around 10%, impacted by lower revenues and fixed cost pressures.

- Intense Technologies is focusing on advancing AI integration across its platforms, including generative AI and agentic AI capabilities to enhance operational efficiency and client services.

- The company maintains a robust cash position of ₹58 crore and remains debt-free, providing flexibility for strategic investments and growth initiatives.

Outlook:

While Q2 results reflect a significant decline in profits, management is optimistic about recovery supported by a healthy deal pipeline, AI-driven product innovation, and expansion into international markets. The company expects top-line growth of 10-15% in FY26 with margin recovery anticipated in the second half of the fiscal year.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.