Company Overview:

Intellect Design Arena Limited is a global leader in Financial Technology (FinTech), offering cutting-edge solutions to banking, insurance, and financial services sectors worldwide. Established in 2011, the company boasts a comprehensive suite of products spanning Global Consumer Banking, Risk & Treasury Management, and Insurance, driven by innovative platforms like eMACH.ai, iTurmeric, and Purple Fabric.

Intellect’s recent achievements include securing significant deals across North America, Europe, APAC, and ANZ regions, with a focus on core banking, lending, wealth management, and underwriting solutions. Recognized by industry reports and awards, Intellect’s disruptive technologies are reshaping the financial landscape, emphasizing codeless platforms for streamlined development and integration.

The company’s financial performance reflects consistent growth, particularly in license revenue, signalling increased adoption of its enterprise-grade solutions. With a strategic global presence and a commitment to sustainability, Intellect Design Arena is poised for continued success in revolutionizing financial technology solutions.

Results Q4FY24:

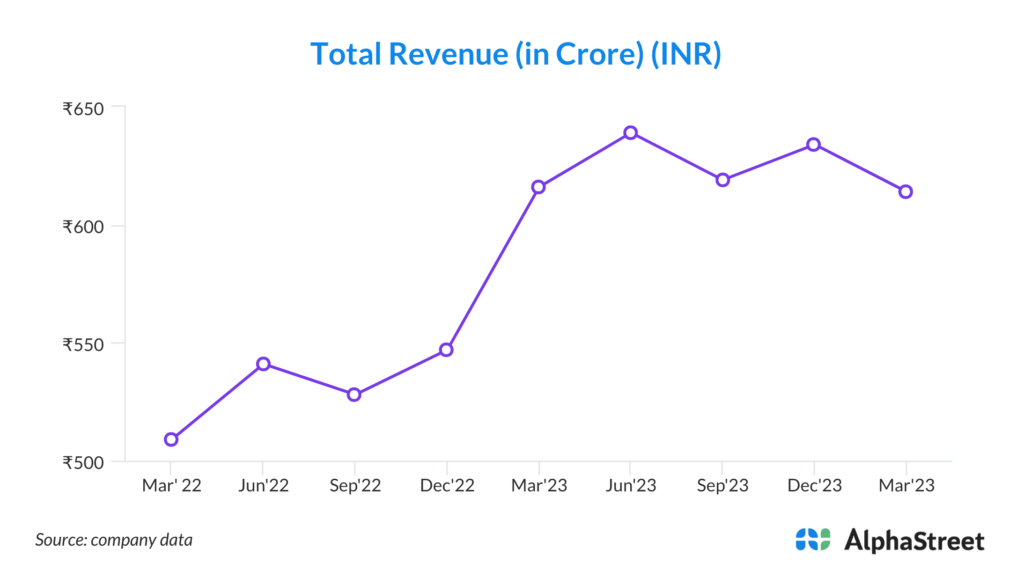

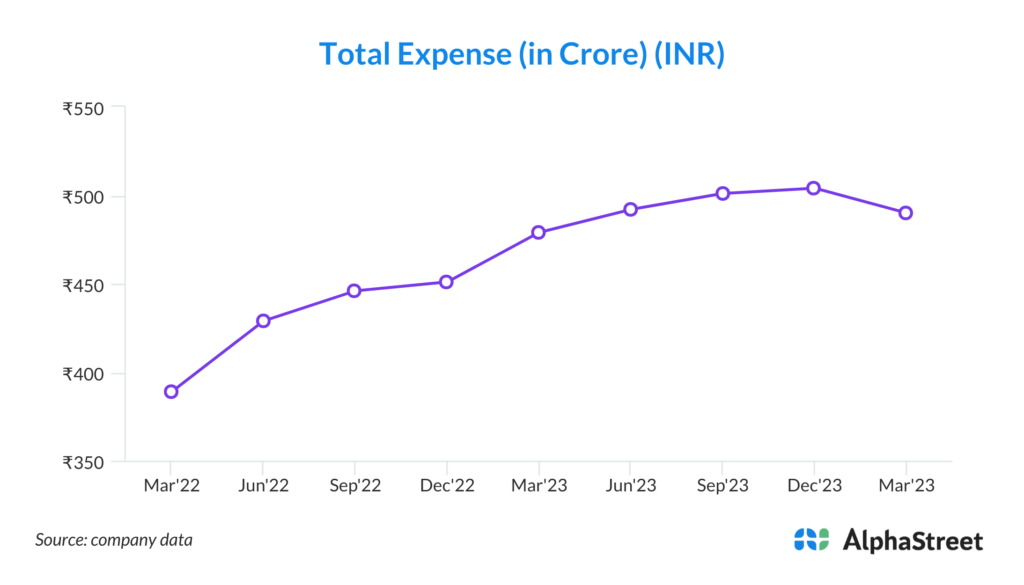

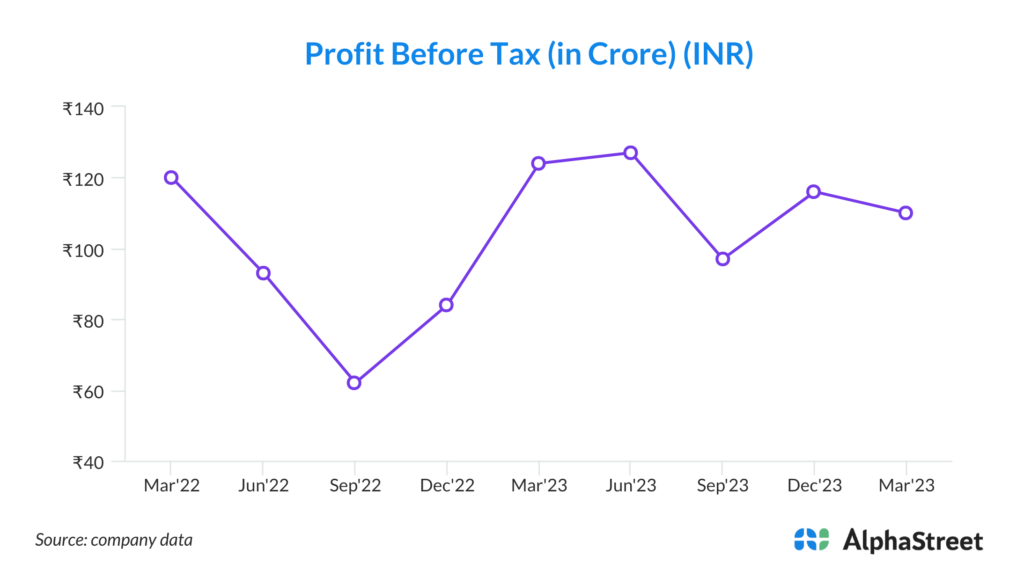

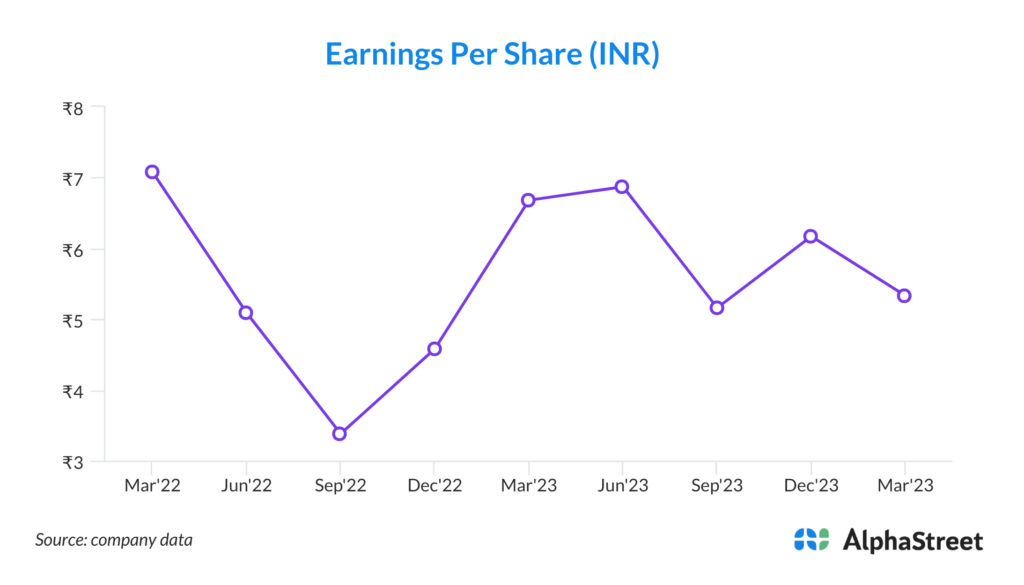

Intellect Design Arena Limited has reported its latest financial results for Q4FY24 and the full fiscal year ending in March 2024. In Q4FY24, the company recorded a total revenue of Rs. 612 crore, slightly lower compared to Rs. 621 crore in Q4FY23. Notably, platform revenue decreased to Rs. 56 crore from Rs. 114 crore in the previous year, while license revenue grew by 18% year-on-year to Rs. 134 crore and AMC revenue increased by 11% year-on-year to Rs. 118 crore.

Despite these fluctuations, the company maintained a healthy gross margin of Rs. 354 crore and an EBITDA of Rs. 137 crore. The profit after tax (PAT) for Q4FY24 stood at Rs. 85 crore, excluding a one-off exceptional item relating to MAT credit write-off. For the full fiscal year FY24, Intellect Design Arena achieved a total revenue of Rs. 2,513 crore, representing a 12% year-on-year growth.

The company’s license revenue notably increased by 35% year-on-year to Rs. 445 crore, while AMC revenue grew by 17% year-on-year to Rs. 448 crore. The strong financial performance demonstrates Intellect’s resilience and continued focus on driving growth across its platform and service offerings in the dynamic financial technology sector.

Key Strengths of the company:

1. Innovative Product Portfolio: Intellect Design Arena boasts a diverse and innovative product portfolio, encompassing solutions tailored for Global Consumer Banking, Risk & Treasury Management, and Insurance. Their platforms like eMACH.ai, iTurmeric, and Purple Fabric demonstrate cutting-edge technology designed to accelerate digital transformation in financial institutions worldwide.

2. Global Market Presence: With successful deal wins across North America, Europe, APAC, and ANZ, Intellect has established a strong global footprint. These strategic partnerships highlight the company’s ability to cater to diverse markets and meet the needs of large financial institutions and banks.

3. Recognition and Awards: Intellect’s industry recognition, including being acknowledged by Gartner and Datos Insights, underscores the company’s leadership in application composition technology and automation within financial services. Such accolades validate the strength and impact of Intellect’s solutions in the evolving FinTech landscape.

4. Strong Financial Performance: Despite variations in specific revenue streams, Intellect Design Arena has demonstrated consistent revenue growth, particularly in license revenue, reflecting increased adoption of their enterprise-grade solutions by leading financial institutions.

5. Technological Expertise: Intellect’s focus on codeless platforms like iTurmeric showcases their commitment to simplifying technology adoption and integration processes. The company’s ability to leverage AI-driven technologies within their platforms signifies deep technological expertise.

6. Strategic Initiatives: Intellect’s emphasis on sustainability and corporate social responsibility reflects a holistic approach to business operations, fostering employee engagement and reducing environmental impact.

7. Commitment to Growth and Innovation: The company’s robust pipeline of deals, deep engagement in global events, and investment in disruptive technologies like eMACH.ai highlight Intellect’s unwavering commitment to driving growth and innovation in the financial technology sector. These efforts position Intellect Design Arena as a key player in reshaping the future of banking and insurance through technology.

Key Risks and concerns for the company:

1. Market Dependence: Intellect Design Arena’s revenue streams heavily rely on the financial services sector. Any downturn or disruption in the banking and insurance industries could adversely impact the company’s financial performance and growth prospects.

2. Competition from Fintech Startups: The evolving landscape of financial technology presents a challenge with the emergence of agile fintech startups. These competitors may offer innovative solutions at lower costs, potentially eroding Intellect’s market share and pricing power.

3. Regulatory Changes: The financial industry is subject to evolving regulatory frameworks globally. Changes in regulations, compliance requirements, or data privacy laws could necessitate costly adjustments to Intellect’s products and operations.

4. Technology Risks: Rapid technological advancements pose risks such as cybersecurity threats and system vulnerabilities. Intellect must continuously invest in robust cybersecurity measures to safeguard its platforms and customer data against cyberattacks.

5. Customer Concentration: Reliance on a few key customers for a significant portion of revenue exposes Intellect to customer-specific risks, including potential loss of business due to contract terminations or shifts in customer preferences.

6. Global Economic Conditions: Intellect’s performance is sensitive to macroeconomic factors such as economic downturns, currency fluctuations, and geopolitical instability. Economic uncertainties can impact customer spending and investment decisions in technology solutions.

7. Execution and Integration Risks: Successfully implementing and integrating complex technology solutions within client organizations requires effective project management. Delays, budget overruns, or unsuccessful deployments could damage customer relationships and harm Intellect’s reputation in the market.

Conclusion:

In conclusion, Intellect Design Arena Limited stands as a leading player in the global financial technology sector, offering innovative solutions and platforms tailored for banking, insurance, and financial services. Despite market challenges and risks, the company’s diverse product portfolio, strong global market presence, and technological expertise position it well for sustained growth and success. Intellect’s recognition by industry analysts and continued investment in disruptive technologies like eMACH.ai and iTurmeric underscore its commitment to driving digital transformation in financial institutions worldwide.

To mitigate risks, Intellect must remain vigilant in addressing market dependencies, regulatory changes, and competition from fintech startups while prioritizing cybersecurity and customer diversification. By navigating these challenges effectively and leveraging its strengths, Intellect Design Arena is poised to capitalize on emerging opportunities and maintain its leadership in shaping the future of financial technology.