Inox India Limited, established in 1976, is a leading provider of comprehensive solutions in the design, engineering, manufacturing, and installation of equipment for cryogenic conditions. The company specializes in supplying high-quality cryogenic equipment, primarily tanks, as well as systems for industries requiring ultra-low temperature applications. Presenting below are its Q1 FY26 Earnings Results.

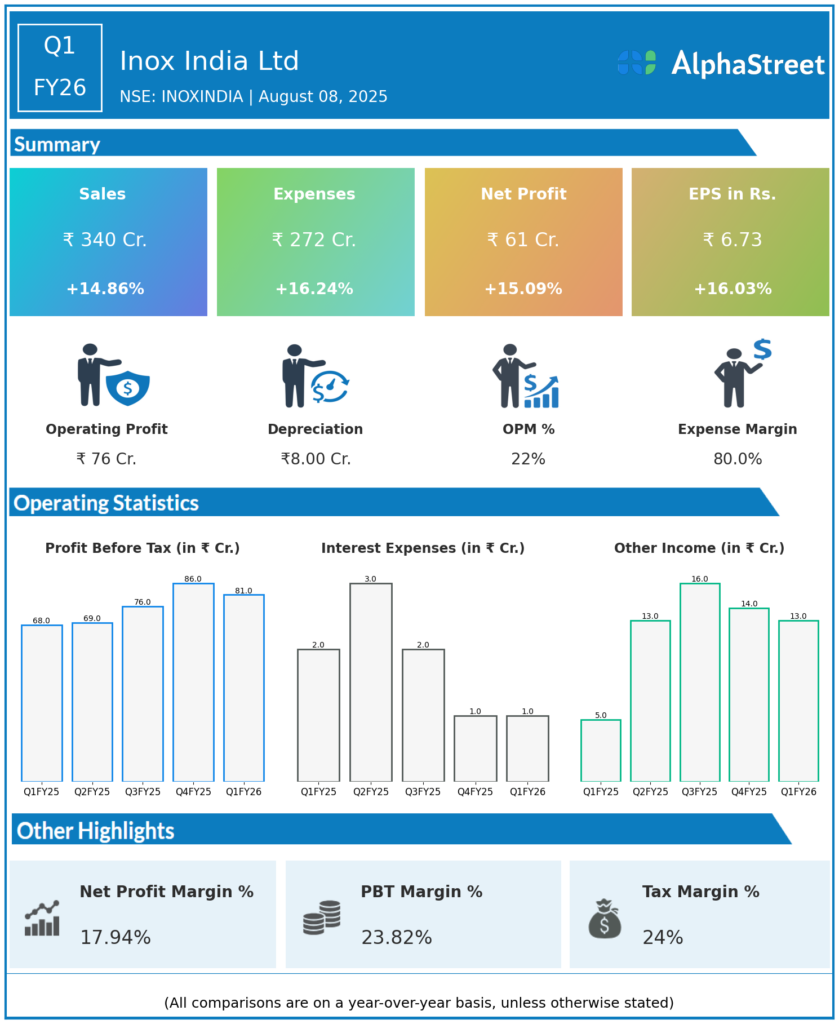

Q1 FY26 Earnings Results

- Revenue: ₹340 crore, up 14.86% year-on-year (YoY) from ₹296 crore in Q1 FY25.

- Total Expenses: ₹272 crore, up 16.24% YoY from ₹234 crore.

- Consolidated Net Profit: ₹61 crore, up 15.09% YoY from ₹53 crore.

- Earnings Per Share (EPS): ₹6.73, up 16.03% YoY from ₹5.80.

Key Operational Insights in Q1 FY26 Earnings

- Steady Revenue Growth: The nearly 15% increase in revenue reflects robust demand for Inox India’s specialized cryogenic equipment and systems, driven by expansions across industrial gases, energy infrastructure, and clean energy projects.

- Cost Management: Total expenses rose slightly faster than revenues, indicating increased input costs and operational activity required to support growth. However, disciplined cost control and operational efficiencies helped maintain healthy profit margins.

- Profit Expansion: Net profit and EPS climbed at a pace similar to revenue, underlining stable operating leverage and margin preservation despite cost pressures.

- Sector Focus: Inox India continues to strengthen its footprint in sectors such as LNG infrastructure, industrial gases, and emerging clean energy applications—leveraging technical expertise and reputation for reliability in critical cryogenic operations.

- Strategic Initiatives: Ongoing investment in engineering, precision manufacturing, and turnkey project delivery enables the company to capitalize on opportunities in both domestic and global markets.

Outlook:

Inox India is well-positioned to benefit from rising demand for advanced cryogenic solutions, fueled by infrastructure expansion and the energy transition. Continued investments in innovation, project execution, and international market penetration are expected to drive growth and margin resilience through FY26 and beyond.

To view Inox India’s previous results: Click Here