Innova Captab Limited (NSE: INNOVACAP | BSE: 544067) announced its unaudited financial results for the third quarter and nine months ended December 31, 2025, on January 23, 2026. The company, a leading integrated pharmaceutical player, demonstrated a significant acceleration in revenue growth driven by its dual focus on Contract Development and Manufacturing Organization (CDMO) services and Branded Generics.

Market Capitalization

As of January 23, 2026, the company’s stock performance and valuation are summarized as follows:

- Current Stock Price: ₹678.05 (NSE).

- Market Capitalization: Approximately ₹3,880.14 Crores.

- Exchange: Listed on both National Stock Exchange (NSE) and BSE Limited.

Latest Quarterly Performance (Q3 FY26)

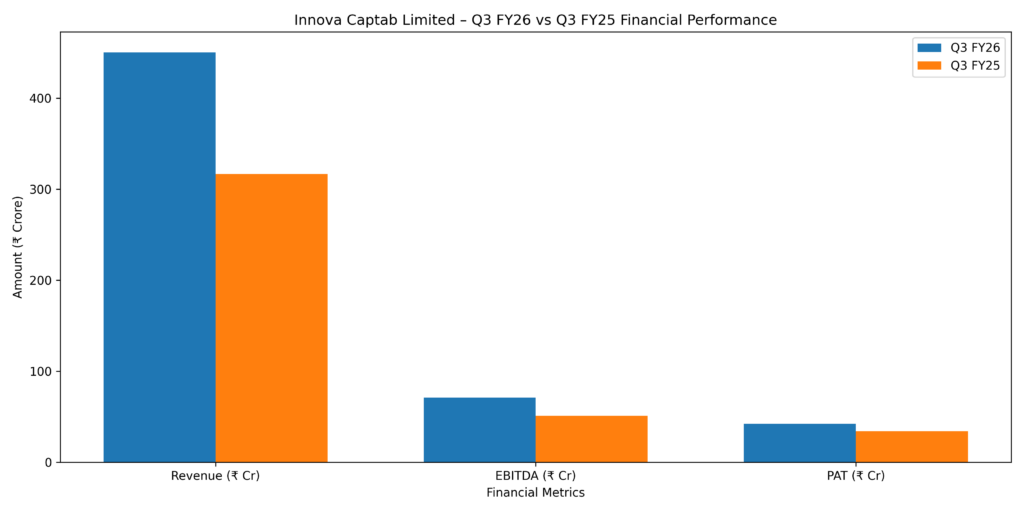

The company reported a stellar top-line performance for the quarter ended December 31, 2025:

- Revenue from Operations: ₹450.3 Crore, a year-on-year (YoY) increase of 42.3% from ₹316.5 Crore in Q3 FY25.

- EBITDA: ₹71.1 Crore, up 39.6% YoY.

- Net Profit (PAT): ₹42.15 Crore, representing a 23.25% YoY increase and a sharp 42.06% sequential (QoQ) recovery.

- Interim Dividend: The Board declared an interim dividend of ₹2 per equity share (20% of face value).

Segment Updates

Innova Captab’s growth was broad-based across its core segments:

- CDMO Segment: Recorded 29% YoY growth in Q3 FY26, fueled by deeper engagement with its over 300 clients and a portfolio exceeding 3,700 products.

- Branded Generics: This vertical saw a sharp 79% YoY growth in Q3 FY26, supported by a network of 220,000+ touchpoints in India and exports to over 60 countries.

Regulatory Milestones

The company recently received GMP Compliance from UK-MHRA for its Cephalosporin unit in Baddi and from PIC/s for its Jammu facility, enhancing its access to regulated international markets.

Equity Analyst Commentary

Analysts have noted a “cautious stance” despite the strong revenue surge. While the company is delivering record quarterly revenues, concerns persist regarding:

- Margin Compression: PAT margins (9.36%) have contracted from Q3 FY24 levels (10.81%) due to rising employee costs, which surged 55% YoY.

- Valuation: With a PEG ratio of 6.02x and a P/E ratio around 31x, some analysts consider the stock “expensive” relative to its historical growth and industry benchmarks.

- Technical Momentum: The stock has faced a downward trend over the past year, trading below key moving averages, leading some analysts to recommend waiting for a better entry point near the 52-week low of ₹625.

Guidance and Future Outlook

Management remains optimistic, targeting a consistent 20%+ growth trajectory. The company aims to:

- Triple Targets: Double its top line, EBITDA, and PAT over the next three years.

- Capacity Expansion: Plans to invest ₹300 Crore in capital expenditure for capacity addition and R&D to drive a 25% revenue increase through regulated market entry.

Strategic Focus

Future growth will be anchored by the commercialization of the Jammu plant and vertical integration into Active Pharmaceutical Ingredients (API).