Key highlights from Infosys (INFY) Q3 FY22 Earnings Concall

Management Update:

-

INFY had a net headcount increase of 12,450 and have increased its annual college recruiting target to 55,000. Voluntary long-term 12-month attrition increased to 25.5%, while quarterly annualized attrition was flattish on a sequential basis.

-

The company also mentioned that its utilization was 88.5%, slightly lower than the previous quarter. The company saw more traction on the digital and the cloud programs, where it saw the most impact in Q3.

Q&A Highlights:

-

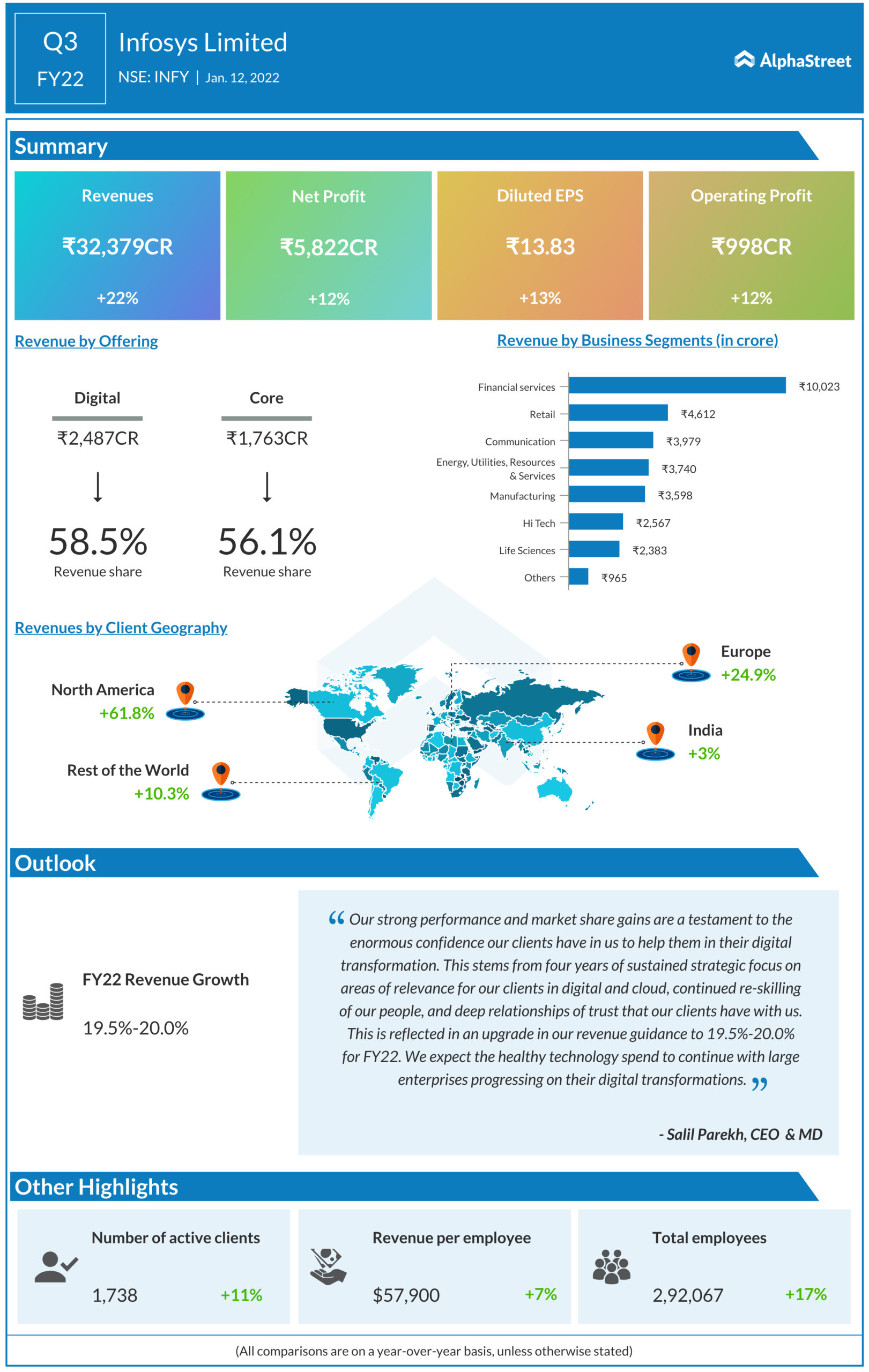

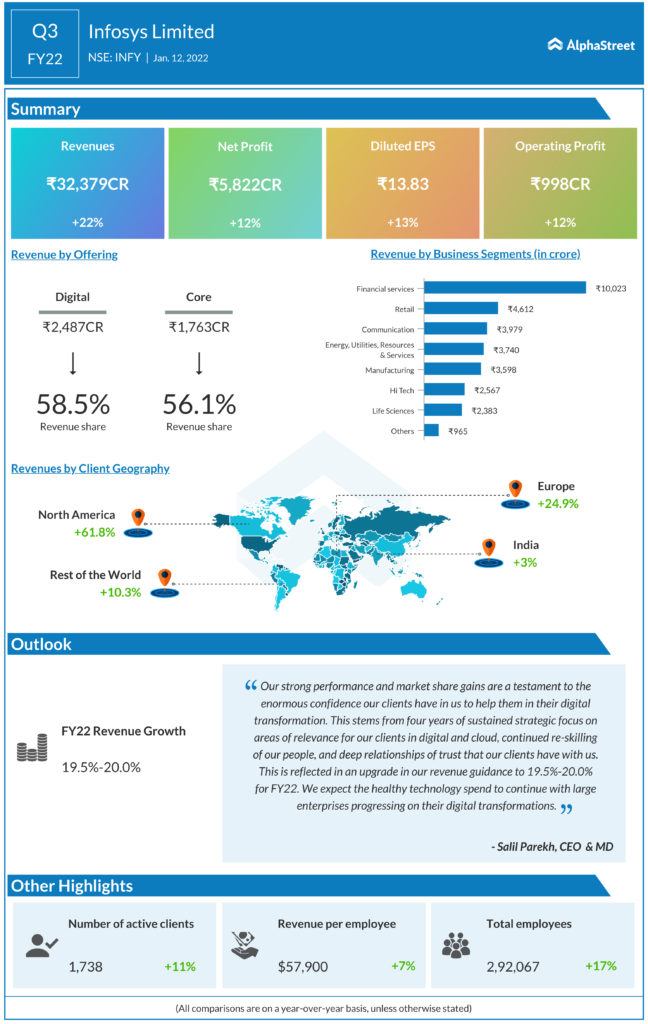

Ankur Rudra of J.P. Morgan queried about the surprises that increased guidance sharply. CEO Salil Parekh said, the company saw very strong momentum in manufacturing and is something that it is looking forward to. INFY also saw good momentum in financial services, given, it’s the company’s largest vertical.

-

On a question asked by Kumar Rakesh of BNP Paribas about continuing this strong growth momentum going ahead, CEO Salil Parekh said, INFY has strong portfolio across digital and cloud. However, it is seeing the cloud capability growing faster than its digital capability.

-

Keith Bachman of BMO asked about the offshore percent of labor increase year-over-year. CFO Nilanjan Roy said that the large labor markets available in India will open up a lot more offshoring opportunities.

-

Nitin Padmanabhan of Investec asked about the INFY’s ability to add freshers versus laterals next year. CFO Nilanjana commented that the company expects to focus both on freshers and laterals next year. There is no specific focus on freshers alone.

-

Manik Taneja of JM Financial asks about the change in offshore mix of revenues over the last 18 months. CEO Salil Parekh commented that it was due to remote working that was in place.

-

James Friedman of Susquehanna asked about the capital allocation strategy. INFY said that it remains committed to return 85% of its free cash flow to shareholders via buybacks and dividends over the next five years.

-

Vimal Gohil of Union AMC queried on core employee cost growth. INFY said that it expects to look at high points of attrition, and doing it more tactically, seeing where demand is high in the market for the skills and targeting those employees.