UFlex Limited (NSE: UFLEX), India’s largest multinational flexible packaging materials and solutions company, announced its business results for the first quarter of FY2022-23.

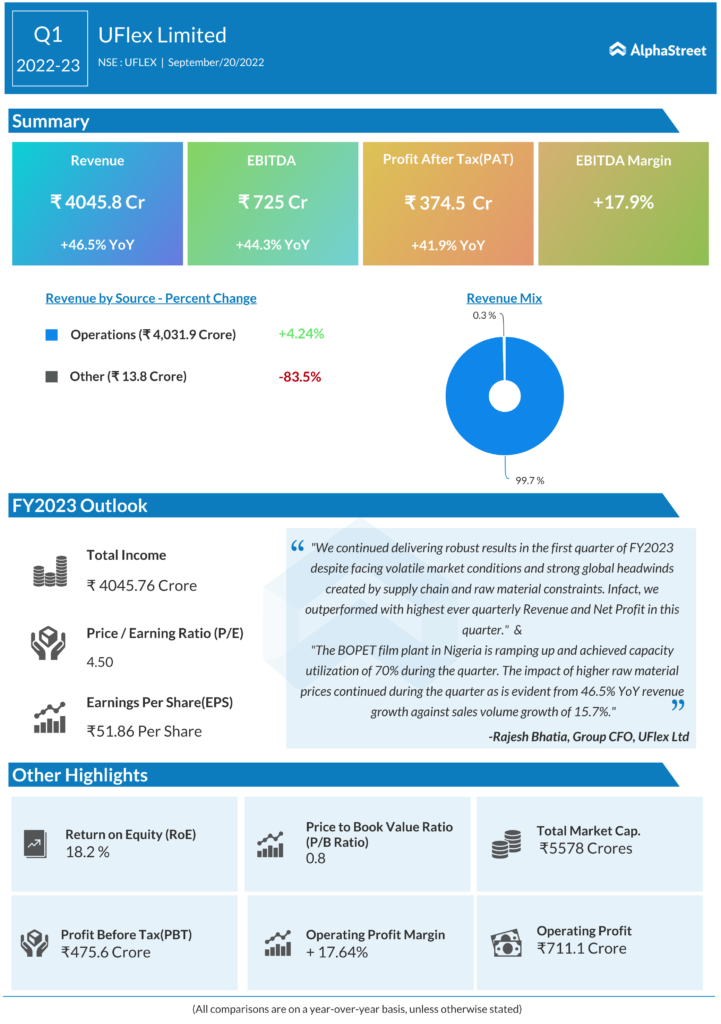

The company reported consolidated EBITDA at INR 725 Cr for Q1 FY22-23, up 44.3% YoY, while consolidated net profit stood at INR 374.5 Cr , up 41.9% YoY.

Consolidated sales recorded a year-on-year increase of 46.5% to 4045.8 Cr in the said quarter.

EBITDA margin for Q1FY23 was 17.9%. Total production rose 14.8% year-on-year to 159,793 MT in the quarter, and total sales were 154,811 MT, a 15.7% year-on-year jump.

Increased Aseptic Liquid Packaging plant capacity was available during the quarter and the business achieved 123% year-over-year sales volume growth.

Uflex has been at the forefront of innovation and has added several feathers to its cap in the past which has been the foundation of its growth story and now the game-changing innovation is expected to cement its leadership position and create new business opportunities.

Focusing on “high margin” business with lower investment will help the company improve its return ratio. The company is constantly adopting an innovative approach and creating a niche for itself. Going forward, the company would seek to increase the share of revenue from the packaging industry, thereby improving returns.