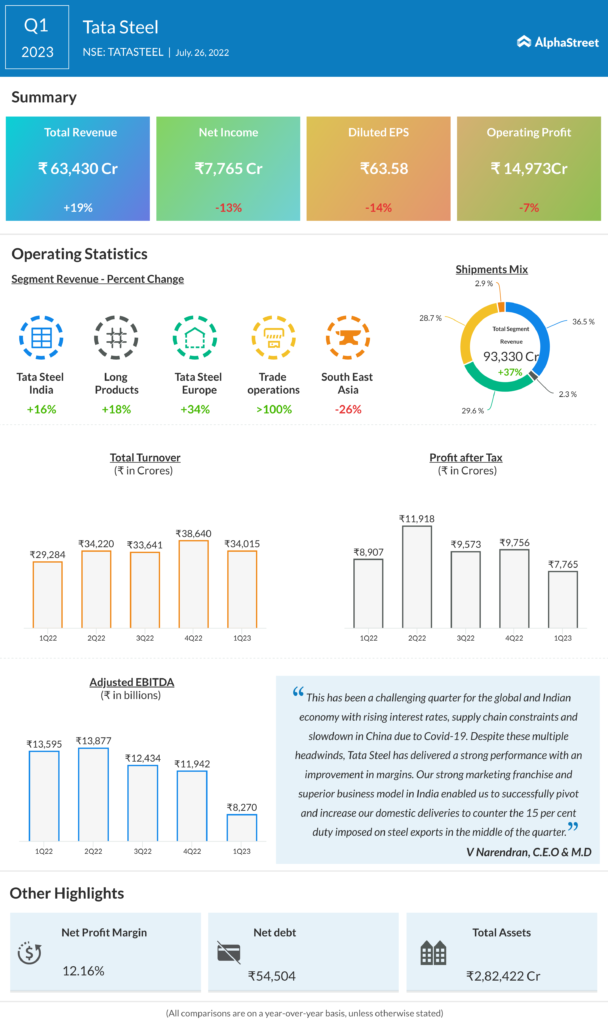

Tata Steel reported a consolidated net profit (attributable to the owners of the company) at Rs 7,765 crore for the quarter ended June, down 12.8 per cent over the year-ago period, in what the company described as a “challenging” quarter. Sequentially, net profit was down 20.4 per cent.

Revenue from operations at Rs 63,430 crore was higher by 18.6 per cent year-on-year (YoY). The numbers beat expectations on revenue and net profit. A poll of analysts by Bloomberg had estimated revenues at Rs 60,474 crore and net profit at Rs 7,275 crore. QoQ, revenues were down by 8.5 per cent.

While Tata Steel’s India operations recorded a fall in profits, Europe saw a surge. Segment results before exception items, interest, tax and depreciation of Tata Steel India stood at Rs 9,615.79 crore, down by 28 per cent YoY while Europe EBITDA recorded a 294 per cent increase to Rs 6,037 crore.

For Europe, it was the highest ever quarterly EBITDA. Revenue per tonne increased by £154 QoQ to £1,248 per tonne due to long-term contracts and product mix.

Deliveries from India, the company said, were marginally lower by 2 per cent YoY due to moderation in exports following the imposition of 15 per cent export duty. However, domestic deliveries were ramped up, it said.

Tata Steel Q1 results: Profit falls 12.8% to Rs 7,765 cr, revenue up 18.6% At a consolidated level, raw material cost increased to Rs 31,319 crore from Rs 19,956 crore in the year-ago period due to higher coking coal consumption cost across entities. Net debt at the end of the quarter stood at Rs 54,504 crore and Chatterjee said that the financial metrics continued to remain strong with net debt to EBITDA <1.0x.