Info Edge is India’s premier online classified company with a portfolio of brands. It owns various brands in different fields like naukri.com (online recruitment), 99acres.com (online real estate), jeevansathi.com (online matrimonial) as well as shiksha.com (online education information services). It also acts as an investor and has invested in many start-ups in the online space and is actively growing its investment portfolio. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

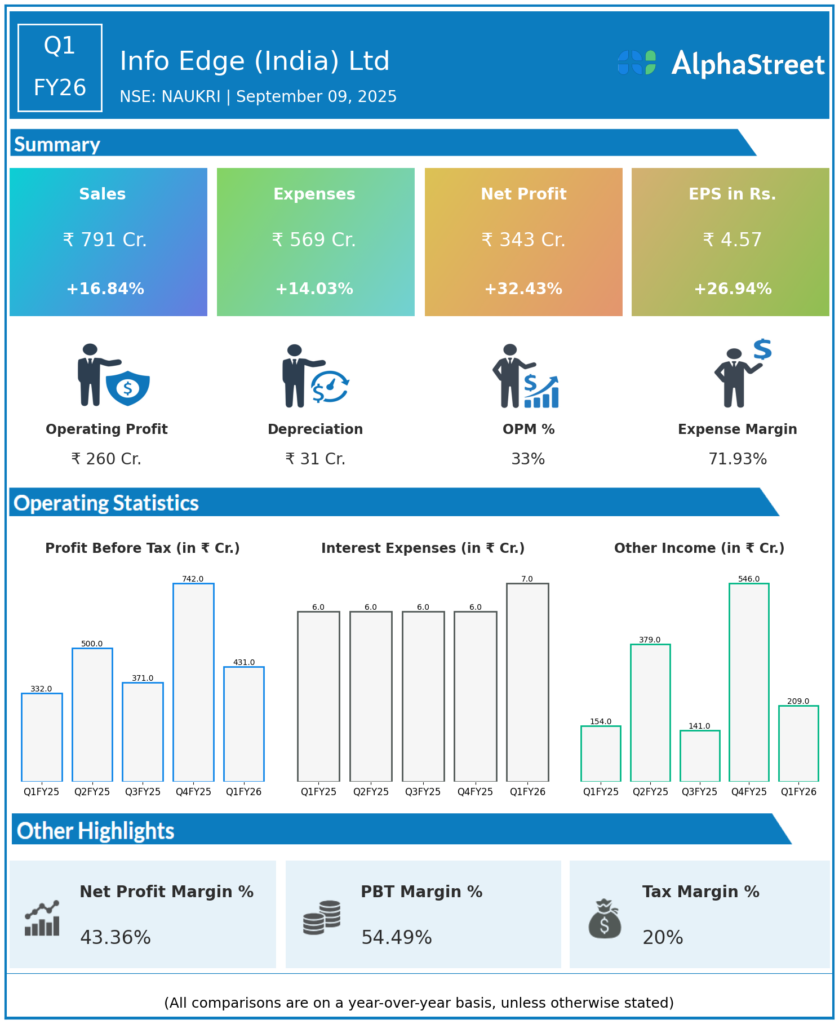

Consolidated Revenue: ₹791 crores, up 17% YoY (Q1 FY25: ₹677 crores); up 5.5% QoQ (Q4 FY25: ₹750 crores).

-

Consolidated Net Profit (PAT): ₹343 crores, up 32.4% YoY (Q1 FY25: ₹233 crores); down 36% QoQ (Q4 FY25: ₹463 crores).

-

Standalone Billings: ₹644.2 crores, up 11.2% YoY (Q1 FY25: ₹579.4 crores), with recruitment solutions growing 9% YoY and non-recruitment portfolio growing 17.6% YoY.

-

Recruitment Business Revenue (Naukri.com): ₹562 crores, up 15% YoY.

-

Non-Recruitment Business Revenue: 99acres ₹111 crores, Jeevansathi ₹34 crores, Shiksha ₹50 crores.

- Operating Profit: ₹250.2 crores with operating margin of 34% on standalone basis.

-

Cash from Operations: ₹179.6 crores before taxes.

-

EPS: ₹4.56; PE ratio approx. 85.5.

Key Management Commentary & Strategic Highlights

-

Managing Director and CEO Hitesh Oberoi noted moderation in recruitment growth amid geopolitical headwinds and a sectoral slowdown, but strong progress in the non-recruitment portfolio driven by market share gains and reduced cash losses.

-

Non-recruitment verticals (99acres, Jeevansathi, and Shiksha) posted healthy gains contributing to overall growth and diversification.

-

The Naukri database expanded to over 108 million resumes with 26,000 resumes added daily in Q1 FY26, enhancing long-term competitive positioning.

-

Strong cash position of ₹4,828 crores supports strategic investments and working capital needs.

-

Management remains cautiously optimistic about near-term growth with structural strengths in recruitment and diversified digital platforms.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹750 crores.

-

Consolidated PAT: ₹678 crores.

-

EPS: ₹7.15

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.