Overview

IndusInd is an Indian Bank with headquarters located in Mumbai. It was founded in the year 1994. The founder is S.P. Hinduja. It has over 2.5 crore customers, 5,000+ distribution points and nearly 2,000 branches across the country. The bank has a wide value of the portfolio which includes microfinance, personal loans, personal and commercial vehicle loans, credit cards, SME loans. The mission of the company “To consistently add value to all our stakeholders by enhancing the sustainability of the organisation and emerge as India’s most convenient Bank with financial metrics amongst the best in the industry”. As on 31st March the Bank’s distribution network includes 2,265 branches/banking outlets and 2,767 on-site and off-site ATMs. The total client base stood at 32 million.

Financial Snapshot

Net Interest Income has increased by 13% YoY to 3,985 crores. NIM has increased to 4.20% as Other income improved by 7% YoY to 1,905 crores. Net Profit grew by 51 % YoY to 1,401 crores for Q3 FY 2022. Net profit improved by 64% to 4,805. Healthy deposits grew 15% YoY to 2,93,349 crores, savings deposits grew by 25% YoY to 88,826 crores.

For FY 2022 Gross NPA stood at 2.27% and Net NPA stood at 0.64%. The Board has recommended dividend of 8.5 per share (85%) for FY 2021-22.

Major Strategies

One of the major strategies opted by the Bank is to reduce the cost to serve. It emphasizes on Reduce turnaround time, Increase STP %. The bank focuses to boost employee productivity and enhances employee experience.

Business Outlook

The bank anticipates that the microfinance business is coming tonormalcy so they are expecting to show steady performance in the coming year. The credit cost is expected in the range of 120 to 150 basis points. The bank further expects PC-5 to be between 45% and 48% of the retail LCR deposit ratio.

Digital Traction

The bank has taken major initiatives to improve the business digitally. It has launched IndusInd Easycredit for Individuals. The facility helps instant sanction and disbursal. IndusInd Easycredit for Business Owners and MSME clients helps to get secured / unsecured loans upto 2 crore digitally.

The bank has launched IndusMerchantSolutions app for retailers which bring their payments, lending and banking needs under a single umbrella. It has even launched IndusEasyWheels portal which provides ancillary services like roadside assistance, mechanic services, insurance. It also helps the repossessed vehicles of the Bank for auction and provides a smooth user experience for customers who are looking for pre-owned vehicles.

SWOT Analysis

Strength-The bank has a strong brand value as it is backed by the Hinduja Group. It has diversified its business in Commercial Banking, Financial Marketing, Retail Banking, Corporate Finance, etc. It has strong marketing strategies and has enhanced its digital presence in social media through Facebook, Instagram, Twitter& YouTube.

Weakness-The bank has a more digital presence which is causing a hindrance in the development in rural areas. The capital structure of the company is not adequate. It has very few branches compared to other leading banks.

Opportunity- To survive in this banking industry the bank needs to expand itself globally. The bank should focus more on the expansion of rural areas.

Threat- Competition from other banking players. Imposition of different rules and regulation by the government is impacting the banking business. Cyber attacks and cyber frauds are also impacting the image of the bank. They are losing their customer confidence. Economic crisis impacts the liquidity of the business. The customers are less inclined in investments which as a whole are creating a hinderance for the banking business.

Industry Analysis

| Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 | |

| ROCE (%) | 3.3 | 3.34 | 3.62 | 3 | 3.11 |

| CASA (%) | 0 | 41.81 | 40.37 | 43.14 | 44 |

| Net Profit Margin (%) | 14.96 | 9.78 | 15.34 | 14.82 | 20.86 |

| Return on Assets (%) | 1.14 | 0.78 | 1.43 | 1.18 | 1.62 |

| Return on Equity / Networth (%) | 9.66 | 6.58 | 12.84 | 12.52 | 15.35 |

In the current scenario the demands for banks have increased due to an increase in working populations and growing disposable income. The banks are inclined more towards digital innovation. Banks with lower NPA and High net interest margins are preferable in the Industry. Now if we do an analysis based on ROCE, ROE and ROA,the margin compared to other major players in the Industry are quiet, less and needs significant improvement. Though IndusInd bank is more inclined towards digital innovation that is a strong point for this bank,but it has very less presence in the rural area.

In Q4 the operating profits grew by 8% and 10% for FY22. The Provision Coverage Ratio was consistent at 72% as on March 31, 2022.

Comparative Study of IndusInd Bank

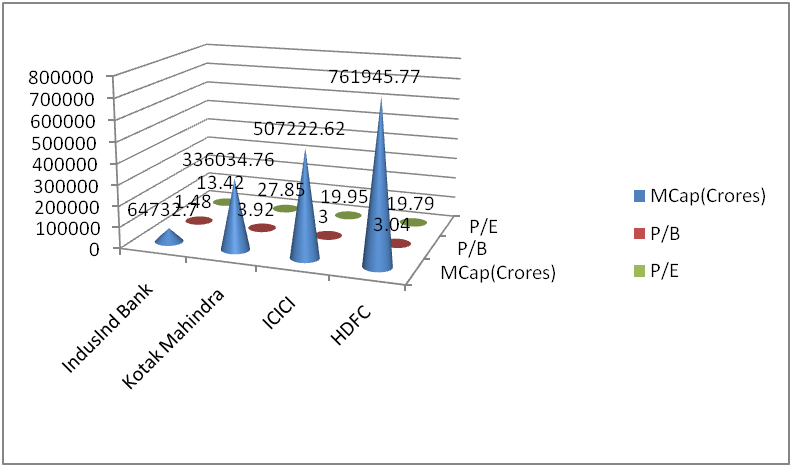

The major competitors of IndusInd Bank are ICICI Bank and Kotak Mahindra, HDFC. Let’s do a comparative study based on different parameters.

Companies with less P/B or P/E ratio are more favourable to investors. So here we can see IndusInd Bank has less P/B and P/E ratio compared to other major players. But in terms of Market Cap, IndusInd has less market cap compared to other major players. But still IndusInd is less preferable compared to other banks. So it should expand its rural presence more and should improve its presence globally.

Segment –wise Revenue Analysis

The retail banking sector recorded revenue of Rs 6209.28 crores. Similarly the treasury business has shown a sharp growth compared to last quarter. There is a sharp fall in revenue for corporate and wholesale banking. The revenue has declined to Rs 2289.17crores from Rs 2354.41 crores in the last quarter.