Quarterly Financial Summary

IndusInd Bank (NSE: INDUSINDBK) reported a consolidated net profit of ₹128 crore for the quarter ended 31 December 2025. This represents a 91% decline compared to ₹1,402 crore in the corresponding quarter of the previous year. On a sequential basis, the bank returned to profit following a loss of ₹437 crore in Q2 FY26.

Revenue and Margins

• Net Interest Income (NII): Declined 13% year-on-year to ₹4,562 crore.

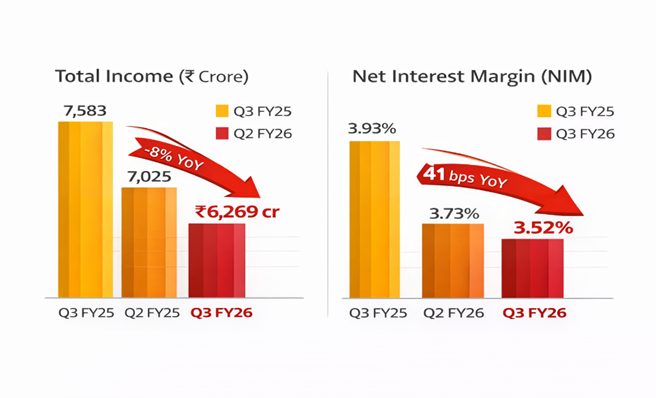

• Total Income: Stood at ₹6,269 crore, down 17% from ₹7,583 crore in Q3 FY25.

• Net Interest Margin (NIM): Reported at 3.52%, compared to 3.93% in the same period last year.

• Operating Profit: Decreased by 37% year-on-year to ₹2,270 crore.

Asset Quality and Provisions

Asset quality metrics showed significant year-on-year stress. Gross Non-Performing Assets (GNPA) rose to 3.56% (₹11,605 crore) from 2.25% in Q3 FY25. Net NPA (NNPA) stood at 1.04% (₹3,304 crore) against 0.68% a year ago. The Provision Coverage Ratio (PCR) remained stable at 72%.

Provisions and contingencies for the quarter were ₹2,096 crore, a 20% increase from ₹1,744 crore in the year-ago period. The bank noted that slippages remained stable, excluding micro-loans, which showed improvement in early buckets.

Balance Sheet and Operations

The bank continued a recalibration of its balance sheet, releasing bulk deposits and lower-return loans.

• Advances: Total advances declined 13% year-on-year to ₹3,17,536 crore.

• Deposits: Total deposits fell 4% year-on-year to ₹3,93,815 crore.

• CASA Ratio: Current Account (CA) deposits dropped 32% YoY, while Savings Account (SA) deposits fell 10% YoY.

• Employee Costs: Included a one-off impact of ₹228.96 crore due to the notification of New Labour Codes.

Growth Context

For the nine months ended 31 December 2025 (9M FY26), net profit stood at ₹295 crore, a 94% decrease from ₹4,904 crore in 9M FY25. Operating profit for the nine-month period declined 38% to ₹6,884 crore.