Indus Towers Limited is a leading telecom infrastructure company engaged in setting up, operating, and maintaining wireless communication towers across India.

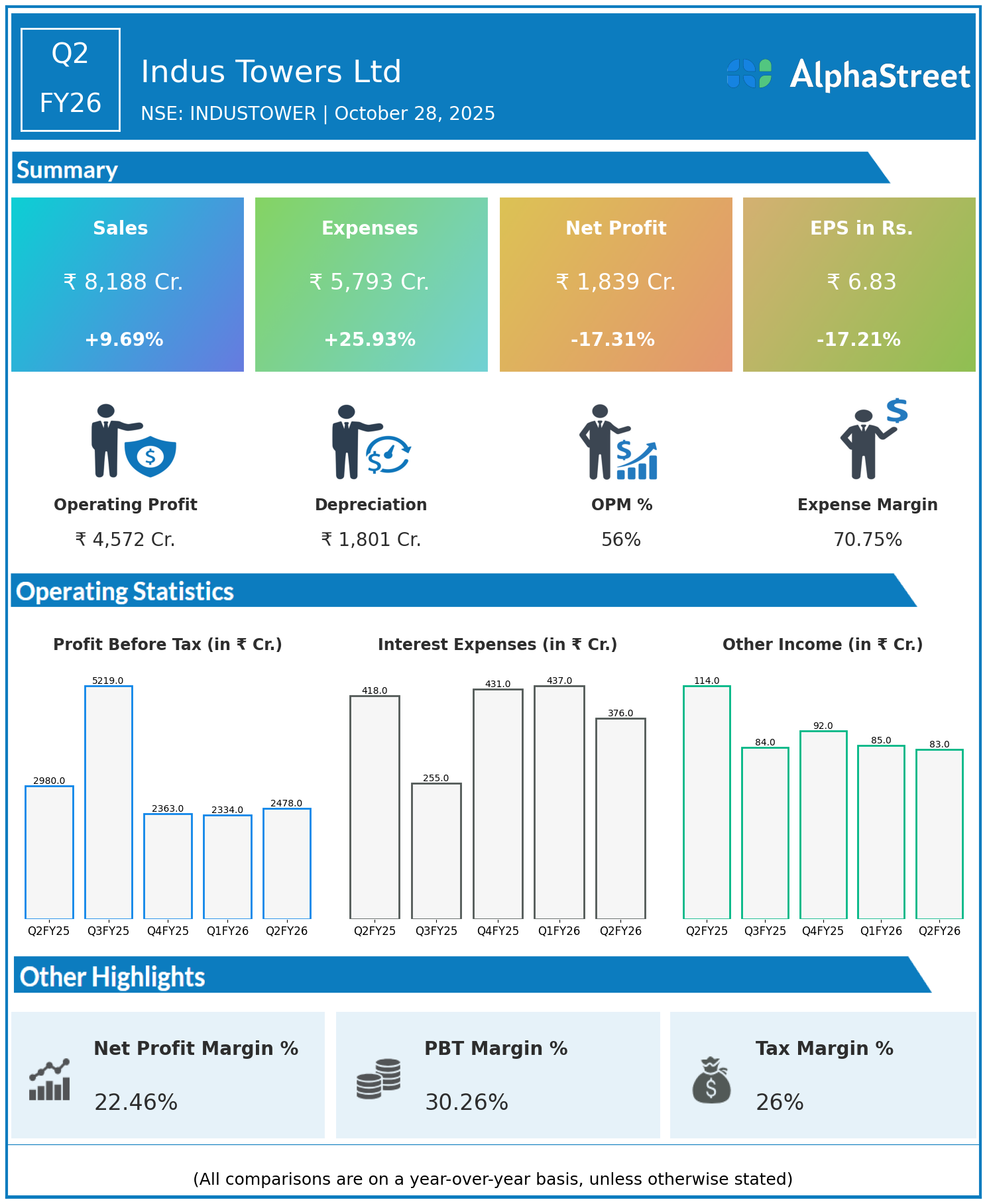

Q2 FY26 Financial Summary:

- Revenues increased 9.69% year on year to ₹8,188 crore from ₹7,465 crore.

- Total expenses rose sharply by 25.93% to ₹5,793 crore from ₹4,600 crore.

- Consolidated net profit declined 17.31% to ₹1,839 crore from ₹2,224 crore in the same quarter last year.

- Earnings per share (EPS) fell 17.21% to ₹6.83 from ₹8.25.

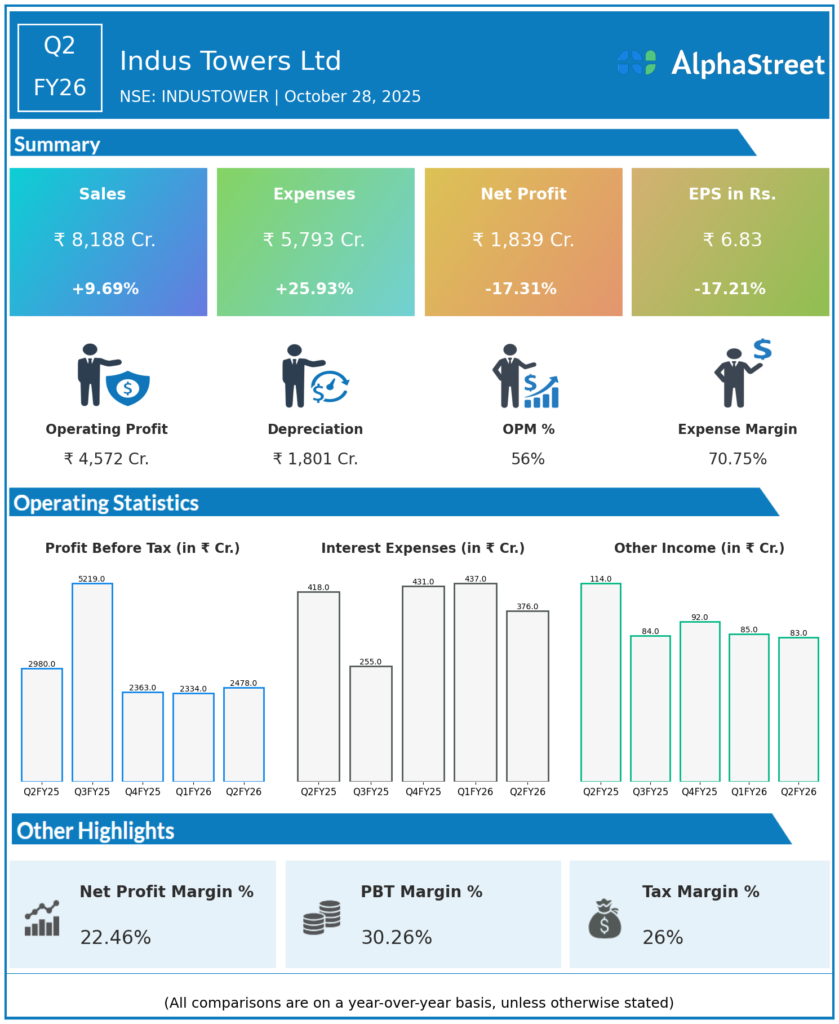

Profit Turnaround Analysis:

- Revenue growth was driven by steady expansion in tower portfolio to 2,56,074 towers and co-locations to 4,15,717 units across 22 telecom circles.

- Despite revenue growth, operating profitability was impacted by a 6% decline in EBITDA to ₹4,613 crore and EBITDA margin compression from 65.7% to 56.3%.

- The margin contraction was due to higher operational costs and pricing pressures in the telecom infrastructure space.

- Impact of pending dues from a large client weighed on net profit, though there was a ₹195 crore writeback of provisions on doubtful receivables improving cash collections.

- The company’s strategy includes international expansion into African markets and leveraging automation/AI to improve efficiency and service quality.

Commentary:

Indus Towers’ Q2 results showcase solid operational growth but profitability was challenged by cost pressures and client dues. The company’s strategic focus on expanding its tower portfolio, enhancing market presence, and technology adoption should support sustainable long-term value creation.

This comprehensive P&L review explains the profit dip despite top-line growth, highlighting key cost and receivables dynamics shaping financials in Q2 FY26.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.